Today seems like a good time to pull out the wayback machine again, for a look at commodity and oil prices. I’ve focused quite a bit on oil prices here, and what they might mean for the U.S. economy, but other commodities are also important.

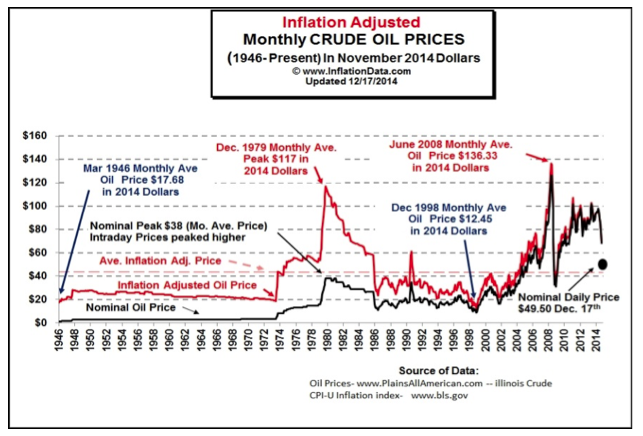

Note that we’ll be looking at real prices in this post. Although commodities (and everything else) are priced in nominal dollars, we need to remove the effects of inflation in order to make valid comparisons over the time frames we’re talking about. The previous two wayback posts, on employment and interest rates, didn’t present this problem. But for anything dealing with prices, we have to account for inflation, so the numbers here may look a bit different from what you remember.

Real Oil Prices Seem To Be Normalizing

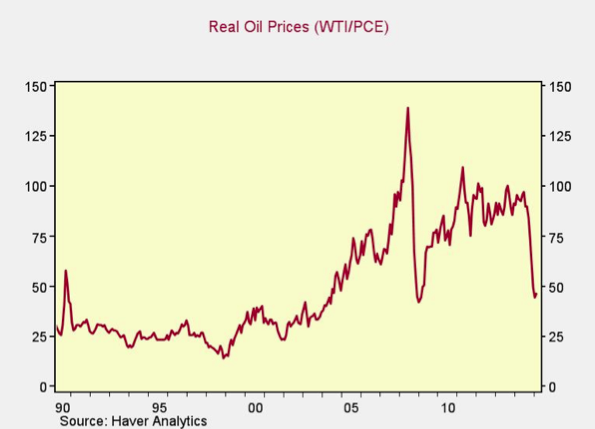

As of today, West Texas Intermediate prices are around $46 per barrel. (I’m using approximate figures, as, of course, they vary.) Oil was around $74 per barrel 5 years ago; 10 years ago, it was around $57; 15 years ago, around $37; 20 years ago, around $25; and 25 years ago, around $31.

Remember, these prices are in real terms, adjusted for inflation, so we can see a couple of things:

- Even though oil looks cheap in terms of the past 10 years, it’s still fairly expensive when you look further back. Any discussion about how cheap oil will change the world should factor in the 2000s and the 1990s, as oil was even cheaper then.

- If anything, it’s the run-up from 2004 through last year that looks abnormal. In many ways, current oil prices are just moving back to normal levels, from an economic perspective. You can see this more clearly in the annotated, but slightly less current, chart below.

Ditto for other commodities

When we look at other commodities, we see roughly the same thing, per the chart below.