The Bureau of Labor Statistics (BLS) of the U.S. Department of Labor will release its always widely anticipated Employment Situation report for March 2016 on Friday, April 1, 2016. As of March 28, 2016, the consensus of economists (as surveyed by Bloomberg News) expects the economy to add 210,000 net new jobs in March 2016, following the 242,000 gain in February 2016, and the average gain of 223,000 per month in the 12 months ending in February 2016. The consensus is looking for the unemployment rate to remain at 4.9% and for growth in average hourly earnings — the best proxy for wages in this report — to rise 2.2% in March 2016 versus March 2015. As always, the members of Federal Reserve’s (Fed) policymaking arm, the Federal Open Market Committee (FOMC), will be watching the report closely, especially the wage readings, as it deliberates on when to raise rates again.

Another important focus for financial markets this week will be a speech by Fed Chair Janet Yellen on Tuesday, March 29. She will address the Economic Club of New York and hold a Q&A session after the speech, led by former Fed Vice Chair Alan Blinder, and the dean of the Columbia University School of Business, Glenn Hubbard. Hubbard was also the Chairman of the Council of Economic Advisors in the first two years of President George W. Bush’s administration. Yellen’s remarks — and the answers to the questions posed by Blinder and Hubbard—are likely to be closely watched, in light of her comments on wages and inflation in her post-FOMC press conference on March 16, and subsequent comments on inflation, wages, and the labor market from her colleagues on the FOMC.

Breaking Down The Fomic Statement

As noted in our Weekly Economic Commentary, “The Fed’s Spring Surprise,” the FOMC announced at the conclusion of its March 15 – 16 meeting that it now plans just two 25 basis point (0.25%) rate hikes this year (instead of four) and that its long-run neutral fed funds rates is now 3.25%, 25 basis points (0.25%) lower than Fed projections in December 2015. The FOMC cited “global economic and financial developments of recent months,” as part of the backdrop supporting these changes. Those two shifts — fewer rate hikes this year and a lower end point for the fed funds rate in the years to come — went a long way toward further resolving the imbalances that wreaked havoc on global markets at the start of 2016. However, the Fed’s decision to help resolve some of the global imbalances may come at a cost, if financial markets and, perhaps more importantly, U.S. consumers begin to see an unwanted uptick in inflation in the coming months.

In our view, the data already show that the labor market has tightened enough to cause some wage inflation, although Yellen said she has yet to see a convincing pickup despite plenty of anecdotal evidence of wage pressures. Readings on inflation, most notably inflation excluding food and energy (also known as core inflation), are also moving higher, especially in the service sector; but here again, in her post-FOMC meeting press conference, Yellen downplayed that rise, noting that some of the higher inflation readings are “transitory.”

Before we review the state of wages heading into the March 2016 employment report, let’s review the FOMC statement released on March 16 and the comments Yellen made on the topic in her post-FOMC press conference that same day. As is most often the case, the FOMC statement didn’t directly mention wage inflation, but did comment on the health of the labor market, noting that: “A range of recent indicators, including strong job gains, points to additional strengthening of the labor market”; and that as it mulls future rate hikes, it is monitoring “a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.”

In her prepared remarks at the press conference, Yellen noted that “wage growth has yet to show a sustained pickup.” When asked about wages in the Q&A portion of the press conference, Yellen replied:

“So I must say I’m — I do see broad-based improvement in the labor market, and I’m somewhat surprised that we’re not seeing more of a pickup in wage growth. But at least — and I have to say, in anecdotal reports, we do hear quite a number of reports of firms facing wage pressures and even broad-based, slightly faster increases in wages — wage increases that they’re granting. But in the aggregate data, one doesn’t yet see any convincing evidence of a pickup in wage growth. It’s mainly isolated to certain sectors and occupations. So I do think, consistent with the 2% inflation objective, that there is certainly scope for further increases in wages. The fact that we have not seen any broad-based pickup is one of the factors that suggests to me that there is continued slack in the labor market, but I would expect wage growth to move up some.”

