Flashback to December 15, 2001. It's been two years since the tech bubble burst. You are in the middle of client reviews and the mood is somber. The terrorist attacks of September 11 are behind us but the country is gripped by the fear of anthrax and the unknown. With the knowledge that prior losses in the market have never lasted more than two years, you urge your clients to remain calm, reassuring them that "this too shall pass." You try to help by keeping them invested so when the rebound comes, as you know it will, they will participate.

Fast forward one year to December 15th, 2002. It turns out that the S&P500's loss of 9.1% in 2000 and 11.89% in 2001 was only the warm up for the 22.1% loss in 2002. For the first time in history, the S&P500 lost value three calendar years in a row. The reason for cautioning clients about past performance not being indicative of future results is palpable. Past performance can only tell us what has already happened, not what will happen.

The decade ending 2010 taught us another hard lesson. We can suffer two devastating recessions in the space of 10 years. Many investors are still well below their high water marks established in 2000 or 2007. Those who lost their nerve at or near the bottom could be substantially upside down.

The adage that insanity is doing the same things over and over and expecting different outcomes can be applied to Modern Portfolio Theory (MPT). If we have learned anything from the past decade it is that building a portfolio based solely on MPT and expecting asset allocation to protect you from losses is insanity.

So what's our alternative? Adding gold to the portfolio doesn't help when ? not if ? gold plummets. Trying to time the market is, at best, an exercise in chance. Using stop orders to trigger liquidation at a specific price seems risky in the wake of the recent "flash crash" and only assures selling low versus a previous high. All these appear to be just another method of doing the same things over and over again.

One way to do things differently is to utilize portfolio insurance in the form of options, financial instruments that can mathematically insulate portfolios from catastrophic losses. The very definition of doing things differently, options can provide the reasonable expectation of a different outcome.

Automotive Analogy

The role of options might be compared to that of automotive safety. While seatbelts, airbags and crumple zones all help protect occupants, they can't prevent accidents. Even those privileged to own the latest European flagships that can tap you on the shoulder if you happen to nod off while driving are unlikely to hit the freeway without first insuring the vehicle.

Similarly, allowing clients to drive an uninsured portfolio through what amounts to a demolition derby makes no sense either. So why do some allow it to happen?

For one, using options is much more complicated than simply recommending a mutual fund or buying a basket of securities and holding on. Compliance oversight and the added regulatory scrutiny of derivatives are other dissuasions.

But the public's desire for some level of protection in a portfolio should not be overlooked. Sales of fixed indexed annuities and structured notes are skyrocketing, based in large part on the desire for principal protection.

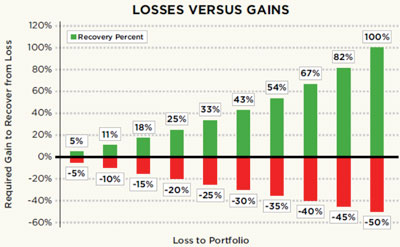

The importance of portfolio protection becomes clear when examining the relationship between gains and losses. Many clients who lose 25% one year and gain 25% the next assume they are back to even. But under this scenario, a $100,000 portfolio becomes $75,000 and only recovers to $93,750. Larger losses make things worse: A 50% loss requires a 100% gain to get back to even.

Source: Kingsroad Financial Insurance Services, Inc.

We all recognize that an 8-10% return objective from an equity-based portfolio rarely achieves its goal year after year. Instead, investments experience significant gains and losses, the net result of which hopefully approaches our investment target return over an extended period of time. As illustrated in the chart below, only twice in the last 20 years (1993 and 2004) did the S&P 500 return, with dividends reinvested, land near the 10% mark.

Source: www.standardandpoors.com/indices. The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on 500 widely held common stocks. One cannot invest directly in an index.

A protective overlay can be applied to virtually any investment strategy using simple option concepts, for example:

Protective Put

Put options can protect a notional percentage of a portfolio. For example, consider a million dollar portfolio with a 70% allocation to equities. Based on recent prices (4/7/2011), the put would cost approximately $650 per contract on the SPY March 30 2012 expiration with a strike price of $120. The strike offers protection at about 10% below the current market price. Dividing the notional exposure ($700,000) by the contract value (strike times 100 or $12,000) requires about 58 contracts, or $37,700, which is roughly 3.7% premium, to use insurance language. A protective put provides downside protection while keeping the upside unlimited, but in this example, it also creates a near 4% drag on performance. To offset this drag, consider pairing this strategy with a covered call:

Covered Call

Selling (or writing) an out of the money call on a percentage of the positions in the portfolio will generate income while still participating in unlimited upside on the remaining positions. This income could be used to offset the cost of a protective put.

Advisors unfamiliar with the nuances of options are ill advised to gain experience using client funds. A better choice may be to research managers with a track record of successful hedging strategies and delegate the allocation.

In summary, a hedged option strategy can provide meaningful benefits:

Hedging can provide the confidence to keep clients invested.

Clients are more likely to stay invested if they know there is a floor to potential losses.

In a severe correction, the protective puts provide cash at a time when prices on the underlying portfolio are depressed, which creates a "buy low, sell high" opportunity.

Advisory revenue is better protected in the event of another significant correction.

Larry Kriesmer, CLU, ChFC and Bernard Surovsky, CFS, are the investment managers of Measured Risk Portfolios, available through Kingsroad Financial Insurance Services, Inc., a Registered Investment Advisor. To request performance information or inquire about selling agreements, please contact the authors at [email protected].