Global inflation has taken hold and will climb further in most major economies over the coming months, reflecting both higher energy prices and higher food prices. The peaks should still be lower than those in 2008, as long as the price of oil does not continue to rise. Headline inflation is also still likely to drop sharply in 2012 as the commodity effects unwind.

In the meantime, the drag on real incomes is another reason to expect the economic recovery to disappoint, even if other central banks do not follow the likely lead of the ECB and raise interest rates sooner than they would otherwise have done.

Despite the recent rise in headline inflation and the prospect of further increases, core inflation remains subdued in most economies. The United Kingdom is an important exception due mainly to temporary factors, namely the past weakness in sterling and the changes in VAT.

Business surveys point to strong growth in global demand. Nonetheless, the recovery is likely to weaken later this year as policy stimulus fades and fiscal consolidation begins, starting in Europe. There are already signs of a slowdown in key emerging economies, notably China.

Despite some improvements in the United States and Germany there is still substantial spare capacity in the labor market and therefore little reason to fear a wage-price spiral. Consumer prices increased by 0.5% month over month in February, driven by a 4.7% m/m increase in gasoline prices and a 0.6% m/m increase in food prices. Gasoline prices probably don't have much further to rise, but we do anticipate some further sharp increases in consumer food prices in the United States. Chinese wages are rising rapidly again, but this is nothing new and may be offset by productivity gains.

Commodity prices are reaching danger levels that will boost inflation in the short term but also will undermine demand for these same commodities, increasing the chances that their prices subsequently collapse.

Despite the additional quantitative easing by the Fed, the base money supply is stable in the United States. Broader monetary aggregates have also continued to stagnate in the United States and Europe. In these circumstances, it is not surprising that short-term inflation expectations have risen, but what is more notable is that longer-term expectations are still relatively low and stable. Inflation is a greater threat in emerging economies, but can be brought under control by a mix of higher interest rates, quantitative measures and faster currency appreciation.

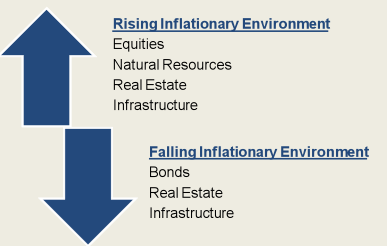

We believe the infrastructure sector will be impacted by six themes this year -- the threat of rising inflation; structural growth in an inconsistent cyclical recovery; large-scale government privatization; increased government interference in regulation and taxation of infrastructure; more share buybacks; and increased merger and acquisition (M&A) activity.

With surging commodity prices and quantitative easing, this year there is the real threat of a significant rise in inflation. However, the pricing of many infrastructure services are directly linked to inflation, which provides investors with a natural hedge in times of uncertainty about price rises. Regulated utilities are often remunerated through real returns on capital, effectively passing inflation through to their customers.

Earthquake in Japan Impacting Commodities and Energy Markets: At 3.41 pm on 11 March, a magnitude 9 earthquake struck off the coast of Japan, leading to devastating tsunamis and a series of aftershocks. The earthquake triggered a crisis at the Fukushima nuclear power stations.

Assuming that the broader power grid infrastructure has not been permanently damaged, we believe the events are likely to put upward pressure on residual fuel oil and diesel cracks, LNG, UK natural gas and rice; downward pressure on naphtha cracks and Dubai spreads relative to other crude grades.

We believe the Fukushima incident will be seen as the worst civilian nuclear incident after that at Chernobyl in 1986, though we would stress that there is large difference in both the nature and the scale between the ongoing problems at Fukushima and Chernobyl. In the Three Mile Island incident, which will be the other typical comparison, there was only one reactor at risk. Differences between Chernobyl and the Fukushima incident include:

The Chernobyl incident was due to gross operator errors, while the Fukushima incident was triggered by the M9.0 earthquake and tsunami.

The Chernobyl incident resulted in the explosion of the reactor vessel and huge fires due to ignition of the graphite moderator. In the Fukushima incident, some hydrogen gas and oxygen generated from the heat exploded, taking out the external structure.

The Chernobyl incident clearly highlighted the problems with the unsafe RMBK graphite moderated reactor design that had a positive void coefficient (difficulty in preventing a runaway reaction once the coolant was lost). The Fukushima incident highlights the high degree of relative safety of light water reactors with water as the moderator, and specifically of Westinghouse (PWR) and General Electric-derived (BWR) designs with containment shells.

What are Listed Infrastructure Securities? -- "Inflation Sensitive Securities To The Rescue"

Simply defined, infrastructure assets represent a broad mix of the large-scale public systems, services and facilities of a country or region that are necessary for economic activity to function. Some examples of infrastructure include power generation and transmission, water supplies and waste water treatment, public transportation, rail, roads, bridges, tunnels, ports, airports, telecommunications, and finally, basic social services such as schools and hospitals. The global-listed infrastructure market represents a market value of roughly $3.9 trillion of outstanding securities currently in the market.

