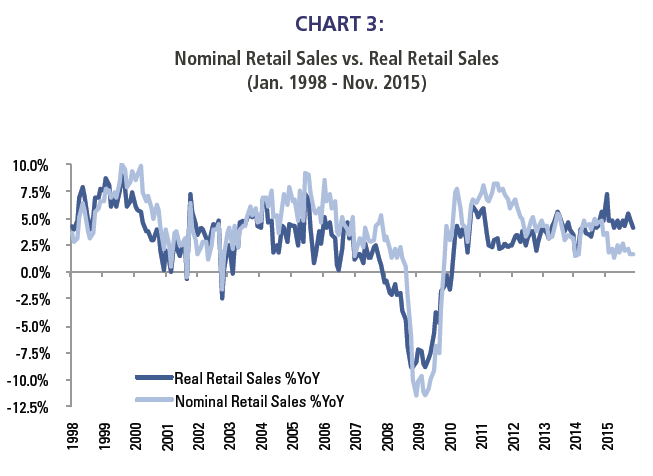

The Wal-Mart world is starkly evident in a comparison of US nominal and real retail sales. For the first time in the history of monthly consumption data, real retail sales (units) are growing faster than are nominal retail sales (which include prices). So, consumers are buying, but price competition is constraining nominal retail sales.

Source: Richard Bernstein Advisors LLC, Bloomberg Finance L.P.

Emerging consumer vs. US consumer

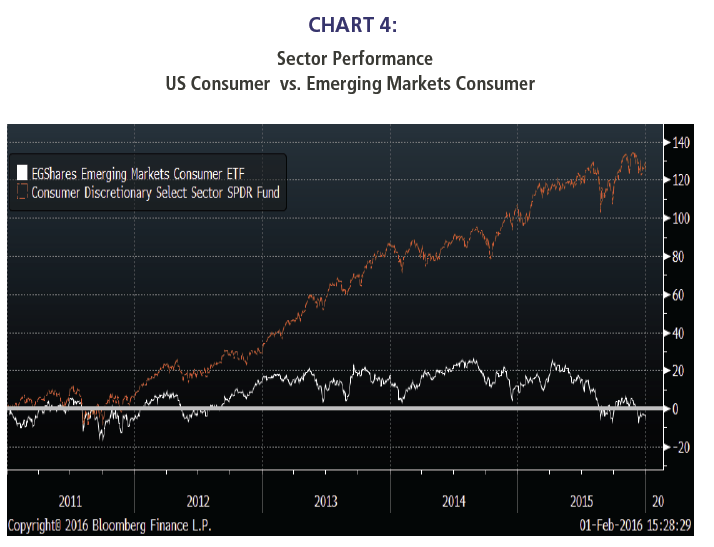

The emerging market consumer has been one of the most discussed growth stories of the past decade or more. Investors believe that US consumers are sated and over-leveraged, but emerging market consumers provide great growth opportunities because of their high savings rates and growing incomes. Unfortunately, sector performance has reflected the exact opposite, and US consumer stocks have outperformed emerging market consumer stocks by more than 1800 basis points per year over the last five years (see Chart 4).

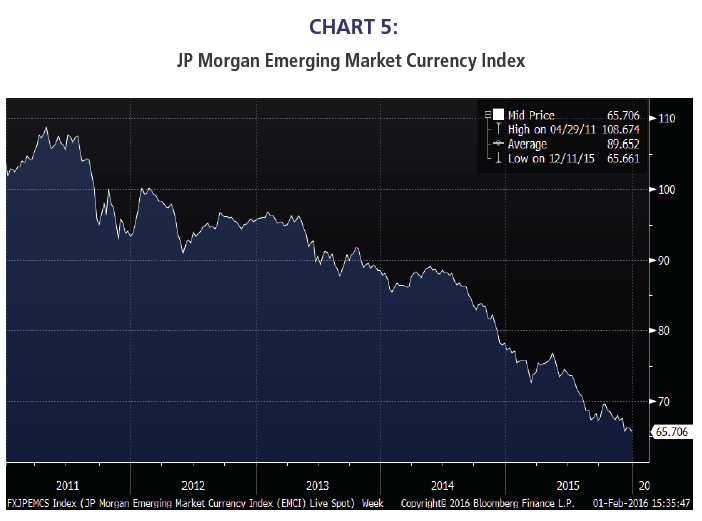

This is understandable when one looks at the secular depreciation of emerging market currencies. Because currency strength or weakness measures purchasing power, a country’s standard of living improves as its currency appreciates and deteriorates as its currency depreciates. Accordingly, when the US dollar was depreciating, some observers pointed out that the US’s standard of living was weakening.

Chart 5 shows the JP Morgan Emerging Market Currency Index, and it has consistently fallen over the last five years. It is curious that investors were pessimistic regarding the outlook for US consumers when the US dollar was falling, but have remained bullish on the prospects for emerging market consumers despite the precipitous fall in EM currencies.

Source: Bloomberg Finance L.P.

Source: Bloomberg Finance L.P.