Here’s a riddle: What’s the difference between $107,000 and $107,001? Answer: $974.40, at least that’s how much more that $1 in income will raise your client’s annual Medicare premiums for Part B and Part D in 2013.

For the first 41 years of the Medicare program, everyone enrolled in Part B paid the same premium regardless of income. The Medicare Modernization Act changed that. Best known for creating the Part D prescription drug benefit, it also introduced a sliding scale for Part B premiums based on income starting in 2007.

The Social Security Administration calls this income-based premium IRMAA, for income-related monthly adjustment amount.

The Upshot Of IRMAA

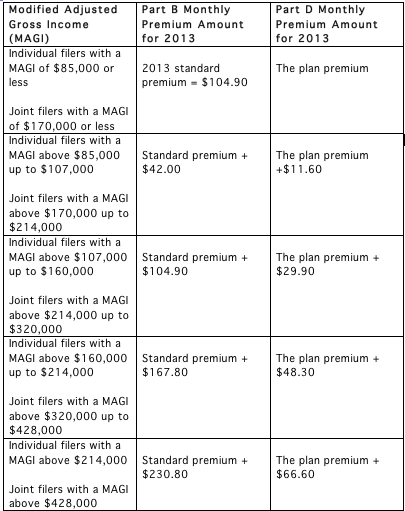

With IRMAA, higher-income beneficiaries pay the standard Part B premium plus an additional amount based on their modified adjusted gross income (MAGI).

The standard Part B premium is set to equal 25 percent of projected program costs, with general revenues funding the other 75 percent. Higher-income enrollees pay a higher percentage of Part B costs. The percentage rises as income rises, with premium amounts that range from 35 percent to 80 percent of the value of Part B coverage.

The Affordable Care Act of 2010 (ACA) contained two provisions that further expanded the reach of IRMAA:

1. It established a new income-related Part D premium that took effect in 2011. The Part D IRMAA uses the same surcharge percentages (35 to 80 percent) and income thresholds as the Part B IRMAA. The surcharge is calculated as a percentage of the national average cost of the standard drug benefit.

2. ACA freezes the income thresholds for IRMAA at 2010 levels from 2011 through 2019.

To return to the case of your client with a MAGI of $107,001: As an individual filer, your client will pay a monthly Part B surcharge of $104.90 and a Part D surcharge of $29.90 (see table). This means that her total monthly Part B premium will be $209.80 and her Part D premium will be the premium for the plan she selects plus $29.90. One dollar less in income and her total monthly Part B premium is $146.90 and her Part D premium is the premium for the plan she selects plus $11.60. That’s a monthly difference of $81.20, an annual difference of $974.40.

IRMAA Tricky For New Retirees

Social Security uses the most recent federal tax return provided by the IRS to determine who must pay higher Medicare premiums. For example, to determine your client’s 2013 Medicare premiums, Social Security typically will look at the tax return filed in 2012 for tax year 2011.

But if your client retires in 2013, her income in 2013 may be lower than it was in 2011 when she was working full time. Social Security will set her premium higher based on her 2011 income, unless she requests a new decision. That’s why your client needs to understand how Medicare premiums are set and what recourse she has if she disagrees with Social Security’s calculation.

Social Security uses the most recent federal tax return provided by the IRS to determine who must pay higher Medicare premiums. For example, to determine your client’s 2013 Medicare premiums, Social Security typically will look at the tax return filed in 2012 for tax year 2011.

But if your client retires in 2013, her income in 2013 may be lower than it was in 2011 when she was working full time. Social Security will set her premium higher based on her 2011 income, unless she requests a new decision. That’s why your client needs to understand how Medicare premiums are set and what recourse she has if she disagrees with Social Security’s calculation.

Social Security encourages higher-income beneficiaries to request a new decision about their Medicare premium if their income has gone down because of any of the following life-changing events:

• They married, divorced or became widowed

• They or their spouse stopped working or reduced their work hours

• They or their spouse lost income-producing property due to a disaster or other event beyond their control

• They or their spouse experienced a scheduled cessation, termination or reorganization of an employer’s pension plan

• They or their spouse received a settlement from an employer or former employer because of the employer’s closure, bankruptcy or reorganization

In each of these instances, the individual needs to supply Social Security with documentation that verifies their changed situation. For example, your client would need to supply Social Security with documentation that verifies that she retired in 2013 and the reduction in income.1

Make IRMAA A Part Of Retirement Planning

You can add value to the service you provide to your clients by helping them understand how income-based Medicare premiums may affect their finances.

For your clients whose income places them near one of the IRMAA income thresholds, you can factor this issue into tax and financial planning. For example, a one-time sale of an asset will prove less profitable if it boosts a client’s income, requiring that she pay a higher Medicare premium for a year.

More and more of your clients may be hit with these premium surcharges in the coming years. From 2007 through 2010, the IRMAA income thresholds were indexed annually for inflation. Because ACA freezes the income thresholds at 2010 levels, the share of Medicare beneficiaries who pay IRMAA is projected to rise from 5.1 percent in 2012 to 9.7 percent in 2019.2

And politicians on both sides of the aisle have proposed an expansion of higher-income Medicare premiums as part of their debt and deficit reduction plans.

Both President Barack Obama’s FY2014 budget proposal and the budget proposal put forward by the Republican chairman of the House Budget Committee would continue the freeze on income thresholds until 25 percent of Medicare beneficiaries pay income-related premiums. Both proposals also increase the amounts of the premium surcharges so that they cover a higher percentage of projected program costs.3

For clients already relying on Medicare or becoming eligible soon, it’s important to educate them about IRMAA. Help them look at strategies to minimize their exposure and identify other ways to make Medicare plan selection choices so they have healthcare coverage that best meets their needs and financial resources.

For your younger clients, an awareness of the role that income may play in setting their future Medicare premiums may help them form a more realistic assessment of their healthcare costs in retirement.

Paula Muschler is manager of the Allsup Medicare Advisor®, a nationwide Medicare plan selection service that helps financial advisors ensure their clients choose the Medicare coverage that matches their needs and preferences. Allsup Medicare Advisor® is an unbiased Medicare plan selection service that serves as a trusted resource for financial advisors and seniors. Allsup Medicare specialists can work with your clients one-on-one to assess their needs, research their Medicare options and help them choose cost-effective coverage that protects their health and retirement savings. Financial advisors may contact (888) 220-9678 or go to FinancialAdvisor.Allsup.com for more information.

1Social Security Administration, “Medicare Premiums: Rules For Higher-Income Beneficiaries,” 2013.

2Kaiser Family Foundation, “Income-Relating Medicare Part B and Part D Premiums Under Current Law and Recent Proposals: What are the Implications for Beneficiaries?” Medicare Policy Issue Brief, February 2012.

3 Kaiser Family Foundation, “Medicare and the Federal Budget: Comparison of Medicare Provisions in Recent Federal Debt and Deficit Reduction Proposal,” Medicare Policy Issue Brief, April 2013.