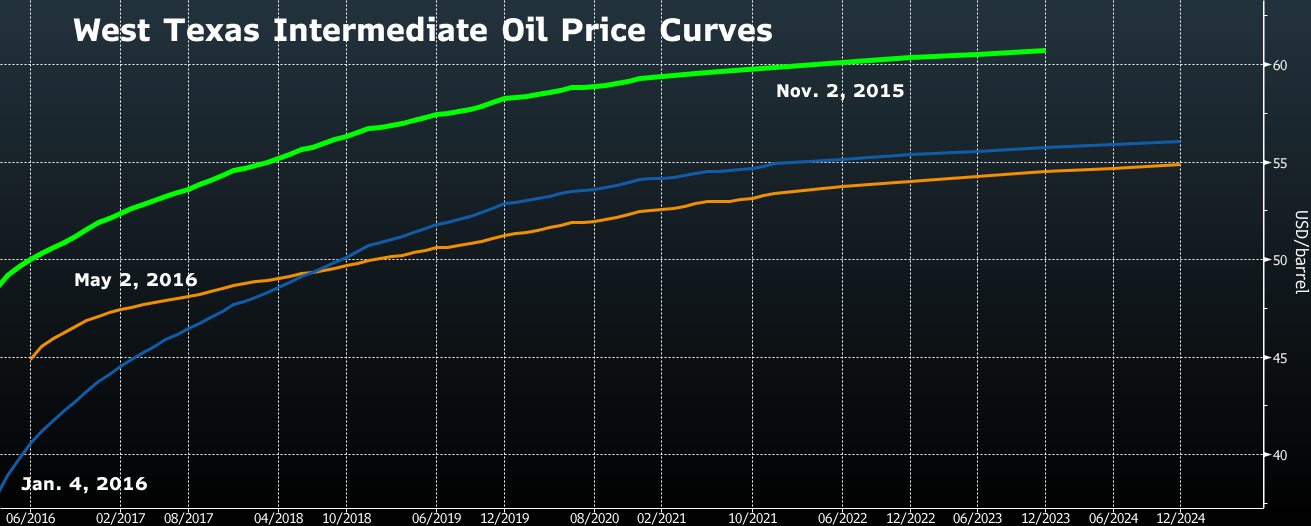

Front-month WTI is now roughly at the same level as six months ago -- $45 a barrel -- but the price of the longest-dated contracts has fallen about $6 over the period. One reason is that slower growth in emerging markets and lower production costs will “put downward pressure on long-dated prices,” said Jeffrey Currie, head of commodities research at Goldman Sachs Group Inc. in New York.

Different Cycle

If prices were to stabilize around $55 into the long term, that would make the current oil-market cycle very different from previous ones -- where each bust sowed the seeds of the next boom. Take the 1998-to-2008 period, when Brent crude, the global benchmark, rose from below $10 to almost $150 as an industry that had just cut costs to the bone struggled to keep up with rapid demand growth in China.

One difference this time is the role played now by shale oil producers. From North Dakota to Texas, dozens of U.S. shale companies have the ability to resume spending, restart drilling and bring on new production as prices rise, boosting output more rapidly than in past cycles dominated by major companies and giant projects.

While shale producers have been hit hard by the downturn -- U.S. production has fallen by almost 700,000 barrels a day since June -- they are also adapting to lower prices by making the process of hydraulic fracturing more efficient. Break-even prices at the wellhead in key shale plays have decreased by as much as 44 percent during the last three years, according to a report by Oslo-based consultant Rystad Energy AS.

Million-Dollar Question

“The million-dollar question is when to start investing again,” said Alex Topouzoglou, an oil analyst at Exane BNP Paribas in London.

Hess Corp., which operates in areas including North Dakota, has said it would boost activity if prices rise to $60 a barrel. Pioneer Natural Resources Co., a shale oil producer focused on Texas, said it would add more drilling rigs as soon as prices rebound to $50.

While U.S. shale oil production will retreat this year and next as the price slump hits drilling, it will subsequently recover, ensuring America remains the world’s biggest source of new supply to 2021, the IEA said in its medium-term oil-market report in February. Total U.S. liquids output will increase by 1.3 million barrels a day by from 2015 to 2021 as drillers lower costs and improve efficiency, it said.

JBC Energy GmbH, a consultant, said this week that oil prices have "risen enough" to push some shale wells back into profitability. "We are now reaching the point at which we could begin to see a rebound" in activity, it said.