Imagine that you screened out 75% of your potential investment universe before even putting one dollar to work on your clients' behalf. Would that kind of blanket rejection be beneficial to your clients? I believe it would be a disadvantage to investors to lose access to 75% of any market on a whim. Yet, that is what happens every day in the ETF market, based on a misunderstanding of ETF trading and liquidity.

There exists a stubborn misconception about how to evaluate ETF liquidity-based on an erroneous notion that trading volume determines the liquidity of an ETF. With conventional securities, liquidity is often assessed by looking at secondary market trading volume. Thinly traded securities may be difficult to sell, as there is often a limited pool of potential buyers, which can impact cost and quality of execution.

Many commentators and investment professionals counsel investors to stay away from smaller or newer ETFs, and often recommend looking at trading volume or AUM thresholds as guidelines before buying an ETF. Unfortunately, newer ETFs or more niche strategies will not meet the specific volume threshold; and therefore, advisors will shy away from allocating to these unique strategies. With ETFs, trading volume of the fund itself is not an indication of its overall liquidity. An ETF can often have much greater liquidity than indicated by its trading volume, thanks to ETF's unique creation and redemption process.

Understanding the creation/redemption process is critical to making a realistic assessment about liquidity and making the most of this innovative asset class for your clients' portfolios.

ETFs Are As Liquid As Their Underlying Securities

If there is one rule of thumb to remember about ETF trading it would be this: the shares of any individual ETF are as liquid as the underlying securities held by the fund. For example, an ETF that tracks the S&P 500® Index-no matter the size or trading volume of the fund-is as liquid as the index itself.

The mechanism for ETF liquidity takes two forms. The first is secondary market trading. The other is a unique creation/redemption process by which sellers can access liquidity through market makers and other specialized intermediaries-e.g., "Authorized Participants."

ETF shares can be created and redeemed by Authorized Participants (AP) at any time, as market conditions warrant. The creation/redemption process is quite simple and works as follows:

To create shares, the AP simply buys a basket of securities that mirrors the fund's current holdings. The AP delivers those securities to the fund sponsor and receives ETF shares in return. Those ETF shares can then be sold into the secondary market.

The redemption process works the same way, just in reverse. The AP buys ETF shares in the secondary market and delivers those shares to the fund sponsor. The AP receives a basket of securities in return, and can then sell those securities at the prevailing market price.

The important part of this process with regard to liquidity is the redemption part. In addition to intermediaries (e.g., market makers and Authorized Participants). ETF shares can be traded for a basket of underlying securities, which are then sold, whenever there is a market demand to redeem ETF shares. So long as the underlying securities are liquid, so too are the ETF shares-regardless of the size or trading volume of the ETF itself.

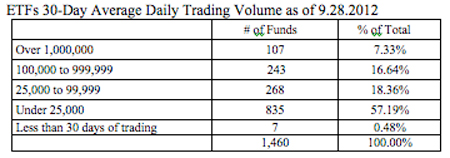

This is a critical mechanism to understand, because looking only at secondary market trading can skew the picture of ETF liquidity. For example, less than 25% of ETFs trade more than 100,000 shares a day (see table). An adviser who automatically rules out funds below this threshold is ruling out the vast majority of vehicles in the market-and vastly reducing the client's potential opportunity set.

SOURCE: Bloomberg September 28, 2012. Past performance is no guarantee of future results.

Executing ETF Trades

Whether ETFs are part of a long-term buy-and-hold strategy, or a tactical trading strategy, they can be highly liquid, cost-effective vehicles for accessing a wide range of asset classes and region. A few simple rules can help guide ETF trading and ensure that you and your clients have access the full range of possibilities available in EF markets:

Pricing: Make sure to check the ETF's "indicative intra-day value" (IIV)-a calculation of intraday market value based on the current price of underlying securities. The IIV has its own ticker and is updated and published virtually continuously (every 15 seconds) throughout the trading day. Comparing the IIV to the ETF price will give investors a clear picture of how well market quotes reflect the current market value of the underlying securities. (Note: In some cases, the IIV may not accurately depict the current market value of the ETF-e.g., ETFs whose underlying securities are traded internationally, infrequently, or lack electronic trading. In such cases, other liquid instruments such as futures contracts and individual stocks with high correlations to the ETF may offer a better gage of the ETF's current market values.)

Liquidity: To gauge the quality and depth of markets made on ETFs, investors can look at trade volumes, bid-offer spreads, and the depth of markets made. It is important not to rely solely on the last sale as it may no longer reflect current market conditions and values of the securities held by the ETF. Careful review of underlying security liquidity, ETF trade volumes, ETF bid-ask quotes and depth of markets will indicate the market's potential capacity to absorb trades under consideration.

Large orders: Because secondary markets may not reflect all sources of potential liquidity, advisors with orders larger than 10,000 shares should contact their broker/trading desks. These desks can tap alternative sources of liquidity, including APs. And for very large orders, APs can create or redeem shares to facilitate the advisor's order.

Limit orders: Avoid market orders for large transactions, or when close monitoring of trade execution is not possible. Limit orders give investors more control over execution: in addition to reducing market impact, they may help buyers avoid both price spikes and sudden market drops (e.g., the "flash crash" of 2010).

Monitoring: All trading should be actively monitored whenever possible. Just as with individual stocks and other securities, bid/ask spreads for ETF shares can change over the course of a trading day. Ensuring optimal trade execution requires close monitoring until the entire trade is completed.

Assessing cost: As with stock trades, ETF traders need to assess the impact of trading costs on their strategies. While trading costs have declined dramatically, it is important to factor commission and market impact costs in evaluating strategies and trading approaches.

A True Picture of Liquidity

When assessing the tradability of ETFs one should not ignore issues like longevity, size or trading volume, but they should also not be the sole barometers. The most accurate reflection of an ETF's tradability is the liquidity of its underlying securities. And for larger trades, partnering with a firm that has a "Best Execution" desk can help investors source liquidity and better manage trading spreads. Arbitrary rejection of an ETF based solely on thin secondary market trading, or small fund size, may close off valuable opportunities for advisors and their clients. As the ETF universe continues to expand, and innovative new strategies continue to come to market, it is important for advisors to maximize that opportunity by using accurate, relevant criteria for investment decisions.

Anthony Davidow CIMA®, Guggenheim Investments, Managing Director, Portfolio Strategist, Head of ETF Knowledge Center.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Past performance is no guarantee of future results. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. Investment involves risks.

This material contains the opinions of the author but not necessarily those of Guggenheim Investments and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. There is no guarantee that results will be achieved. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.