• Volatility has presented us with an opportunity to purchase structured products such as commercial mortgage-backed securities at much more attractive valuations.

• Risk premiums on investment-grade corporates are now well wide of historical average and approaching levels historically observed during recessions.

• While we still view high yield as an attractive investment alternative, we do not believe this is the time to stretch for return or reach for yield by adding significant risk to the portfolio

• Fixed-income markets have been volatile recently thanks to a host of factors. However, the repricing in risk assets has created more attractive entry points for long-term investors. Below we detail three of our “best ideas” in the taxable fixed income space.

Structured products

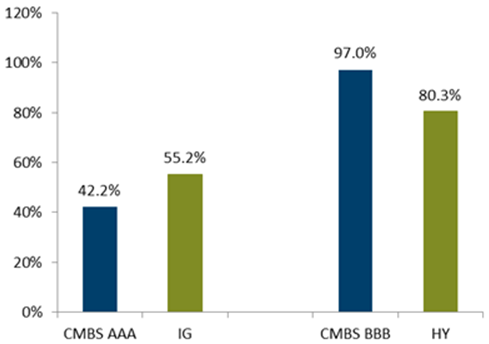

Risk premiums on credit assets have materially widened, creating attractive value in sectors that are not fundamentally impacted by the drivers of global volatility. We see particular value in commercial mortgage-backed securities (CMBS), where spreads have widened in similar magnitude to those of corporate credit sectors (Exhibit 1). From a fundamental perspective, commercial real estate has been supported by high occupancy rates and availability of credit, allowing property prices to climb 12.7% over the last 12 months. However, commercial underwriting standards have become increasingly aggressive, and we now prefer structures underwritten in 2012 and 2013 that feature lower loan-to-value (LTV) ratios. Property values on these assets have appreciated over 50% since origination and the firming economy has enabled cash flows to grow at an annualized rate of 5%. As a result, we have few fundamental concerns. Yet the volatility has presented us with an opportunity to purchase these assets at much more attractive valuations.

Source: Barclays, February 23, 2016

Investment-grade corporates

Investment grade (IG) was the first shoe to drop in credit markets during 2015, underperforming high yield and emerging markets – two sectors with much higher risk profiles and sensitivity to commodities – on a duration-adjusted basis over the first eight months of the year. Resulting risk premiums are now well wide of historical average and approaching levels historically observed during recessions. U.S. economic growth has decelerated and certain manufacturing/industrial sectors are struggling, but the economy is 70% consumption-based and continues to chug along at the post-crisis trend rate of 2%. As a result, we are receiving recessionary-like compensation even as the economy continues to expand.

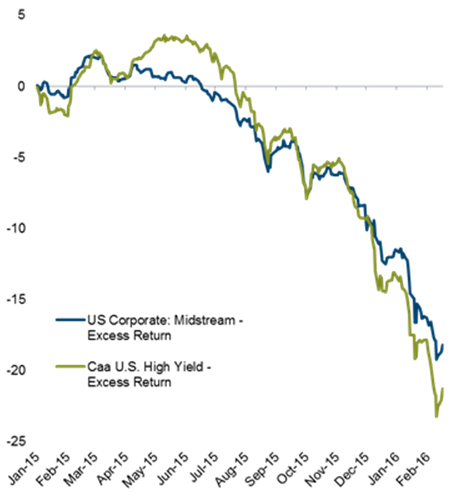

We also see value in the pipeline sector. These companies are involved in the storage and transportation of oil and natural gas, and their fundamental business operations have historically been insensitive to the price of the underlying commodity. Despite this, bond prices have been dragged lower due to the sector’s broader association with the energy complex, and have performed eerily similar to the lowest-quality rungs of the high-yield market (Exhibit 2). Bonds are currently priced at levels that indicate severe financial stress even though they have investment-grade balance sheets, investment-grade ratings, and liquidation debt coverage in excess of 100% (i.e., borrowers can fully repay their bonds at par). We see this as an opportunity.

Source: Barclays, February 23, 2016