A fog has long shrouded the inner workings of 401(k) plans. This lack of transparency has prompted action by the Securities and Exchange Commission, the Department of Labor and Congress-who are working on new rules that will ultimately dictate how the fees in these plans will be applied and disclosed.

Among the items that have sparked the interest of regulators are 12b-1 fees, the status of fiduciaries and brokers, plan sponsor fee disclosure and participant fee disclosure. Ultimately, these regulators and legislators will converge on the source of the fog: revenue sharing. And their work could dramatically alter revenue-sharing practices. Advisors who work with qualified retirement plans had best be up to speed on the nuances because it will affect both their revenue and their liability.

Understanding Fees

Consider an investor, Sam, who makes a single purchase of $10,000 of "Bond Fund Class A" within an IRA or brokerage account via a fund company. Sam's purchase includes a sales charge of 4% that is netted from the $10,000. He also pays a 1% annual operating expense of the fund netted from the gross returns.

Where does the money generated by this fee go? Who is Sam paying?

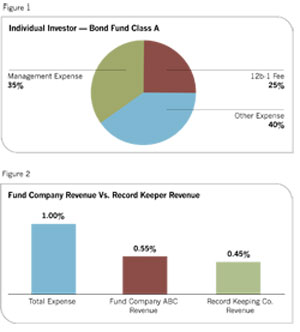

Figure 1 shows how this 1% annual operating expense is allocated when Sam makes the purchase in an IRA or brokerage account. While other expenses, such as the cost of purchasing the underlying investments, are netted from the returns, let's limit this inspection to the base annual operating expense.

Three components make up the 1% fee. Note that only 0.35% of the fee goes to the individuals who manage the fund.

"Other operating expenses," a somewhat vague category that can include any number of things, accounts for 0.40% of the fee. Generally speaking, this category refers to the administrative functions required to keep the fund operating.

A key element of the "other" category is "Fund Company ABC," the firm that runs Bond Fund A and is responsible for keeping tabs on Sam as an individual investor. When Sam has a question about his account, it's someone from Fund Company ABC that takes his call. When he moves and wants to have his statement sent to his new address, it's once again Fund Company ABC's responsibility. The company may be split into several affiliated companies to perform these services but, ultimately, it's still Fund Company ABC.

The remaining 0.25% is the "12b-1 servicing fee." The merits of this commission have been debated for years, and 12b-1 fees in excess of 0.25% might disappear if the SEC follows the path it has laid out.

These three components add up to the 1% fee netted from the gross returns of Bond Fund Class A. It's a bit of an oversimplification-but essentially accurate-to say that if the fund makes a gross return of 10% this year, Sam and the other shareholders will receive 9%.

While the fee breakdown is fairly straightforward, things get a bit murkier when the fund is purchased within a 401(k) plan.

Enter the Recordkeeper

Let's assume Sam participates in his employer's qualified 401(k) plan managed by a record keeper. Sam sees no line item on his quarterly statement from the record keeper about fees and is delighted by the fact that Bond Fund Class A (the same fund he uses in his IRA) is also one of the options available under the 401(k) plan. He pays no upfront fees or commissions when he purchases that same fund in his 401(k) account as he does when he makes purchases of Bond Fund Class A in his IRA account. Since it's the same share class, the operating expense is exactly the same: 1%.

But what Sam-and many others-may not realize is that the allocation of that 1% is very different under the 401(k) plan. Figure 2 depicts the change.

While the total is still 1%, it now appears that all of the 12b-1 servicing fees and some of the "other operating expenses" are being paid to the record keeper.

Who is this record keeper? It's the firm that provides the quarterly statements for the 401(k) plan. It also runs the Web site and call center for the plan so Sam can review his investments and make changes to his account.

Why is nearly half of the overall expense ratio now paid to this record keeper? There are two reasons.

Firm ABC, which offers Bond Fund Class A, doesn't have to keep track of Sam as an individual if he buys Bond Fund Class A within the 401(k) plan. Instead, the record keeper now has to keep track of Sam's account and produce his statements. Because of this, Firm ABC has volunteered to "share" some of the revenue it receives with the record keeper.

The other, more subtle, reason for this transfer in revenue-including the significant transfer of all of the 12b-1 fees generated by Sam's investment-is that the record keeper only works with funds that share the revenue. If Firm ABC refused to share this revenue, the record keeper might not make it available as an option. In short, it's pay to play.

Why should the record keeper care? After all, it could always bill Sam's employer for the work it's providing.

Perhaps, but that's not the way the 401(k) industry functions. Record keeping companies have typically marketed their products assuming that some or all of their fees would be paid by revenue sharing from the funds within their client's plans. Companies sponsoring plans have become accustomed to the concept that there are few billable costs for the plan. Sam, as a participant, and his employer, as the sponsor, may have never paid a direct fee related to the 401(k) plan.

Many have argued that this arrangement is meaningless to participants since the same 1% is assessed either way. But those people seem to be losing ground to the critics, who say that the menu of available funds within a 401(k) plan are too influenced by whether the fund shares revenue with the pay-to-play record keeper. If the broker or advisor servicing the plan expects to receive the 12b-1 fees as compensation, this can further eliminate options that might otherwise be available. It might also mean even more expensive share classes (R shares) are used to pay all of the various parties.

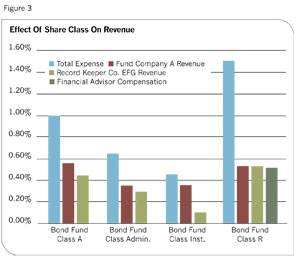

Figure 3 again examines our hypothetical investment in Bond Fund Class A, this time including a look at the sister funds-Class Admin, Class Inst. and Class R-with differences in their overall pricing structure. R shares, a relatively recent class, are funds often offered at much higher expense ratios to generate greater revenue.

The "Institutional" class is virtually identical to the Class A version except that it has less than half the overall cost and there is a significant difference in the revenue sharing. While Class A generates 0.45% (nearly half the operating expenses) in revenue for the record keeper, Class Inst. generates only 0.10%.

This is a dramatic disparity in revenue by percentage, one that is amplified many times over when 401(k) plans with millions in assets shift to different share classes. A $10 million investment in Bond Fund Class A generates $45,000 in revenue sharing while the same investment in Class Inst. generates only $10,000 in revenue.

A federal judge recently ruled that energy company Edison International violated its "duty of prudence" by using retail funds when the company could have used available institutional versions instead. There is not, as of yet, a litmus test to determine what amount of fees is appropriate. We will have to wait and see what the SEC, the DOL and Congress come up with as the final answer to this question.

In the meantime, it may be wise for advisors to examine their current practices in anticipation of coming changes.

Here are some guidelines that may be useful for advisors and their clients:

Be straightforward about the universe of funds available through the record keeper. Don't promise to screen the entire universe of funds if, in reality, the record keeper/revenue requirement limits it to a few hundred.

Calculate the annual revenue sharing and commissions (if applicable) being produced by the plan and share these results with the plan sponsor.

Benchmark the all-in fees of the record keeper to see if they are within a reasonable range of the competition's.

Avoid offering the most expensive share classes of the investments to generate excess revenue.

Given the ramifications of pending regulatory activity on advisors' revenue and liability, those professionals servicing qualified plan clients should know exactly where their practice stands on revenue sharing. Given the added costs and potential for lower returns with funds that share revenue, it's even more important.

Marshall J. Cobb, CRSP, is founder and president of Cobb Retirement Solutions, LLC, a fee-only firm offering qualified plan analysis and oversight to corporations and organizations. Based in Houston, he can be reached at 713.660.9605 or [email protected].