When Hamlet puzzled about "the undiscovered country" while walking the grounds of Elsinore Castle in Denmark, he may as well have been speaking about Scandinavia as far as U.S. investors are concerned. The four Nordic countries-encompassed by the United Kingdom, Germany, the Baltics and Russia-are as foreign an investment destination as any obscure frontier market. They shouldn't be. Together, Sweden, Norway, Denmark and Finland make up a formidable economic region, as potent as it is unrecognized.

Despite being best known for its extensive public safety net, Scandinavia boasts a strong penchant for innovation and trade. "Local companies have successfully ventured across borders decades before the most other developed markets," explains Per Johansson, fund manager of the $361 million Fidelity Nordic Fund, "and this is evident today in the region's large number of global companies that's unusually high as a percent of GDP."

Low-priced, catwalk-chic retailer H&M (known locally as Hennes & Mauritz), with stores sprouting up along the world's major fashion avenues, was one of the first in its industry to export its franchise beyond its home market. Volvo and Scania have a strong hold on the truck market. AP Moller-Maersk is the world's largest shipping line. Novo Nordisk is the leader in diabetes care. Ericsson is a major provider of telecommunications equipment and services. Bang & Olufsen is an iconic home entertainment systems maker. And Vestas Wind Power is in the forefront of alternative energy.

Broadly speaking, Norway is the fifth-largest oil producer in the world. Its $550 billion sovereign wealth fund, financed through surplus oil revenues, diversifies the country's wealth and ensures its citizens remarkable security.

In its latest study, the World Economic Forum identified Sweden as the world's second most competitive economy, two slots ahead of the U.S. "Combined with a strong focus on education over the years (ranked second for higher education and training) and the world's strongest technological adoption (ranked first in technological readiness), Sweden has developed a very sophisticated business culture (second) and is one of the world's leading innovators (ranked fifth)," the WEF reported.

While Denmark is overbanked and going through consolidation, overall Scandinavian banks are among the healthiest in the developed market. While hurt by an expansion into the Baltics that turned sour during the last recession, they have largely sidestepped the 2008 financial crisis. They maintain high capital reserves and have very little exposure to the sovereign debt of Europe's troubled economies.

Local Economies And Markets

The banks' sound status reflects the general health of local economies. Their fortunes are especially linked to a sound mortgage market that never went subprime, which demands 15%-20% down, and whose obligations are attached to individuals as well as to properties to help ensure continued performance.

Government finances are also sound. According to the Economist Intelligence Unit, Denmark's projected 2011 budget deficit of 3.9% of GDP is the region's largest. Finland's shortfall is expected to be -1.7%, while Sweden's balance will likely turn positive. Norway's surplus should exceed 13%.

Debt levels, as a percent of GDP, are benign. Denmark, Finland and Sweden are between 47% and 49%; Norway's is 36.6%. And Scandinavia's current accounts-except for Finland's, which is fractionally negative-are in the black.

In contrast, the U.S. is running a 9% budget deficit, its net public debt is 66.1% of GDP, and it has a current account deficit of 3.2%.

Scandinavia's positive macro picture reflects the region's economic health.

On a GDP-weighted basis, economic growth grew by 2.84% in 2010. And the EIU projects 2011 expansion of 2.08%, with Sweden leading the pack with a 3.7% growth rate.

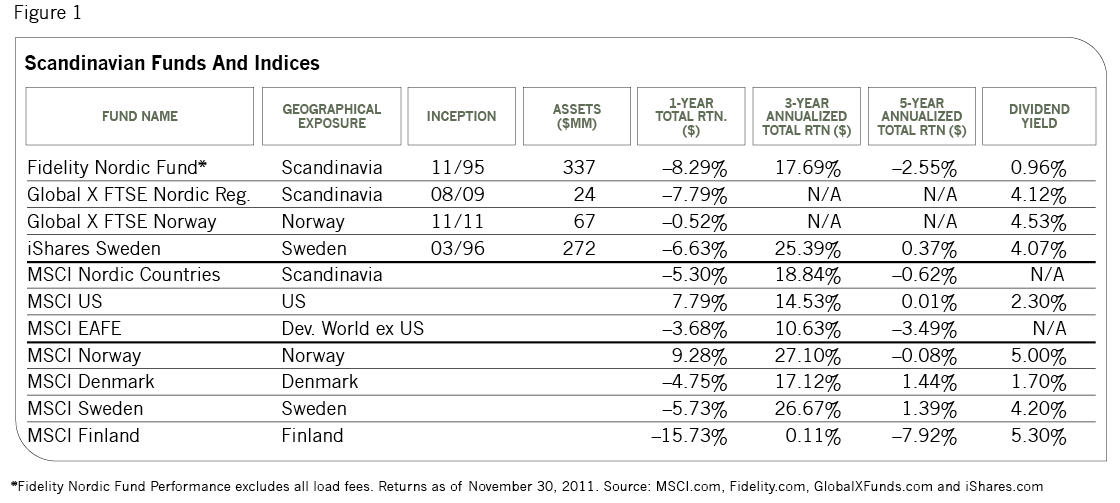

These positives have been underpinning equity market performance that's been outperforming the developed world. According to the Morgan Stanley Capital Indices, the three-year annualized total returns of the Nordic region through November were 18.84% annualized in U.S. dollar terms. That's 4.31 percentage points more per year than the MSCI U.S. Index and 8.21 percentage points more than the MSCI EAFE Index, which measures developed stock market performance excluding the U.S.