Infrastructure has emerged as its own differentiated asset class providing unique investment characteristics. Part of what defines infrastructure assets is that they provide a necessary good or service to society and they have a monopolistic position in their market with high barriers to entry for competitors. Given these characteristics, infrastructure assets tend to be highly regulated, which result in investments with distinct qualities.

Infrastructure assets usually are built to have long useful lives since they provide a vital service and since they are expensive to construct. Additionally, the demand for the output from these assets tends to be inelastic given the scarcity of the resource being offered. With the pricing power that results from their position in the market, the revenue growth from these assets is typically limited to the rate of inflation by regulators. These factors result in infrastructure investments being able to offer long-term stable cash flows that have the potential for inflation hedging.

Another characteristic of infrastructure investments is that they exhibit a hybrid nature of both fixed-income cash flows coupled with capital gains. They behave somewhat like a bond with their stable cash flows described above. In addition, these assets can be improved upon and their capacity can be expanded allowing for their principal value to grow over time. The best opportunity for capital gains comes from investments involving development risk or monopoly businesses.

Finally, infrastructure investments do offer a variety of risk and return profiles. Infrastructure investments range from low-risk regulated assets to moderate-risk loosely regulated entities such as energy production. The assets offer varying amounts of inflation protection and different levels of vulnerability to economic cycles. It is important to note that while these assets are all considered the same asset class, not all of them will exhibit the same risk and return behavior.

What is the Infrastructure Investment Opportunity?

Global demographic trends are driving the need for infrastructure construction in the world's developing economies. China and India have shifted from agrarian to industrial, urban societies. These countries require new, modern infrastructure in order to facilitate the expansion of industry, the urbanization of their economies, and the effects of continued population growth and an expanding middle class.

In the developed markets, the basic infrastructure is old and dilapidated, having been constructed in the middle of the twentieth century. The percent of GDP that is spent on infrastructure has been steadily declining for decades in most developed economies, leaving them with a crumbling legacy. This entire supply of old infrastructure needs to be either repaired or replaced.

The amount of investment that is required to fix or upgrade existing infrastructure in the developed economies is truly stunning, especially when one examines the state of the union in our own country. The American Society of Civil Engineers in has estimated that the infrastructure funding needs are $2.2 trillion over a five-year period in the United States.

America's infrastructure currently holds a "D" Average (Source: American Society of Civil Engineers, Report Card for America's Infrastructure 2009)

|

American Society of Civil Engineers 2009 Report Card for America's Infrastructure |

|

|

|

Aviation |

D |

|

|

Bridges |

C |

|

|

Dams |

D |

|

|

Drinking Water |

D- |

|

|

Energy |

D+ |

|

|

Hazardous Waste |

D |

|

|

Inland Waterways |

D- |

|

|

Levees |

D- |

|

|

Public Parks & Recreation |

C- |

|

|

Rail |

C- |

|

|

Roads |

D- |

|

|

School |

D |

|

|

Solid Waste |

C+ |

|

|

Transit |

D |

|

|

Wastewater |

D- |

|

Even more disconcerting, funding levels as a share of all federal expenditures are exactly the same as they were more than 20 years ago. America's crumbling infrastructure has been well documented over the past few years. The ready supply of capital for projects is dwarfed by the demand for Infrastructure, which is driven by:

Population Growth

Urbanizations

Aging Infrastructure

Favorable economic/political climate

Over the years, the U.S. government has pushed the responsibility for the growth and upkeep of America's infrastructure down to the state level. The states have found that they have been unable to meet the capital requirements of this task. More recently, the economic downturn has reduced all of the usual sources of revenue for the states. Real estate taxes, income taxes, and sales taxes have all declined precisely when the need for capital is the greatest. With the states' inability to incur a budget deficit from year to year, they are unable to generate the capital for essential improvements to their infrastructure. The states are at a cross roads and many are now beginning to court private investors in order to fill their budget gaps.

Investors are viewing listed infrastructure as another "club" in their golf bag, offering them alternative access to a dynamic market opportunity. The liquidity and transparency have become more attractive than ever in today's opaque investment environment. The ability to generate income and total return explains some of its recent gain in popularity, particularly after 2010's drubbing of investment portfolios.

Benefits Of Listed Infrastructure Investments

Investors responded to a recent survey conducted by Capital Innovations Institute? in July of 2011 and listed their top attributes of an attractive investment:

Diversification

Liquidity

Reasonable fees

Valuation and daily market pricing

Transparent corporate governance

Active management and value creationListed infrastructure can provide these unique attributes to investors in a framework that can be straightforward and easy to understand, differentiating it from many other complex, unlisted (private equity type) investments.

