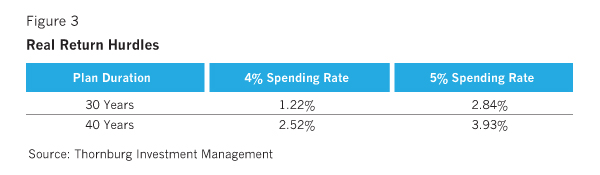

Combining these three factors and preparing a simple cash flow model yields a real return hurdle (after the cost of inflation, investment expenses, and taxes) that must be achieved or exceeded each year to provide a retirement that will sustain itself for 30-40 years and beyond. The following grid illustrates the real return hurdle at a 4% and 5% initial spending rate assuming that all the retirement savings will be used to support the retirement plan with no legacy amount specified.

For instance, a retiree with a $1 million retirement portfolio who wishes to plan for a 30-year retirement and desires to spend $50,000 (5%) a year after taxes and indexes to inflation, would need to achieve a real return hurdle of 2.84%. Reduce the initial spending level to $40,000 (4%) and the real return hurdle drops to 1.22%. Keep in mind that when we are looking at after-tax spending amounts here, this assumes that any taxes due each year are paid from the assets in the investment portfolio, not from the spending amounts being taken from the portfolio.

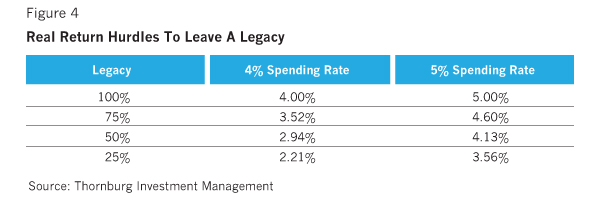

For a majority of the baby-boomers retiring in the coming years, most, if not all, of the retirement savings accumulated during retirement plus the future earnings on these savings will be spent over their planned retirement period. The concept of spending some, if not all, of the retirement savings to fund a retirement will be the norm, not the exception. For these retirees, a legacy amount will be available only if they do not use all their financial resources due to an unusually strong investment market or if spending amounts are actually less than planned. However, for those retirees who want to plan a legacy at the beginning of the retirement plan, the following analysis shows what real return hurdle would be required to provide for a sustainable spending plan, plus leave a legacy at the end of the 30-year plan. Needless to say, higher returns are required to achieve both objectives, as illustrated in Figure 4. The planned legacy amount in the left column is expressed as a percentage of the initial retirement savings and is not increased to account for inflation.

For a retiree who wants an initial spending rate of 4% and also desires to leave 25% of the initial portfolio value as a legacy, this will require a real return hurdle of 2.21%, as compared with 1.22% from Figure 3 showing no legacy. As the desired legacy amount increases, so does the real return hurdle required. Note that this chart pertains to a 30-year retirement plan, so if a 40-year plan is desired, these real return hurdles will go even higher.

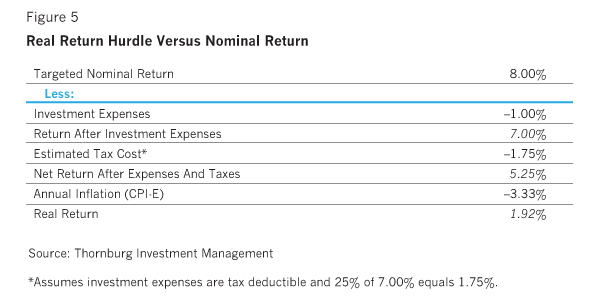

Let's use these real return hurdles in a hypothetical example assuming that a retiree wishes to use the following plan assumptions.

Time Frame: 30-year retirement period.

Spending Rate: 4% initial spending rate, indexed to

inflation.

Legacy: 25% of initial retirement savings.

Per Figure 4, the retiree has a 2.21% real return hurdle to achieve these goals. The next step is to assess the retiree's costs. Let's assume the following:

Investment Expenses: The retiree is paying the financial advisor 1% of their assets under management per year. All

other costs are included in the net return.

