There is an old saying that successful real estate investors follow three important considerations: location, location, location. When the real estate market is booming, one can make good returns in marginal properties, but those investments are unlikely to hold their value during a downturn in the market.

The same can be true of equity investing during the past several years. When the global economy was binging on credit, it was fine to invest in marginal locations’ equity markets. However, as the global economy slowed, those fringe markets have disappointed, and “location, location, location” has proved as important to equity performance as it is in real estate.

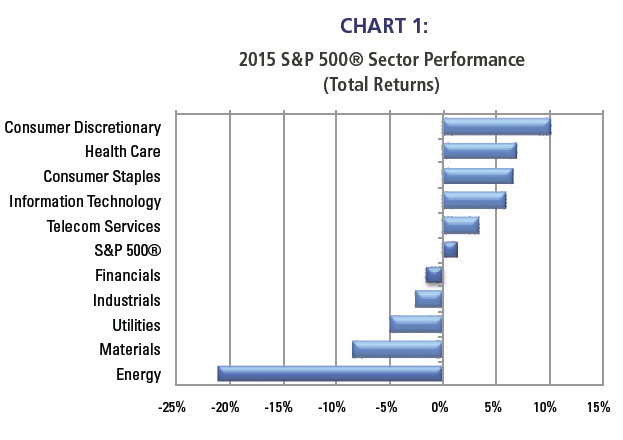

The equity world’s equivalent of A+ office space is the US consumer sector. It’s not an accident that Consumer Discretionary stocks were 2015’s best performing sector in the US (see Chart 1) because the US consumer has been the strongest and most stable part of the global economy. Our overweight of Consumer Discretionary stocks was a major fillip to our performance.

Source: Bloomberg Finance L.P.

Mute the TV

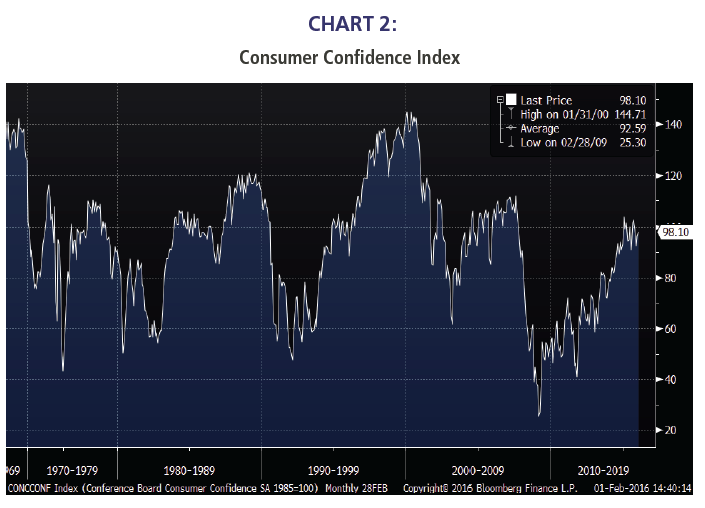

Our Year Ahead report emphasized that 2016’s political rhetoric was likely to give very misleading signals about the health of the US’s household sector. Although politicians from both parties suggest the US household sector is in terrible shape, households themselves do not seem to agree at all with that assessment.

Chart 2 shows the Conference Board’s Consumer Confidence Index. The latest reading (98.1) is close to the cycle high and is well above the long-term average (92.6). A reading above the long-term average indicates that consumers are more confident than “normal”. One would never know that by listening to the political pundits. Rather, one might think that the US household sector was in terrible shape. The outperformance of consumer stocks demonstrates the stock market muted the TV and paid attention to actual data like consumer confidence.

Source: Bloomberg Finance L.P.

The US consumer is benefitting from what we have called the “Wal-Mart World”. Excess global capacity is putting pressure on product prices as countries compete for market share within the stable and healthy US consumer market. Effectively, the entire world is acting like a giant Wal-Mart, and is offering consumers lower and lower prices.