1. Diversification: There are a series of risk and return elements to any investment strategy. Listed infrastructure permits investors to diversify across "sectors," which may help to ameliorate some of the inherent risks that are present in infrastructure. These risks include regulatory risk, demand risk, interest rate or refinancing risk. Diversification across regulatory sectors, physical assets, currency exposure and political risks (country or regions) helps investors construct a portfolio that achieves their desired risk return profile or "risk budgeting process." This can be achieved in a global diversified portfolio of holdings.

2. Large Investment Universe that Provides Liquidity: Investors may access investment vehicles, separately managed accounts, and mutual funds, all of which have liquidity that is not available in direct project finance deals. This liquidity feature allows investors to easily put money to work and conversely trim their listed infrastructure exposure to maintain their asset allocation models ($1.79 trillion dollars).

3. Reasonable Fees: "Fee drag" or the fees that are accessed to an investment portfolio challenges investors and portfolio managers alike when it comes to investment performance. Fees are typically higher in private infrastructure transactions. An actively managed portfolio of listed infrastructure investments at institutional pricing can be more attractive than buying the benchmark and paying active management fees.

4. Valuation and Daily Market Pricing: Unlisted infrastructure valuations are performed by an independent auditor or administrator. On the other hand, since listed securities are exchange traded and market priced, investors are provided with the transparency that they need, especially in the current market environment where investment transparency is at a premium.

5. Transparent Governance: Listed companies are subject to examination by regulatory authorities, governments, investor advocacy groups like UNPRI/UN Global Compact, labor unions and are subject to media scrutiny. There is increased focus by these companies on social issues, the environment and governance.

6. Active Management: The value proposition behind active investments in a portfolio of listed infrastructure securities can be seen through examining the composition of the frequently used benchmarks. The Macquarie Global Infrastructure Benchmark is almost entirely comprised of global listed utilities companies (approximately 90%). The S & P Global Infrastructure Benchmark is more diversified, comprised of 40% utilities companies, 40% transportation companies and 20% energy companies. Active portfolio management in the listed infrastructure sector provides the ability to generate significant returns while avoiding unwanted sector concentration in the benchmark. Additionally, stock market volatility has risen, creating a greater dispersion of returns among individual stocks and expanding the scope for active managers to distinguish themselves from a benchmark.

Risks And Rewards

Investing in listed infrastructure provides the

ability for investors to add income, further diversify their portfolio and

thereby improve overall long-term performance. Investors add another asset

class with a low degree of correlation to the aggregate portfolio. If history

is an indicator, stock market recoveries have come in relatively short bursts

and outperformance has occurred in a select number of sectors; infrastructure

has been one of these sectors. As the markets continue to rebound from their

lows, listed infrastructure is well positioned to capitalize for investors.

Viewing the historical data, Infrastructure stocks have typically experienced yields of 5.15% while traditional stocks yields have been 4.37%, and bonds producing 4.29%*. These securities yield and growth potential have made infrastructure stocks attractive during economic "booms" and "busts," particularly when compared with the long term performance characteristics of common stocks and bonds.

Infrastructure Stocks provide return enhancement to Stock and Bond Portfolios

|

|

Bonds |

Common Stocks |

Infrastructure Stocks |

|

Annualized returns* |

6.52% |

0.83% |

10.86% |

|

Annualized volatility* |

5.89% |

15.31% |

12.95% |

|

Infrastructure Correlations* |

36.44% |

45.53% |

|

*Sources: Standard & Poor's and Lehman Brothers. Figures are from Nov 30, 2001 to December 31, 20109. Common stocks refer to the S&P

Global 1200, bonds refer to the Barclays Capital Global Aggregate and infrastructure stocks refer to the S&P Global Infrastructure Index.

Global Growth Dynamics continue to drive investment in infrastructure worldwide. Populace regions in Latin America, China and India are experiencing growth infrastructure investment over multiple sectors including regulated utilities, transportation and social infrastructure. This infrastructure investment growth is necessary for these regions to accommodate their burgeoning population explosions. (Chart Below)

|

Age |

China |

India |

Mexico |

Western Europe |

USA |

|

0-19 |

30.9% |

41.3% |

41.0% |

22.6% |

27.7% |

|

20-39 |

33.5% |

32.2% |

32.7% |

26.6% |

27.6% |

|

40-59 |

24.8% |

18.9% |

18.1% |

28.7% |

27.9% |

|

60+ |

10.8% |

7.65 |

8.2% |

22.1% |

16.8% |

In contrast, examination of the United States and Europe reveals a different story in terms of demographic trends. Growth has been stagnant in the first quarter and second quarter of 2010, but we are beginning to see some slow growth or recovery. Effects of the US $789 billion stimulus package that was implemented in the United States is finally taking hold and select industries are benefitting from the government services effort. The stimulus total for infrastructure, science, renovation projects for government and educational buildings came to roughly $120 billion. Capital Innovations shared the breakdown of this package for a New York Times article entitled, "Turning Infrastructure into Profits":

- $26.5 billion-Energy investments, including $4.5 billion for retrofitting federal buildings to improve energy efficiency and $11 billion to modernize the electric grid.

