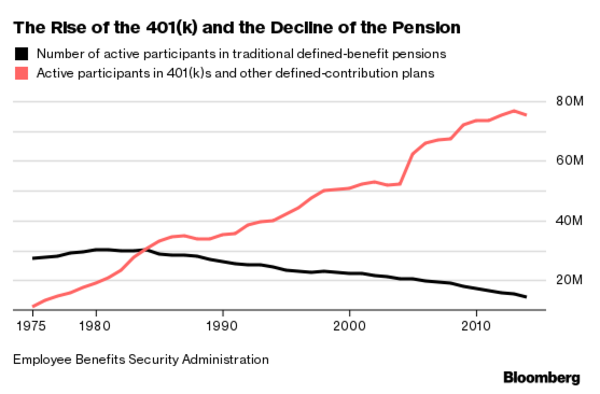

Millions of American workers are frozen out of their companies' pension plans. Maybe you get a 401(k), if you're lucky. But the traditional pension is dead.

Unless, perhaps, you're already retired.

It still lives for millions of older Americans who worked and qualified for their pensions in another era. Today's retirees are living pretty well, new research finds—much better than previously thought.

The usual way to measure people’s economic well-being is to ask them. But sometimes surveys confuse people, especially about what qualifies as income.

A new paper by U.S. Census Bureau researchers Adam Bee and Joshua Mitchell uses a Social Security Administration database of 2012 tax filings and other earnings data to check on those survey responses. Older Americans, it turns out, are underestimating their income—by a lot.

The median U.S. household 65 or older earned $44,400 in 2012, those data show, a figure 30 percent higher than the median given in the census’s Current Population Survey from that year. And whereas the original survey found that 9.1 percent of Americans 65 and older were living below the poverty line, the new study puts their poverty rate a full two percentage points lower, at 6.9 percent.

The main reason for the discrepancy: Many of the people surveyed aren't including retirement benefits in their reported income. While just 44 percent of the older survey respondents reported retirement income, tax filings and other data show the actual share getting it is 68 percent.

The most popular retirement benefit among older Americans is still the traditional pension, collected by 56 percent of households 65 and older. Withdrawals from individual retirement accounts (IRAs) were taken by 32 percent of older households, and about 5 percent took money directly from 401(k)-style defined-contribution plans.

Many people think of the proceeds of pensions and IRAs as savings, not income, and they're not necessarily wrong. But that's not how economists or tax collectors generally do. Pensions and retirement accounts include not just the money you've personally saved—usually without paying taxes on it—but also your employer's contributions and any investment gains over the years.

And if you don't include that money in your reported income, you end up looking—to the Census, anyway—much poorer than you are. It means a retiree who regularly cashes in the proceeds from a $2 million IRA can appear financially indistinguishable from a destitute retiree living on Social Security alone.