While the fee breakdown is fairly straightforward, things get a bit murkier when the fund is purchased within a 401(k) plan.

Enter the Recordkeeper

Let's assume Sam participates in his employer's qualified 401(k) plan managed by a record keeper. Sam sees no line item on his quarterly statement from the record keeper about fees and is delighted by the fact that Bond Fund Class A (the same fund he uses in his IRA) is also one of the options available under the 401(k) plan. He pays no upfront fees or commissions when he purchases that same fund in his 401(k) account as he does when he makes purchases of Bond Fund Class A in his IRA account. Since it's the same share class, the operating expense is exactly the same: 1%.

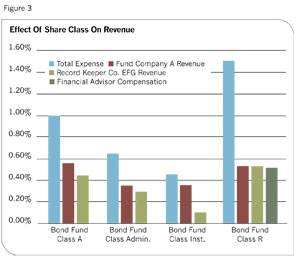

But what Sam-and many others-may not realize is that the allocation of that 1% is very different under the 401(k) plan. Figure 2 depicts the change.

While the total is still 1%, it now appears that all of the 12b-1 servicing fees and some of the "other operating expenses" are being paid to the record keeper.

Who is this record keeper? It's the firm that provides the quarterly statements for the 401(k) plan. It also runs the Web site and call center for the plan so Sam can review his investments and make changes to his account.

Why is nearly half of the overall expense ratio now paid to this record keeper? There are two reasons.

Firm ABC, which offers Bond Fund Class A, doesn't have to keep track of Sam as an individual if he buys Bond Fund Class A within the 401(k) plan. Instead, the record keeper now has to keep track of Sam's account and produce his statements. Because of this, Firm ABC has volunteered to "share" some of the revenue it receives with the record keeper.

The other, more subtle, reason for this transfer in revenue-including the significant transfer of all of the 12b-1 fees generated by Sam's investment-is that the record keeper only works with funds that share the revenue. If Firm ABC refused to share this revenue, the record keeper might not make it available as an option. In short, it's pay to play.

Why should the record keeper care? After all, it could always bill Sam's employer for the work it's providing.