Over the trailing five years, Scandinavia was down 62 basis points a year, while the U.S. broke even and the EAFE was down 3.5%. And over the last decade, Scandinavian shares have generated annualized total returns of 8.05%, which is more than 5 full percentage points better than U.S. stocks and which outpaces foreign stocks by 2.77 percentage points.

While Norway, Denmark and Sweden have moved somewhat comparably over the longer term, Finland has been the region's outlier. Its market was fractionally down over the past decade and it lost nearly 16% over the past year. (Finland is the only Nordic country that's an official member of the euro zone. Meanwhile, Denmark's currency, the krone, shadows the euro.)

Finnish losses contributed to the region's underperformance of U.S. stocks by more than 13% over the past year and the EAFE by more than 1.6%. Recessionary fears also contributed to the selloff of Scandinavian industrial and financial shares, says Martin Guri, chief equity strategist at Nordea AB (the region's largest bank), and there has been blowback from uncertainty across the euro zone. "Scandinavia is a high beta play on Continental Europe," Guri explains, "so when European stocks go up, Nordic shares tend to rise even more, and when the continent sells off, Scandinavian shares get hit harder."

He believes, however, that if the global economy can avoid falling into recession, Scandinavian shares should resume their outperformance. "I think slowdown fears and Europe's debt crisis have been largely priced into the market," says Guri, "and that in 2012, I think the euro zone is more likely to be the source of positive news now that politicians finally realize what needs to be done."

If this pans out, then this could bring an end to the temporary disconnect between Scandinavia's compelling fundamentals and recent market underperformance.

Investments

Funds are an easy way to gain diversified foreign exposure. Unfortunately, echoing the region's little-tracked status, few funds are offered in the states. A preliminary search turned up only one actively managed fund, the $337 million Fidelity Nordic Fund.

Fidelity manager Per Johansson is enthusiastic about the region's corporate culture because of its sophisticated, transparent approach to management; high governance standards; delegation of authority; emphasis on return on capital over pure revenue growth; and focus on shareholder returns. However, over the shorter and longer terms, the fund has trailed the MSCI Nordic Index.

Global X offers the only ETF that tracks the FTSE Nordic 30 Index (GXF). The firm also offers the only Norway-focused fund, which tracks the local FTSE index (NORW). The latter, according to Global X CEO Bruno del Ama, is responding to market demand for exposure to Norway's oil-rich economy and a currency that's buoyed by the country's wealth.

BlackRock's iShares Sweden fund (EWD) provides exposure to Scandinavia's largest economy, whose GDP represents nearly 35% of the region and a bourse that accounts for about half of Scandinavia's market capitalization. Senior iShares portfolio manager Greg Savage believes the argument for Sweden is its comparatively large, diversified economy, which offers investors exposure to the local and regional markets, as well as to global leaders. Except for the past year, the ETF has outperformed the Nordic MSCI Index over the medium and longer terms.

With limited fund options, investors and advisors who can regularly track companies should also consider direct investments in Scandinavian shares. Many of the large, leading names trade as American Depositary Receipts on the New York Stock Exchange or over the counter.

Among the most familiar names is fashion retailer Hennes & Mauritz. The Stockholm-based company has successfully jumped across national borders by collaborating with major designers and inexpensively churning out new, affordable lines. Barclays Capital retail analyst Karen Howland believes gross margin expansion driven by same-store growth of 3.2% in 2012 should substantially drive H&M's shares.

After expanding across Scandinavia, incumbent Oslo-based service provider Telenor turned east to Central Europe, the Balkans and Russia, and then to Asia. With three-quarters of its revenue generated abroad, Deutsche Bank telecom analyst David Wright believes top-line growth will continue to accelerate "thanks to its best-in-class GDP footprint."

The world's largest maker of insulin, Danish health care giant Novo Nordisk, has seen long-term growth fueled by the global expansion of diabetes. Carnegie Investment Bank's head of equity research, Peter Hansen, explains Novo uniquely retains its competitive lead through constant innovation and patenting of new drugs that shelter the firm from material loss due to generic competition.

Risks

While Scandinavian fundamentals remain sound, the region stands perched on the doorstep of the world's largest systemic risk: the potential breakup of the euro zone. This, along with sluggish world growth, has produced substantial market volatility across the region. This makes local shares vulnerable over the short term.

Whatever happens to the euro, Scandinavia will most likely retain its safe haven status, and its currencies-especially the Norwegian krone and Swedish krona-may appreciate. This would translate into higher valuations for dollar-based investors. But it could hurt exports.

A slowdown in emerging market growth is another risk. Jan Storup Nielson, Nordea's senior economic analyst, recalls Scandinavian vulnerability to the Baltic states was revealed during the financial crisis when many markets feared they would be the source of a rash of bad debts. Conditions have since tempered. Today, with half of the Nordic growth geared to exports, Nielson's main concern is decelerating Chinese growth.

In its 2011 Prosperity Index, which tracks economic opportunity and growth, education, wealth and government, the independent London-based Legatum Institute ranked the four Nordic countries in the top seven out of 110 countries studied. Perhaps it's a surprise to Americans to learn that Scandinavia's high tax and high services model, which is promoting a healthy society, has fueled some of the most compelling investment returns around. It shouldn't be.