Negative Interest Rates: Powerful out-of-the-box thinking or insanity?

By Wendy W. Stojadinovic, CFA

Yes, it’s true: there actually are investors who are buying bonds that have negative yields. For example, investors are buying German two-year government bonds with a 0% coupon for a price of $101 knowing they will only get $100 back at maturity. Or in other words, these investors are paying the German government to hold their money!

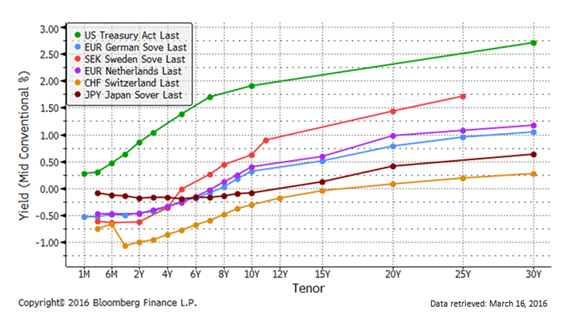

For years I’ve listened to complaints that U.S. interest rates are too low, but when you compare U.S. rates to Germany, Sweden, Netherlands, Switzerland and Japan, U.S. rates are relatively attractive. In these five developed countries, their bonds maturing in five years or less are trading at negative rates. In Switzerland, bonds as long as 15 years to maturity are trading at negative interest rates. According to Bloomberg, more than $7 trillion of global government bonds yield less than zero. This sounds insane; so, why is this happening?

It begins with central bank policy attempting to foster higher growth and 2% inflation. When a central bank sets policy rates, it basically sets two rates: first is the interest rate it will pay member banks for deposits of excess reserves and second is the interest rate it will charge member banks for lending cash to them. In theory, a bank should be highly incented to make loans or other investments that earn it more than what it costs to borrow the money.

In turn, lower bank borrowing costs allow it to lend at lower rates, which should spur demand for loans and lead to higher growth and inflation. Central banks have kept rates at near 0% for years, but there has not been a lot of loan growth. If only it were that simple. There just hasn’t been enough demand for loans due to economic uncertainty, and where there is demand, there are regulatory hurdles that hinder the banks’ ability to make the loans.

Central bank policy rates have enormous influence on the level of short term bond rates, but they have less effect on longer term rates. To increase loan demand, central banks needed to more directly influence longer term rates lower so they implemented quantitative easing (QE). QE occurs when central banks actively buy securities on the open market. The larger the quantity they buy, the more yields on those securities decline. Lower rates also push investors looking for income to take more risk by moving into longer maturities or into bonds with more credit risk in order to get yield. The higher the demand for these securities, the lower those rates go, too, which should also lead to higher corporate borrowing to fund capital expenditures and greater home mortgage demand, which spurs economic growth and inflation.

The U.S. was the first to implement QE, but it stopped QE in 2014 and now other central banks are ramping up. Unfortunately, the central banks of the five developed countries in the chart have had to be even more aggressive with monetary policy by instituting negative rates. To implement the negative rate policy, central banks simply charge (instead of paying) its member banks interest on the cash they deposit at the central bank that exceeds their minimum required balance. If the prospect of earning nothing on excess reserves was not enough incentive to make loans, certainly paying the central bank to hold the cash should be!

Besides stimulating loan growth, negative rate policies have also been used to fight currency appreciation and deflation. To understand the battle of currency appreciation, it’s important to review the theory of interest rate parity. This theory says that the relationship between the currency exchange rates among countries is a function of the level of their local interest rates, such that the variance between each country’s interest rates is about the same as the difference in their currencies. If there is a difference, traders typically come in and arbitrage the difference away. In theory, the value of a country’s currency should rise and fall as its interest rates rise and fall. Therefore, lower central bank rates should lead to a weaker currency which should boost economic activity through exports because that country’s goods and services are now cheaper for foreigners to buy.

