Key Points

- Both Hillary Clinton and Donald Trump have said they want to increase spending on infrastructure, which could mean an increase in the issuance of municipal revenue bonds.

- When constructing a municipal bond portfolio, we suggest investors start with a core of general obligation and essential service revenue bonds.

- For potentially higher yields—but also higher risks—consider adding bonds from issuers with some business risks.

Cooper J. Howard, CFA, is senior research analyst, fixed-income and income planning, at Charles Schwab & Co.

Rob Williams is director of income planning at the Schwab Center for Financial Research.

Democratic presidential candidate Hillary Clinton and her Republican counterpart Donald Trump may differ on a number of issues, but they appear to agree on at least one thing: Both candidates have publicly said they support spending to repair and improve roads, bridges and other parts of America’s infrastructure. Whoever wins in November, a successful push for more infrastructure spending could have implications for the municipal bond market, in the form of increased issuance of revenue bonds.

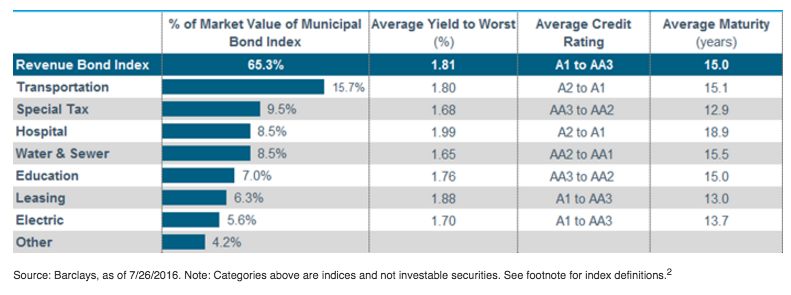

Here we’ll consider some of the factors investors should weigh before investing in such bonds, which already make up nearly two-thirds of the municipal bond market.

Investment needed

In its 2013 Report Card for America's Infrastructure, the American Society of Civil Engineers gave the United States a poor D+ grade and estimated that the country needs to spend $3.6 trillion by 2020 to modernize its infrastructure. Such spending could go toward transportation, inland waterways, and power-generation and transmission projects, among others.

As you can see in the chart below, state and local government spending on construction projects was 7% lower in 2015 than its 2009 peak. That came after such spending had risen at an average annual rate of nearly 6% from 1993 to 2009.

Infrastructure spending is down 7% since peaking in 2009

Although both the Democratic and Republican presidential candidates have said they want to increase infrastructure spending, campaign plans don’t always turn into reality. However, given the apparent consensus on the issue, some increase seems likely. That, in turn, could mean an increase in the issuance of municipal revenue bonds. In our view, such bonds should be part of a well-diversified muni portfolio.

Follow the money

So where does the revenue backing a revenue bond come from? Issuers of revenue bonds generally pay bond holders with money earned from either selling a product—like water—or providing a service—like transportation. That makes them different from general obligation (GO) bonds, which are issued by governments and generally backed by tax revenues.

As a result, the credit characteristics of revenue bonds tend to vary more than those of GO bonds, so it’s important to understand where the revenue backing a given bond comes from.

Issuers of revenue bonds are generally subject to business risks that can influence their ability to pay the bonds back.

There are a number of different types of revenue bonds

Start with essential services such as water and sewer

We suggest starting with bonds backed by a revenue source from services that users cannot live without, such as water and sewer. Because the demand for water and sewer services tends to be steady, the credit quality of such bonds is often higher, on average, than that of other revenue bonds. However, that usually also means lower average yields than other types of revenue bonds. We suggest focusing on water and sewer systems in large and mature areas, with stable or improving demographic trends.

Consider revenue bonds with some business risk for higher yields

For potentially higher yields—but also the possibility of additional credit risk—consider transportation, special tax, or education revenue bonds.

Transportation revenue bonds are backed by the revenue from a transportation system, such as an airport, toll road or municipal transit system. Credit quality varies widely among transportation bond issuers. We suggest focusing on systems that are located in densely populated areas and serve a reliable customer base. Such issuers—particularly those with strong management—will generally have the flexibility to weather economic downturns and meet their obligations to bond holders.

Special tax revenue bonds are secured by a special tax, such as a sales tax. The credit quality of sales tax-backed bonds can often be high as the issuers may have access to strong cash flows and there tend to be limits on the ability to issue such bonds. That said, bonds backed by sales taxes may be more dependent on the business cycle than other kinds of revenue bonds. Consumer spending—and therefore sales taxes—tends to do better when the economy is growing and could struggle when growth slows. Investors should also avoid concentrating their holdings in bonds backed by taxes that face similar economic risks. For details, you can read credit rating reports or prospectuses, or talk with a Schwab bond specialist.

Education revenue bonds can come from both private and public colleges that generate revenue from tuition, dorm rents and state and federal funding. From a credit perspective, demand is one of the major factors distinguishing stronger higher education issuers from weaker ones. Institutions with strong demand, more selective admissions criteria and larger endowments tend to be better able to manage economic downturns, demographic changes, increased competition, and other issuers.

Conservative investors may want to avoid bonds with more speculative credit characteristics

Lower credit-quality hospital, leasing or electric revenue bonds may offer higher yields, but may be more exposed to business risks relative to other revenue bonds. More conservative investors should limit, or even avoid these types of revenue bonds.

Hospital revenue bonds are backed by the revenues of not-for-profit (NFP) hospitals. Issuers can range from large, highly sought-after hospital systems to smaller nursing homes with less stable credit characteristics. Compared to other sectors of the municipal market, NFP hospitals tend to operate in an environment without a natural monopoly, and with the exception of larger, more established systems, tend to be lower rated. Nursing homes and other care facilities can also issue municipal bonds, but the credit quality is generally more speculative and not a good fit, in our view, for most investors who look to individual municipal bonds for stability and income.

Leasing revenue bonds, sometimes also called certificates of participation, or COPs, are backed by lease payments from properties leased out by a bond issuer. Such bonds tend to be issued by entities that can’t secure a more stable revenue stream, perhaps because they couldn’t get voter authorization or tax-backing to construct the facility. We would generally be cautious with these types of bond structures.

Electric revenue bonds are usually issued to build power plants. Generally, the sale of electricity is the primary revenue source to pay these bonds back. Issuers are often exposed to higher business risks relative to other revenue bond issuers.

Next steps

Navigating through the revenue bond market can be tricky, as this $2.3 trillion sector defies generalization.

If you’re doing it on your own, we would suggest that the core of your municipal bond portfolio comprise GO bonds and revenue bonds issued by issuers that have a natural monopoly, or near monopoly, on a given service or product. You could then consider adding other revenue bonds for potentially additional yield and diversification purposes. We suggest diversifying among at least 10 different issuers who do not share similar credit or economic risks. Also, review a bond’s indenture or latest rating report to understand the revenue sources backing that bond.

If you don’t want to build a portfolio on your own, use a mutual fund or other professionally managed solution. Very often, funds have professional credit analysts who will monitor the portfolio’s holdings.

In either case, consider using the help of a Schwab Fixed Income Specialist. They can help you navigate the market and provide the information you need to address credit issues and find the types of revenue bonds that make sense in a diversified muni portfolio.