After lagging the broad market averages for the past two calendar years, stocks in three traditionally defensive sectors-health care, utilities and consumer staples-are leading the pack.

Through mid-August, companies in the Standard & Poor's 500 index's consumer staples, health-care and utilities sectors managed to stay in positive territory for 2011, while the S&P 500 index as a whole dropped more than 6%. During the brutal market pullback from mid-July to mid-August, companies in the utilities and consumer staples sectors fell about 6%, compared to a 10% decline for the S&P 500. Health care stocks fell about as much as the market during that one-month period, giving up impressive gains from earlier in the year.

The appeal of companies in these sectors lies in the all-weather revenue streams they provide, particularly in tough economic times. People might stop buying luxury cars, Gucci watches or even laptop computers when finances are tight; but they're unlikely to forgo necessities such as soap, toilet paper, electricity and prescription drugs. Often, these mature stalwarts have ample cash flow and above-average dividends, which can provide a cushion during market downturns.

Because of these safety-net characteristics, these defensive sectors don't stand out at the beginning of an economic upswing; instead, cyclical stocks tend to shine. But they often find their footing in the middle to later stages of a market rally when investors favor the predictable profits from mature, stable companies over rapid growth.

John B. Cooper, the managing director at Stuyvesant Capital Partners in Armonk, N.Y., believes such stocks will continue to lead the market this year. He thinks an emphasis on defensive sectors such as health care and utilities is "the key to successful investing in 2011," and is tilting client portfolios in that direction.

"On any kind of rally, a lot of investors will run back to old favorites, such as industrial and materials companies," says Cooper. "But we think that with their international exposure and pricing power, defensive industries have better prospects now than those sectors."

That doesn't necessarily mean investors should pile into those stocks or the ETFs that focus on them. For many people, broad market averages already offer ample exposure. In the S&P 500, for example, the health-care sector represents 11.6% of assets, consumer staples 11.2%, and utilities 3.6%. High-dividend ETFs or mutual funds usually have even greater exposure to these areas. The iShares Dow Jones Select Dividend (DVY), for example, has 34% of its assets in utilities and 20% in consumer staples.

The advantages could also evaporate quickly if the economy takes a turn for the better and these stocks' defensive characteristics become less relevant for investors. Schwab director of market and sector analysis Brad Sorenson believes the consumer staples and utilities sectors will underperform the market over the next three to six months as economic conditions improve and investors gravitate to more growth-oriented shares. He expects health-care stocks to perform somewhat better, but only in line with the market.

At the same time, he hedges that forecast with a warning that "we will not be dogmatic on our current cyclical stance and recognize that if confidence doesn't begin to rebound in the near future, the second-half outlook will have to be downgraded and we would be forced to shift our views."

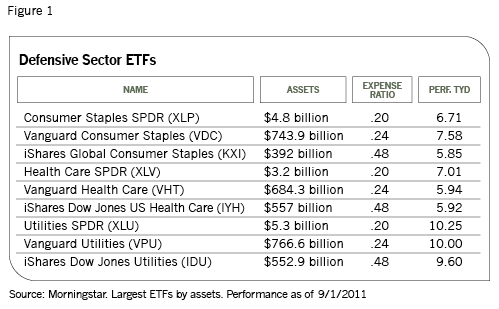

The strong relative performance of defensive sectors so far this year suggests investors don't yet see a full-swing economic recovery coming. Those who agree, and who want to tilt portfolios toward mature companies that don't pack a lot of surprises, can use ETFs that focus on health care, utilities and consumer staples as satellite holdings. While they don't offer active management, their expense ratios, which usually fall between 0.20% and 0.60%, are a fraction of the cost of the average sector mutual fund.

Those who want to enter these defensive spaces should look closely at the pros and cons of each sector.

Health Care

Pros: This sector should benefit in the long term from an aging population, a stable and growing demand for health-care services, increasing demand from emerging market countries and healthy merger activity among biotechnology companies.

Cons: Health-care industry reform is likely to put pressure on industry profits in the coming years. Large pharmaceutical faces both patent expirations, unexciting product pipelines and increasing competition from lower-priced generic drugs.

ETFs: Pharmaceutical companies represent 48% of the health-care component of the S&P 500, and are a large weighting in many ETFs in this category. Other subsectors include health-care services and equipment, biotechnology, health-care providers and health-care technologies.

