It’s time for our monthly look at market risk factors. Just as with the economy, there are several key factors that matter for the market, in determining both the risk level and the immediacy of the risk. Stocks have largely recovered from their recent pullback, but given valuations and recent market behavior, it will be useful to keep an eye on these factors.

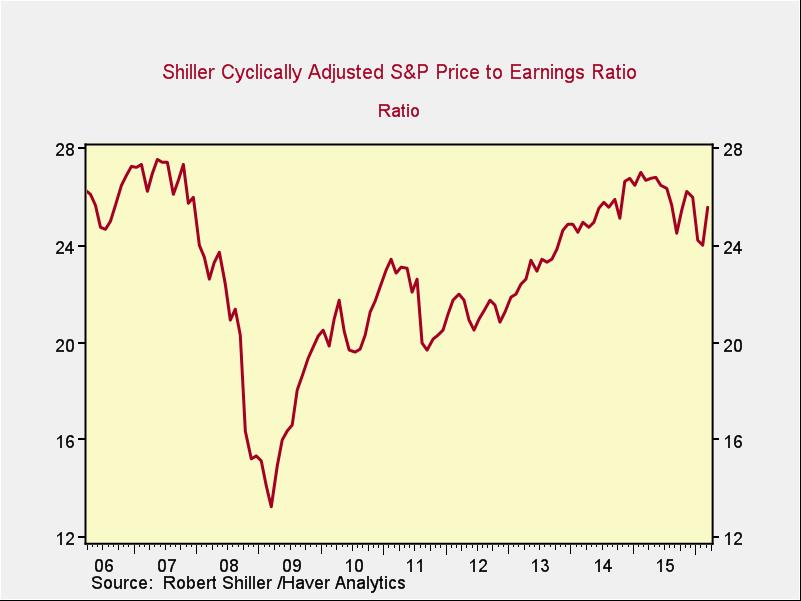

Risk factor #1: Valuation levels

When it comes to assessing valuations, I find longer-term metrics, particularly the cyclically adjusted P/E ratio, which looks at average earnings over the past 10 years, to be the most useful.

Two things jump out here:

First, valuations are approaching the levels of 2007–2008, which speaks for itself.