- $7.5 billion-Promoting drinking water infrastructure improvements and infrastructure improvements for water and waste disposal in rural areas.

- $6.25 billion-Public housing development and renovation.

- $28.5 billion-Infrastructure Improvement which includes $7.2 billion to increase broadband access and usage.

- $48 billion-Transportation projects, including a $27.5 billion investment in highway improvements and construction and $9.3 billion investment in rail transportation.

Clearly, there are a host of beneficiaries from this package and the benefits will continue to accrue to select organizations throughout 2011. Thus, security selection will remain critical. The developed markets countries need to rebuild and retrofit their existing infrastructure, so these countries will focus on investment in "Brownfield" (existing infrastructure) & "Rehabilitative Brownfield" for the foreseeable future. Emerging market countries have a slightly different challenge in that these target regions need to build infrastructure from the ground up. Therefore, "Greenfield" infrastructure projects and companies will be the area of highest growth for these developing nations.

From an economic perspective, there are concerns regarding short-term deflation and much more widespread fears of long-term, worldwide inflation. The exposure to a diversified pool of infrastructure securities has shown beneficial to investors in both scenarios. Post credit-crisis, short term deflation has proven to be a pervasive determinant, creating a difficult market in which to operate or invest. Falling consumer prices in first half of 2011 and excessive market volatility have further hindered investors seeking shelter from the storm. The market, as a whole, is extremely tumultuous and volatile, offering the opportunity for either outperformance or underperformance.

We believe the sector will be impacted by several themes this year -- the threat of rising inflation; structural growth in an inconsistent cyclical recovery; large-scale government privatization; increased government interference in regulation and taxation of infrastructure; more share buybacks; and increased merger and acquisition (M&A)activity.

Investors have recently become hesitant to chase stocks of regulated utilities due to their high PEs vs. S&P 500, and potential risks to future allowed ROEs. On the other hand, sluggish economic recovery and falling natural gas prices have diluted the appeal of diversified utilities. We continue to see upside to PEs for regulated utilities driven by low (and falling) 10-year Treasury yields, high utility dividends and visible utility EPS growth. Even though the group looks fully valued relative to the S&P 500, a combination of high dividend yields, decent and visible EPS growth and no equity dilution appeals to us, at least over the next few months. With power demand sluggish and gas prices falling, we recognize the appeal of 5% dividend yields of many diversified utilities and potential future growth in their merchant power businesses. Electric loads and/or natural gas prices need to rise first, however, and recent trends are not encouraging for either, with power demand growth clearly slowing down and medium-term natural gas prices fully reversing the March-May rally.

We therefore remain cautious on diversified utilities as a group and more bullish on water, wastewater and telecommunication type utilities given their 10%+ expected shareholder returns and low risk to earnings growth, even when compared to regulated electric utilities. Add the lack of commodity risk, the less discretionary nature of investment spending and the larger headroom to utility bills, and we could have a recipe for outperformance this summer in today's risk-averse equity market. Transportation segments have led to significant downside risk in the first half of 2011, but upon further examination select companies have long-term off take contracts that were not factored in to the short term market volatility, so there is "value on sale" this quarter within the transportation sector securities that are 30-40% down from their January 2011 price point. The cash flow profile on these companies has not changed so the sector is ripe for value investors to harvest some great long-term, buy and hold investments.

These types of companies that have the ability to hedge the currency risk as well as negotiate long-term contracts generate the inelastic revenue streams institutional investors find so attractive during these times of growing inflation and uncertainty.

During this period of increased volatility, investors are struggling reliable asset classes that offer the potential for dependable, long lasting performance and short-term liquidity. Infrastructure offer protection from inflation, inelastic demand, and stable cash flows. Listed Infrastructure offers investors the chance to capitalize on all the advantages of the asset class within a liquid investment vehicle, backed by the strongest cash flows in the market today.

Who said sewage isn't sexy????

Michael D. Underhill is chief investment officer and cofounder of Capital Innovations, an investment firm based in Hartland, Wis., that manages infrastructure, timber and agricultural investments primarily for institutional clients that include some of the world's largest sovereign wealth funds, corporate and public defined benefit plans, endowments and foundations, insurance companies, and financial institutions.