Tax Cost: The tax accountant and financial advisor estimate that a 25% tax bracket/cost is a good estimate.

Annual Inflation: The long-term CPI-E annual inflation rate of 3.33% for retirees will be assumed to continue into the

future.

Now that we know the retiree's cost, converting a nominal return to a real return for comparison to the real return hurdle is straightforward. Assume a portfolio allocation is being considered that has a targeted 8% nominal return. The nominal return, in the hypothetical investment in Figure 5, is converted into a real return of 1.92%. Will this will be sufficient to meet or exceed the real return hurdle of 2.21%?

Comparing the real return of 1.92% to the 2.21% real return hurdle the retiree needs to achieve gives you a quick gauge that the plan is probably not realistic. Either the retiree will need to lower her expectations for the amount of the legacy, lower spending expectations or the portfolio needs to include more investments with the possibility for higher returns. In doing this analysis, it is important to remember that the two most important variables, nominal returns and inflation, are based upon historical experience and are impossible to accurately predict for the future. With that being said, historical information is the only information we have for this purpose.

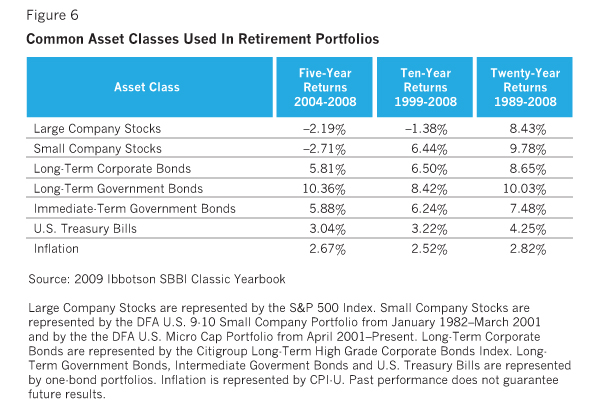

Once the analysis is complete, retirees should examine investment returns published by the financial press in a new light. They should be comparing how these investments may help achieve the long-term retirement plan's real return hurdle. In Figure 6 are the five-, ten- and 20-year trailing nominal returns for some of the more popular asset classes used to construct retirement portfolios.

A couple of things become readily apparent when reviewing these asset classes. First, a retiree with the retirement plan discussed above cannot invest solely in U.S. Treasury Bills because they prefer the lower historical risk of the asset class. Deducting just the 3.33% average cost of inflation from these returns leaves the retiree woefully short of the real return hurdle required and, after deducting tax and investment expenses, would actually result in a negative real return. The retiree is losing purchasing power by that percentage each and every year. Second, to realize just how hard it has been, especially recently, to generate a real return sufficient to sustain a reasonable spending level, let alone leave a sizeable legacy, take a look at the five- and ten-year returns for these asset classes. Using a knowledgeable financial advisor will be critical to creating and monitoring a retirement portfolio to meet the plan objectives.

In summary, planning for a 30- to 40-year retirement period makes preserving purchasing power of paramount importance. Being able to see how the retirement plan variables relate to a real return hurdle is a great first step. Going through the process of identifying each retiree's unique cost structure, including inflation assumptions, investment expenses, and taxes, will determine

how the real return from an investment compares to the real return hurdle needed to accomplish the plan.

Please note that any discussion related to average returns over a long period of time, such as a 30- to 40-year retirement, needs to be accompanied by a good understanding of the order in which returns are realized, called the "sequence of returns." For a retiree who is liquidating a small amount of their retirement savings each year to support their expenses, the order in which returns are realized is very important. It should be deemed an integral part of the discussion on preserving purchasing power.

Jack Gardner is the president of Thornburg Securities Corp., distributor of the Thornburg family of mutual funds, and a managing director of Thornburg Investment Management, the advisor to the funds. Gardner is a Certified Investment Management Analyst and Accredited Investment Fiduciary Analyst, and holds a B.S. degree in accounting from Stonehill College and an M.S. in computer information Systems from Bentley College.