Uptick In Wages Remains Key

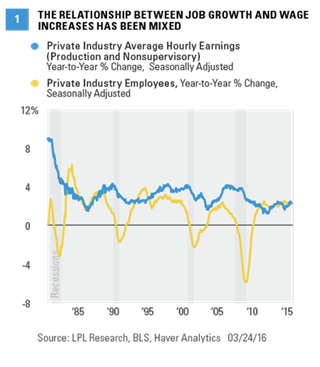

Our view is generally aligned with Yellen’s, in that a decisive upturn in wage inflation remains key to moving inflation and inflation expectations higher. Although, in theory, a more robust pace of job growth should coincide with an upturn in wage inflation, the relationship between wages and job creation has been mixed over the past 30 years or so [Figure 1]. In the mid-1980s, the year-over-year percent change in wages began to accelerate just as the year-over-year percent change in private sector jobs did. But in the aftermath of the early 1990s recession, wage acceleration lagged significantly behind acceleration in overall employment, as wages didn’t begin to accelerate until early 1995, more than three-and-a-half years after job growth began to accelerate.

Similarly, the mild 2001 recession ended in late 2001, and job growth didn’t begin to accelerate until April 2002. It would be almost another year (March 2003) until wages began accelerating. In the economic recovery that commenced in June 2009, employment began to accelerate in the fall of 2009. Wage growth, however, continued to decelerate for another three years, and didn’t begin to accelerate decisively until late 2012, only to roll over again in late 2014 — despite robust (225,000+ per month) job growth in 2013 and 2014. Wages generally accelerated throughout 2015 and into early 2016 (from a year-over-year change of 1.6% in February 2015 to 2.4% in February 2016). We continue to expect a modest acceleration in wage inflation over the remainder of 2016.

Wages can also be influenced by the slack in the overall economy, measured in this case by the output gap, the difference between actual gross domestic product (GDP) and potential GDP [Figure 2]. An output gap below zero suggests that there is slack in the economy. When the output gap is negative — and moving further in that direction as it was between the start of the Great Recession and June 2009 — it puts tremendous downward pressure on wages. When the output gap is negative but improving, as it has been since mid-2009, the downward pressure on wages abates somewhat, and that is what we have seen in the wage data to date. In the period just prior to the start of the Great Recession in late 2007, wages were running at well over 4% on a year-over-year basis. By September 2012, after the economy had run below its long-term potential growth rate for more than five years, wage growth compressed to just 1.2%. A pickup the labor market and the overall economy since late 2012 has helped to narrow the output gap and driven wage growth into the 2 – 2.5% range, a big improvement, but still well below the pace seen prior to the Great Recession in the mid-2000s. It’s clear that the Fed, or at least Yellen, wants to see wages move closer to that 4.0% level before raising rates again.

Wages In The Good Old American Know-Hows Sectors Leading The Way

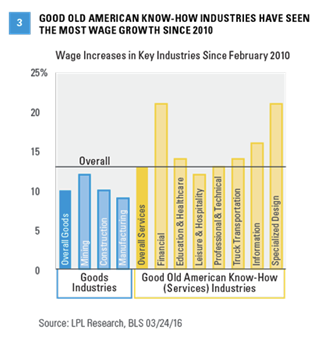

Figure 3 looks at the wage gains seen in the overall economy and in key industries since the labor market bottomed out in February 2010. Overall, average hourly earnings in the private industry have increased by 13% since the economy began regularly creating jobs in February 2010, eight months after the end of the Great Recession. Wages in the broad goods-producing sectors (mining, construction, and manufacturing) have increased by 10% over that span, with mining (+12%) far outstripping construction (+10%) and manufacturing (+9%), despite the collapse in oil prices over the past two years or so. On the services side, wages in the private sector (up 13% since February 2010) have outpaced wages in the goods-producing sector as a whole (+10%). Within the private services sector, one clear winner is the broad financial services area, where wages have increased more than 21% since February 2010 — albeit from a depressed base, as no sector suffered more than financial services during the housing-induced Great Recession. “Specialized design services,” also up 21%, has been another leader in wage growth. Both categories fall under our “good old American know-how” umbrella, including real estate and credit intermediation, commonly known as commercial banking. Wages in those areas are up 17% and 16%, respectively, since February 2010.

Several other good old American know-how segments of the economy, including education and healthcare, leisure and hospitality, professional and technical services, truck transportation, and information services, have seen wages increase more than average since the labor market bottomed out in early 2010, as noted in Figure 3. On balance, while wage growth has been rather tepid over the last 12 months (+2.2%) and since the economy began creating jobs in February 2010 (13% or 2% per year), there is evidence, in our view, that shortages of skilled workers in key areas of the economy have led to a pickup in wages. In addition to hitting that 4% level for wages as noted above, it appears that Yellen and her FOMC colleagues want to see more evidence that those improvements have spread to all sectors of the labor market before moving rates higher again.

John Canally is chief economic strategist for LPL Financial.