With all the intervention by central banks globally to reduce interest rates the last few years, we’ve witnessed a lot more currency volatility. Safe-haven currencies strengthened while currencies in countries where central banks were cutting rates weakened. Sweden and Denmark are known for their safe-haven, stable currencies but too much money flowing in pushes the currencies so high it stifles their ability to export and slows their economies. The Swedish and Danish central banks were the first to impose negative deposit rates in order to reduce capital inflows from other countries and prevent rapid currency appreciation. The Swiss National Bank followed with negative rates shortly thereafter. The Swiss had maintained a cap in the value of the Swiss franc relative to the Euro, but there was so much pressure on the Swiss franc to appreciate that they had to abandon it.

With respect to deflation, by June 2014, the European Central Bank cut rates into negative territory. While its currency, the Euro, had been weakening the whole time, it was more focused on thwarting deflation fears. Deflation is difficult to defeat so extraordinary measures are being taken. For decades, Japan has struggled with low levels of inflation, and finally, with the help of enormous central bank intervention, Japan actually saw more normal levels of inflation in 2014, but inflation has since waned. The Bank of Japan does not want deflationary sentiment to come back, so at its January policy meeting, it joined the negative interest rate club.

The fight against currency appreciation and deflation explains negative short term rates, but what explains why longer term bonds have negative yields?

I think the answer goes back to deflation and currency devaluation. Switzerland, Sweden and Japan have all had more than a few years of deflation since the financial crisis, while inflation in Germany hovers around 0%. Investors buying bonds at negative rates are not buying them for income like a typical investor does. They are investing for risk management purposes. For example, investors seeking to avoid devaluation of their local currency would rather be invested in a stronger currency even if it means taking a small loss of interest. Banks, for example, are forced to own government bonds to meet regulatory requirements. If you are a European bank required to own sovereign debt, you certainly wouldn’t want to own too much Italian or Greek debt, so the only alternatives are to balance that risk with the low-to-negative yielding debt in the strong countries.

I understand these reasons for negative rates, but there are lots of reasons for concern. While counterintuitive, the longer we have negative rates on longer maturity debt, the more I worry about deflationary sentiment taking root. Using negative rates for too long could spur destabilizing currency wars. We just witnessed the devastation in markets in August when China had to devalue its currency. China could not support its peg to the dollar given how strong the dollar was becoming as the Federal Reserve was preparing to raise U.S. rates. What happens to the supply of credit and liquidity in the system when we face the prospect of having to pay to be invested in a money market fund? How confident can we be in our banks knowing their profits are being squeezed if they cannot pass on negative rates to their depositors? If banks do pass through negative rates, they risk losing depositors who are their main funding source, and then banks will be even less able to lend. What are the societal consequences of effectively taxing savers with negative rates and then effectively or even actually paying people to borrow money?

So where does it stop?

There is a theoretical boundary for how low negative interest rates can go. With the exception of very large depositors, banks are not passing the negative interest rates they are being charged onto their customers, but at some point they may have to in order to stay profitable. Savers and investors may be willing to put up with slightly negative rates because there is a cost to doing something else with their money, like the cost of buying a safe to put it in, but there is a limit. Money used for liquidity and for commerce purposes can also be interest-rate agnostic, but at some level they too will find a cheaper way. Some European central banks believe the lower bound for policy rates is around -0.75%.

When the Chair of the Federal Reserve, Janet Yellen, was asked about the possibility of negative rates in the U.S. during her semiannual monetary policy report to Congress in February, she stated they have not found any legal reason they couldn’t use it as a tool for monetary policy, but thus far, they were not considering it. We can always cling to the idea that, “it will never happen here,” but Yellen’s answer felt to me like it opened the door a little, and markets reacted violently to the idea. Those two days of her testimony marked the lows in the stock market and the widest credit spreads in the bond market for 2016 thus far. Markets have recovered since mid-February, and thankfully, during her press conference after the March Federal Reserve meeting, Yellen repeated unequivocally that negative interest rates were not being considered. Hopefully, all this unconventional monetary policy stops where it started, here, in the U.S.

In the meantime, bond investors need to be nimble by focusing on total return strategies, not just income, and being diversified to keep risk in check.

Wendy W. Stojadinovic is director of fixed-income strategy at Cleary Gull.