In 2013, both of those factors were called into question. With the U.S. markets finding momentum and rumored rate hikes from the central banks in Europe and the U.S., emerging markets struggled through the spring and summer months. In fact, India and Brazil, which had been standard bearers for emerging economies, suffered as their currencies lost substantial value. These swift changes in currency value reminded foreign investors that currency movements are an overlooked component of return and raised the question: How can investors effectively manage currency risk?

Currency Exposure In Foreign Investments

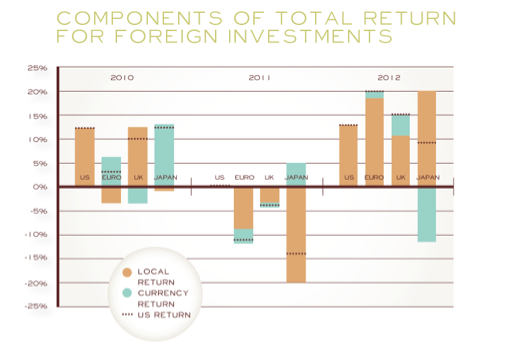

If the U.S. dollar gains value compared with the foreign currency, this will be a draw on the total return of the foreign investment. Conversely, if the foreign currency increases in value relative to the U.S. dollar, this would magnify the investment’s total return. At times, the currency return portion can overpower the total return of the foreign investment, whether on the upside or on the downside. Some investors may be swayed by this and change their foreign allocation, not realizing that the performance was primarily due to currency movements.

As an investor, it is important to balance the return potential with the added risks of retaining currency exposure in your portfolio. Over the long term, investors have been rewarded for including foreign currencies as the dollar has underperformed. The illustration below compares the annual performance of international stocks with and without currency exposure. In more years than not, the currency exposure has yielded additional returns to U.S. investors.

Diversification Benefits Of Currency Exposure

There are three primary reasons why currencies offer so much additional diversification to investors:

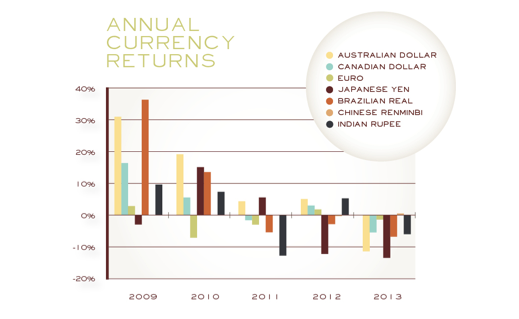

1. Currencies are not highly correlated with other currencies. The chart below provides the annual returns of several currencies relative to the U.S. Dollar.

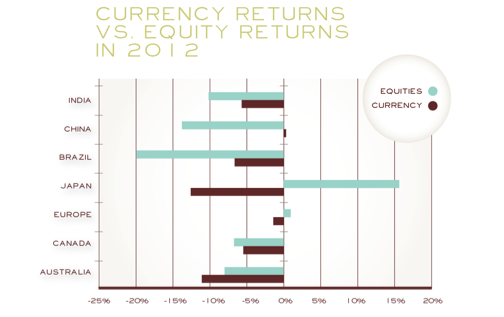

3. Currencies are not highly correlated with the country’s equity market. The illustration below compares the equity market returns and currency returns across various countries around the world during 2012.

Conclusion For much of the past 10 years, international investments were strong performers. Emerging markets, in particular, were popular with investors. Their growth was spurred by a combination of the comparative potential of developing economies and enthusiastic investments from western countries.

For much of the past 10 years, international investments were strong performers. Emerging markets, in particular, were popular with investors. Their growth was spurred by a combination of the comparative potential of developing economies and enthusiastic investments from western countries.

Many investors do not realize that there is inherent currency exposure in most foreign investments. Mutual funds, exchange-traded funds and individual securities are all usually exposed to the risks and rewards of their currency exposure. Whenever an investor or a fund manager makes a foreign investment, the first step is to convert U.S. dollars to the foreign currency. When that foreign investment is sold, the conversion takes place in reverse and the proceeds from that sale are returned in U.S. dollars. Therefore, foreign investments contain two sources of returns for US investors: the return of the investment priced in the local currency and the return of the foreign currency compared to the US dollar.

However, this additional return potential does not come without risk. In recent years, the dollar has been exceptionally strong, which diminished the returns of international investments for U.S. investors. This is not surprising; there will inevitably be time periods when a single currency outperforms all others. Further, in lower-risk investments such as bonds, the added volatility of currency can often be a substantial portion of the foreign investment’s total risk. In higher risk assets such as stocks, the added currency risk is usually less significant and not as material to investors. Regardless, investors must ensure their risk tolerance accurately matches the risk of their portfolio, and the currency exposure may greatly affect the portfolio level risk.

There are methods that can be used by investors to remove the effects of currency changes from their international investments, typically through currency hedges that invest in the foreign exchange market. Certain mutual funds and exchange traded funds have been developed to facilitate this process. However, the reality is that diversifying your currency exposure is not a bad thing. We’ve all heard the adage, “Don’t put all of your eggs in one basket.” This has been used to explain why diversification across securities and asset classes is critical for investors. However, the concept of spreading risk across multiple currencies is an added level of portfolio diversification. Obviously, this may introduce other risks, but the idea of unhinging a portfolio from some of its dependency on the U.S. Dollar or any single currency may be attractive.

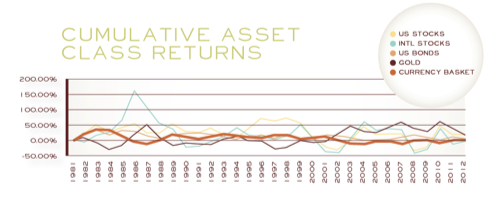

2. Currencies are not highly correlated with traditional investments. The charts below illustrate the cumulative returns of a diversified currency basket relative to U.S. stocks, foreign stocks, U.S. bonds and gold over an extended time period. All of these various investment types move independently from each other.

More often than not, investors fail to recognize the risk of not diversifying their portfolio’s currency exposure. Currencies can be deceiving because U.S. investors view their portfolio value in terms of U.S. dollars. Therefore, changes in the value of U.S. dollars relative to other currencies are not usually ‘felt’ by U.S. investors. In reality, there is an opportunity cost for U.S. investors if foreign currencies are appreciating relative to the U.S. dollar. Again, investors that view their portfolio in US dollar terms would not recognize this. This becomes increasingly important as inflationary pressures rise in the U.S. If inflation increases, it could cause the U.S. dollar to devalue and ultimately lead to decreasing purchasing power for U.S. investors. The point is that there is a differing set of risks introduced to investors that chose to denominate their portfolio in one single currency.

The recent volatility and severe loss in select emerging market investments is causing many investors to better understand how currencies affect foreign investment returns and risk. Although most foreign investments have inherent currency exposure, this offers benefits to investors, as currencies are not highly correlated with other currencies, not highly correlated with traditional investments, and not highly correlated with their country’s equity markets. Some investors have the misconception that avoiding currency exposure and even foreign investments will eliminate currency risk. Rather, this shifts or concentrates the currency risk in one single currency and removes the potential opportunities offered by currency diversification.

Steve Osterink Jr. CFA, CFP, AIF, is chief investment officer for Advisory Alpha, an asset management firm serving independent financial advisors, individual investors, and retirement plan clients. Advisory Alpha employs a series investment strategies that are composed of Exchange Traded Products and globally diversified across traditional as well as alternative asset classes. Steve can be reached at [email protected].

Managing Currency Risk

December 24, 2013

« Previous Article

| Next Article »

Login in order to post a comment