While health-care companies tend to have higher dividend yields than most stocks, the higher expense ratio of sector ETFs versus broad market ETFs often narrows or eliminates that advantage. Recently, for example, the SPDR S&P 500 (SPY) had a dividend yield of 2.06% and an expense ratio of 0.09%. The Health Care SPDR fund (XLV), which follows the health-care component of that index, had a 2% yield and 0.20% expense ratio.

Health Care SPDR is the most actively traded ETF in the group. The Vanguard Health Care fund (VHT) tracks another U.S. health-care index that has more small and mid-cap stocks, and its performance and industry distribution are similar to those of the SPDR offering. The iShares S&P Global Health Care fund (IXJ) provides industry exposure to both foreign and domestic companies while ETFs such as the Merrill Lynch Pharmaceutical HOLDRs fund (PPH), the S&P Biotech SPDR fund (XBI) and the iShares Nasdaq Biotechnology portfolio (IBB) offer targeted subsector exposure.

Consumer Staples

Pros: Increasing sales in developing markets have driven revenue growth among companies involved in everyday needs industries such as beverages, food, household and personal products, and tobacco. Because many of the companies in this category derive a large percentage of their profits overseas, a weaker U.S. dollar and favorable currency exchange rates have helped enhance their profits. Consumer spending has fallen as much as many observers thought it would, so the companies have been able to maintain or even raise prices.

The industry giants that dominate the group offer generous yields and the ETFs have dividend yields that beat the broader offerings by 30% or more. The subsector weightings are also more spread out than they are in the health-care sector.

Cons: Generic brands threaten these companies' market share, while a strengthening of the U.S. dollar could eat into profits. Rising commodity prices could also impact companies that use agricultural or chemical ingredients in their products. Some companies could have trouble raising prices in the future if high unemployment and the recession linger.

ETFs: Market-cap-weighted ETFs such as the Consumer Staples SPDR fund (XLP) and the Vanguard Consumer Staples fund (VDC) concentrate heavily on relatively few holdings. In the former fund, for example, Proctor & Gamble and Philip Morris together account for nearly one-quarter of assets and the top ten holdings represent two-thirds of assets.

Going beyond the plain vanilla health-care ETFs, the iShares S&P Global Consumer Staples fund (KXI) offers international exposure to the group through holdings such as Nestle and British American Tobacco. The EG Shares Emerging Markets Dow Jones Consumer Titan fund (ECON) focuses on consumer goods companies based in emerging markets.

A recent standout ETF is First Trust's Consumer Staples AlphaDEX fund (FXG). Based on an index that ranks consumer staples stocks in the Russell 1000 index, it was up nearly 11% for 2011 as of mid-August, more than double the return of its nearest category competitor.

Utilities

Pros: High dividend yields have long drawn investors to electric, gas and other utilities, and utility ETFs sport yields in the 4% to 5% range. Prices for coal, the fuel for much of the nation's electrical production, remain low. Growing infrastructure repair and build-out needs promise to bring an increase in demand for power and boost earnings growth for the sector.

Cons: Long considered a bastion for "widows and orphans," utility stocks usually lag other sectors, often by a significant margin, in bull markets. In 2009 and 2010, for example, utility stocks rose an average of 21%, while the S&P rose 51%. Utility projects are capital-intensive, so costly capacity expansion could hurt their bottom lines.

ETFs: With a dividend yield of 4.4%, the Utilities SPDR fund (XLU), by far the largest of the group in terms of market capitalization, provides an attractive level of income. It also has a beta of 0.57%, which points to a low correlation with the overall market. The portfolio is relatively concentrated, with the top five holdings accounting for over one-third of assets. The Vanguard Utilities fund (VPU) has many of the same names, but the inclusion of some small and mid-cap names gives the overall portfolio a slightly higher earnings growth rate.

While a few ETFs focus on international utilities, their recent performance has been disappointing. The Invesco PowerShares Global Emerging Markets Infrastructure fund (PXR) lost nearly 16% through mid-August, while the S&P International Utilities SPDR fund (IPU) was down 15%. If the goal is to ride out market turbulence with high-dividend stocks that don't come with a lot of surprises, such dismal performance suggests it's better to stay local with this group.