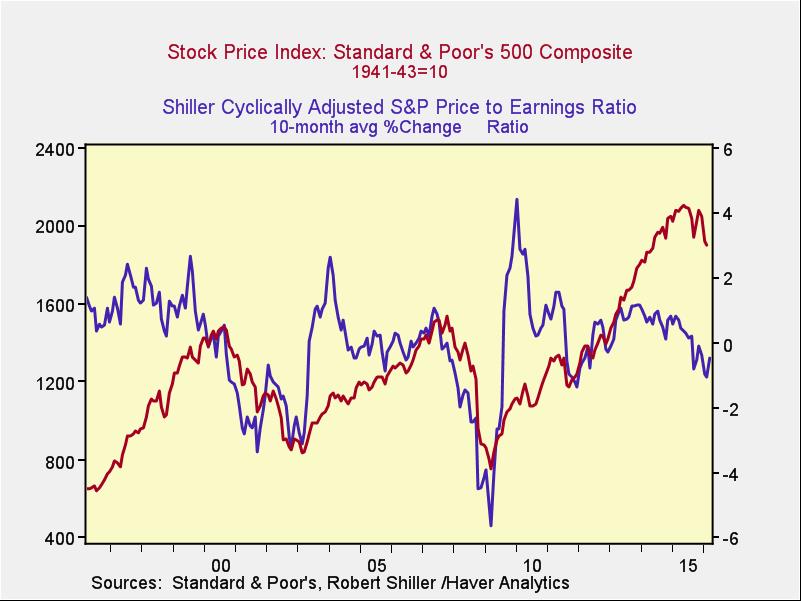

Risk factor #2: Changes in valuation levels

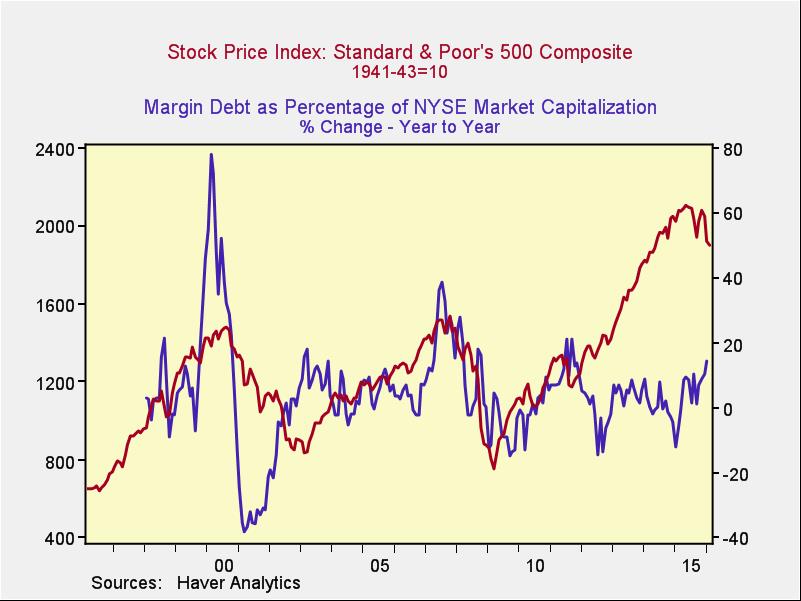

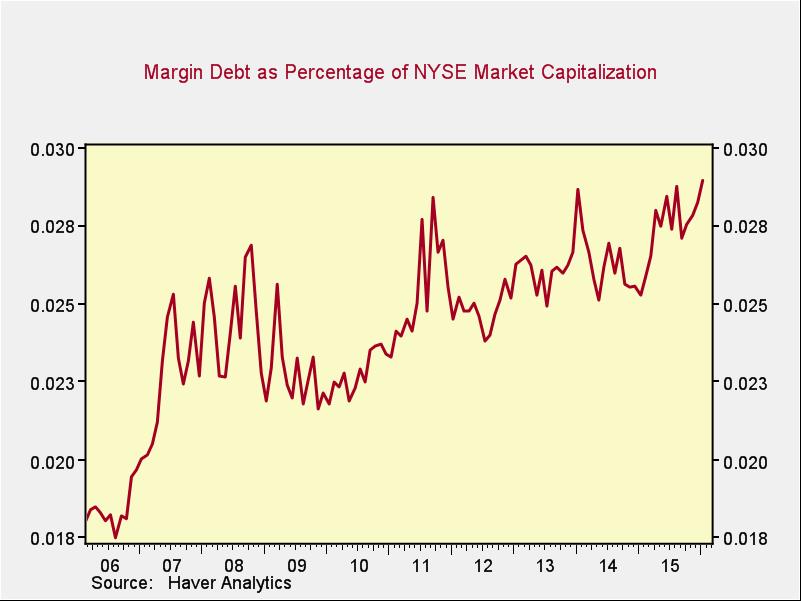

Risk Factor #3: Margin debt

Risk factor #4: Changes in margin debt

This risk trigger isn’t being pulled just yet, but it may be soon enough.

Second, even at the bottom of the recent pullback, valuations were at levels above any point since before the crisis.

Although valuations are at close to peak levels for the past 10 years, they remain well below the 2000 peak, so you could argue that this metric isn’t suggesting high risk. Of course, that assumes we might head back to 2000 bubble conditions, which doesn't exactly mean risks are low.

Another way to use this data is to look at the changes in valuation levels over time as an indicator of trouble ahead.

Here, you can see that when valuations roll over, with the change dropping below zero over a 10-month or 200-day period, the market itself typically drops shortly thereafter. Despite the recent recovery, we're still seeing that kind of decline, so this is clearly an indicator of potential risk. The metric is recovering, however, which means the risk may be receding.

Another indicator of potential trouble is margin debt.Here, we can see that, as a percentage of market capitalization, margin debt has moved up to an all-time high, above the level of 2000. This is certainly an indicator of higher risk, but again, not necessarily immediate risk.

If we look at the change over time, however, even as the absolute risk level remains high, the immediate risk does not. We don’t yet see the kind of spike in debt that occurred just before previous pullbacks, although we are definitely moving in that direction.