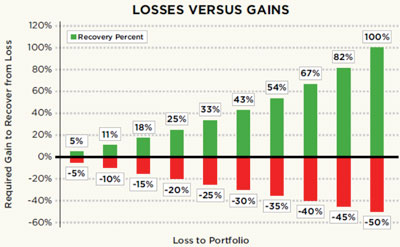

The importance of portfolio protection becomes clear when examining the relationship between gains and losses. Many clients who lose 25% one year and gain 25% the next assume they are back to even. But under this scenario, a $100,000 portfolio becomes $75,000 and only recovers to $93,750. Larger losses make things worse: A 50% loss requires a 100% gain to get back to even.

Source: Kingsroad Financial Insurance Services, Inc.

We all recognize that an 8-10% return objective from an equity-based portfolio rarely achieves its goal year after year. Instead, investments experience significant gains and losses, the net result of which hopefully approaches our investment target return over an extended period of time. As illustrated in the chart below, only twice in the last 20 years (1993 and 2004) did the S&P 500 return, with dividends reinvested, land near the 10% mark.

Source: www.standardandpoors.com/indices. The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on 500 widely held common stocks. One cannot invest directly in an index.

A protective overlay can be applied to virtually any investment strategy using simple option concepts, for example:

Protective Put

Put options can protect a notional percentage of a portfolio. For example, consider a million dollar portfolio with a 70% allocation to equities. Based on recent prices (4/7/2011), the put would cost approximately $650 per contract on the SPY March 30 2012 expiration with a strike price of $120. The strike offers protection at about 10% below the current market price. Dividing the notional exposure ($700,000) by the contract value (strike times 100 or $12,000) requires about 58 contracts, or $37,700, which is roughly 3.7% premium, to use insurance language. A protective put provides downside protection while keeping the upside unlimited, but in this example, it also creates a near 4% drag on performance. To offset this drag, consider pairing this strategy with a covered call:

Covered Call

Selling (or writing) an out of the money call on a percentage of the positions in the portfolio will generate income while still participating in unlimited upside on the remaining positions. This income could be used to offset the cost of a protective put.