Key Points

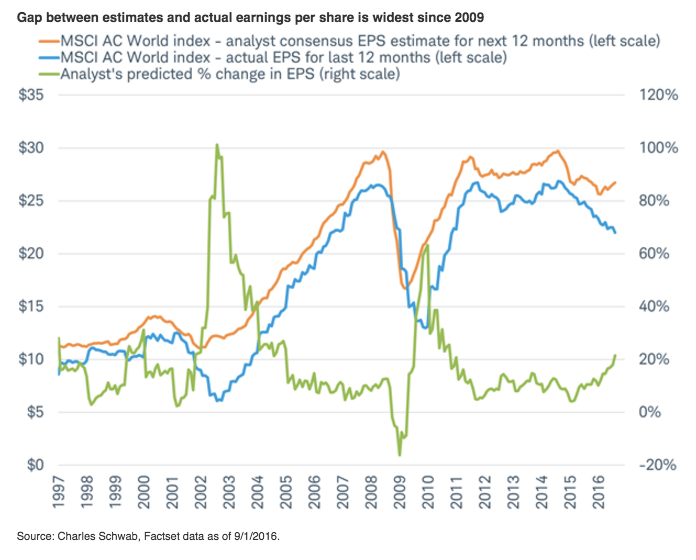

- The gap between estimates for the year ahead and actual earnings is now the widest since 2009.

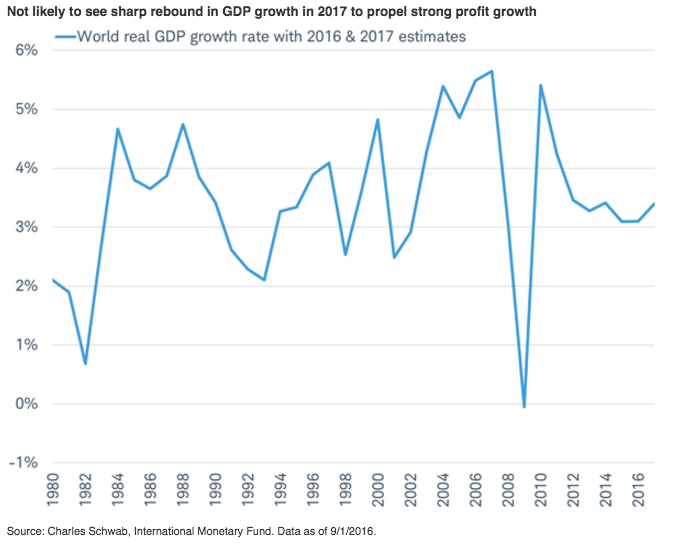

- Unlike 2009, the slump in earnings has not been accompanied by a global recession which would be followed by a sharp rebound in the economy and earnings.

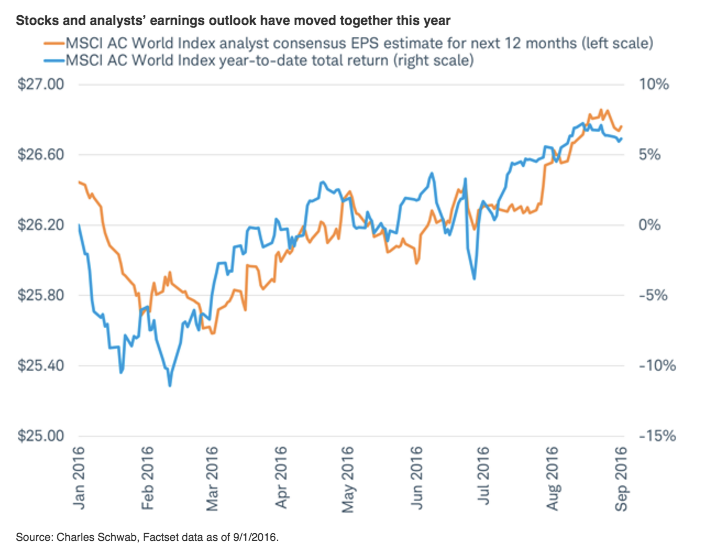

- For the past six months, global stocks have been supported by an improving earnings outlook, but with expectations stretched, stocks are vulnerable to a pullback if actual earnings fail to deliver on the promise of better growth.

After a year and a half of cutting their earnings estimates for the world’s companies by a total of 14%, analysts have spent the past six months raising them. Are they now expecting too much?

These divergent trends have made the gap between estimates and actual earnings the widest since 2009, as you can see in the 20 year history illustrated in the chart below.

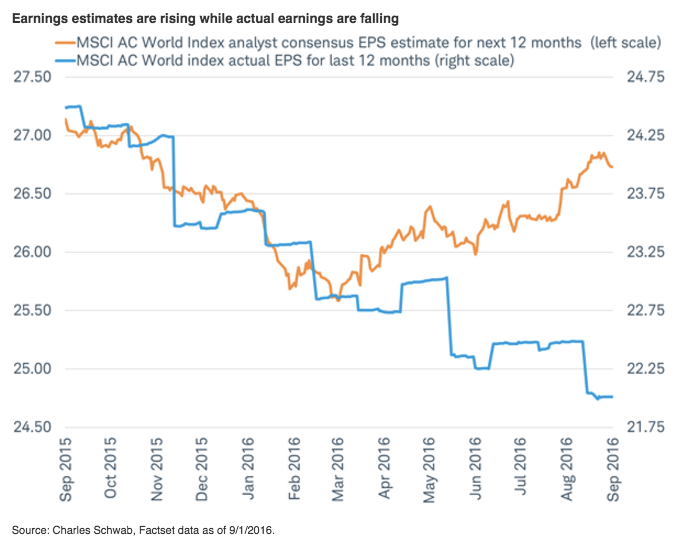

Since the end of February, the trends in earnings estimates for the coming year and actual earnings over the past year have headed in different directions, as you can see in the chart below.

There were good reasons back in 2009 for the optimism that drove the wide gap between actual earnings results over the prior year and earnings expectations for the year ahead after the global recession cut earnings per share in half. In the two years following the low point in 2009, earnings doubled as the global economy rebounded from a contraction in 2009 with GDP growth of +5.4% in 2010 and +4.2% in 2011. A similar scenario unfolded in 2002. Back then, earnings also doubled in the two years following a recession which caused a 50% drop in earnings and a wide gap between actual trailing earnings and forward estimates. Within two years of the 2002 low, earnings had fully recovered their losses.

Can we look forward to a powerful rebound in earnings similar to those that followed the gaps of 2002 and 2009? We doubt it. The slump in earnings in recent years was not accompanied by a global recession which would be followed by a sharp rebound in global growth of 5% and a big jump in earnings. Instead, economists expect more of the same sluggish growth in 2017 (the IMF sees global GDP accelerating to 3.4% in 2017 from 3.1% in 2016), as you can see in the chart below. While that doesn’t rule out a modest turnaround in earnings, it does make the consensus forecast for more than 20% earnings growth over the next year at risk of being overly optimistic.

The chart below shows that stocks have been rising since February supported by the improving outlook for earnings. However, the recent slowing pace of the gains along with the wide gap between estimates and actual earnings suggests an increasing need for actual earnings to start to improve and validate analysts’ optimism.

While many factors vie for investors’ attention, the outlook for earnings is arguably the most important driver of the stock market. After two years of declines, actual earnings may soon begin to turn around. But, with expectations now stretched to the widest gap in more than seven years, stocks are vulnerable to a pullback if actual earnings fail to deliver on the promise of better growth. The potential for the return of volatility is a reminder that rebalancing back to your strategic asset allocation targets may be a smart idea.