This week’s article is a follow-up to last week’s article (which generated a lot of attention) about stressed-out, tapped-out American consumers.

The Dow Jones Industrial Average has been going sideways ever since the Commerce Department reported that retail sales in July came to a grinding halt (0.0%) in the month of July.

At the same time, the list of companies warning of disappointing sales—Starbucks, McDonald’s, Ford, Burberry, Gap, and many others—suggests trouble in shopping paradise.

Most recently, Target reported a Q2 drop of 1.1% in same-store sales and said it expects a “challenging environment in the back half of the year.”

There are many reasons why Americans have become reluctant shoppers, such as stagnant incomes and rising debt loads, but one of the underappreciated challenges is a distinct change in spending psychology.

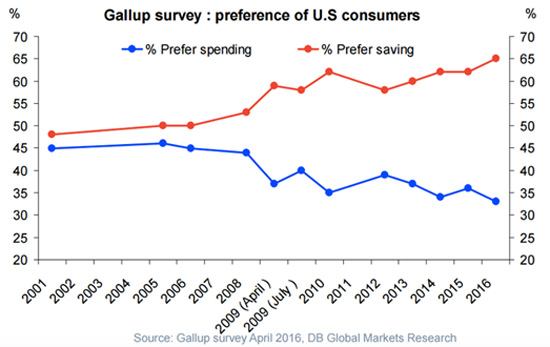

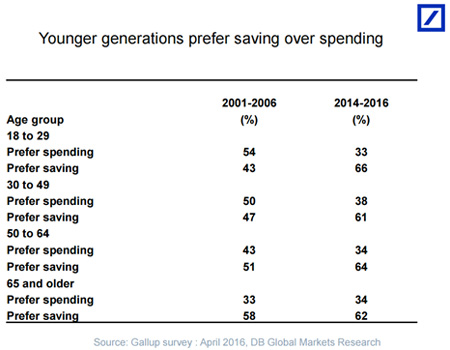

According to Deutsche Bank, Americans are becoming big savers.

Maersk isn’t the only shipper singing the blues. “World GDP growth is struggling… Combined with trade growth slowing down, this is a recipe for a very bad market,” said Evangelos Chatzis of rival shipper Danaos.

Tony Sagami leads the Yield Shark and Rational Bear advisories at Mauldin Economics.

This article was originally published at Mauldin Economics.

The saving-vs.-spending mentality has shifted for all adults, but the change is most dramatic for the live-in-mom’s-basement generation.

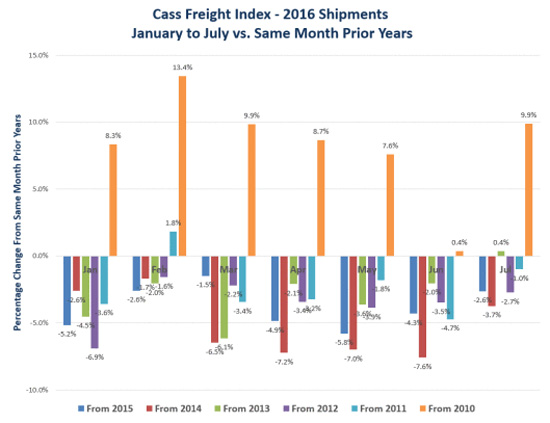

You know where else the evidence of shopping fatigue is showing up? In the transportation food chain.

Truck Slowdown: Truck shipments continue to decline. July shipments were down versus 2015, 2014, 2012, and 2011.

Ship Slowdown:

“Currently we are challenged by market headwinds,” said CEO Soren Skou during the latest earnings call, “…in the form of low growth and excess capacity in both our industries, and that has led to declining prices and declining revenue.”

And Jakob Stausholm, a member of Maersk Line's management board, told Reuters, “It’s really tough, and everybody in the industry is really suffering, and so have we.”

Port Slowdown: The Port of Long Beach just reported a 7.7% year-over-year decline in the number of shipping containers passing through:

“Due to continued market uncertainty and high inventory levels, the traditional holiday peak season is off to a slow start, and several national forecasts have been revised downward to reflect this softness in cargo movement.”

High inventory levels? The inventory-to-sales ratio is climbing, which tells me that demand is weakening and businesses are having trouble selling their products.

The ratio typically increases during the late stages of an economic expansion and often represents the turning point in a business cycle.

Remember, companies accumulate inventory for one of two reasons: (1) voluntary accumulation in anticipation of booming sales, or (2) involuntary accumulation as unsold goods pile up.

You’ve heard it a million times—the US is a consumer-driven economy with 70% of GDP tied to consumer spending. That is why you need to connect the dots between the retailers’ warnings, the shift from spending to saving, and the struggles of the entire transportation food chain.

If you do, I think you’ll find very few reasons to find anything to be bullish about regarding the stock market, other than the frantic monetary efforts of central bankers around the world.

Remember… buy, hold, and pray is NOT an investment strategy.

There are proven, time-tested strategies for earning stable income, though, even in times of economic uncertainty. Consider trying Yield Shark, my monthly newsletter focused on high-yield dividend payers, risk-free for 90 days.