Do not forget that the combined populations of China and India alone are more than 2.5 billion (putting aside the populations of other emerging countries). The expanding middle class in these areas is driving strong consumption demand and accounting for an increasing share of wealth creation globally. This structural story remains in its infancy, but we believe it will continue to create strong investment opportunities.

An increasing number of these countries are embarking on reform programs to boost or sustain growth. In many cases, this follows the election of pro-reformist leaders: for example, Narendra Modi in India, Peña Nieto in Mexico, Joko Widodo in Indonesia and Xi Jinping in China. The most common reforms rein in the influence of the state on the economy and release the potential of the private sector. But reforms are also typically country-specific; for example, China is looking to move its economy away from credit and investment and increasingly toward domestic consumption growth, while in India there is a greater need for investment and infrastructure spending to reduce supply bottlenecks. While the reform process is unlikely to be smooth in either case, over time it could lift these countries' GDP meaningfully.

Emerging market equity mutual fund flows have been very volatile over 2014, and it is possible this volatility could continue into 2015 given the still-uncertain global backdrop. The year started with an extraordinary level of investor bearishness toward global emerging markets, reflected by net outflows of more than $40 billion from dedicated funds. Since then, flows have reversed somewhat, but year to date there have still been outflows of around $10 billion, according to fund-flow data firm EPFR Global.

The Challenge of a Stronger U.S. Dollar

In 2015, we believe the primary challenge facing global emerging markets is the future monetary policy normalization in the U.S. The prospect of a restrictive policy on the U.S. dollar bears monitoring closely, since a stronger U.S. dollar has historically been correlated with weaker relative returns in the global emerging markets. That said, the dollar has already strengthened sharply on a real effective exchange-rate basis over 2014, and we believe it is unlikely that it will continue to appreciate at such a pace in 2015.

Tail risks remain, most notably in Ukraine and the Middle East, although given the global nature of the current crises, any significant deterioration in either situation is likely to have global effects, not just emerging market ones. While the recent pressure on energy prices is creating strains on the budgets of certain energy-producing emerging countries, lower prices are a benefit to the energy importers and overall should boost global consumption demand to the potential benefit of emerging market exporters.

Our 2015 outlook for these countries is constructive but more muted than would otherwise likely be the case in a more "normal" global expansionary phase of the cycle. We are currently positioned with a portfolio beta of around 1 (i.e., our overall market sensitivity is broadly in line with the index), and we are fully invested, although we have a net underweight exposure to the more cyclical sectors (materials and energy). Generally speaking, we have overweight positions in markets that could benefit from potential reforms or benefit from a pickup in manufacturing and industrial exports and weak energy prices. Global emerging markets look as if they will be supported by strong domestic demand growth and potential reform. But challenges remain in these countries, especially if there is a strong U.S. dollar.

Global emerging markets look as if they will be supported by strong domestic demand growth and potential reform. But challenges remain in these countries, especially if there is a strong U.S. dollar.

As 2014 progressed, it was apparent there was a divergence among countries, and some benefited less from the global recovery. The only developed economy really showing momentum is the U.S., while growth in the euro zone and Japan is stalling, and unorthodox policy measures are being increasingly employed. Rather than assessing how emerging markets will fare in a global expansionary cycle, we find ourselves instead focusing on how they might perform in a low-growth world.

Lower Growth For Longer

Such countries are expected to benefit in a global cyclical upturn given their higher beta nature. But while their exports, particularly in manufacturing and industrials, have been increasing, the overall effect has so far been more muted than would otherwise be expected at this stage in the cycle.

Meanwhile, import demand for commodities has been weak. A slowdown in the commodity cycle is partly to blame, especially because of the United States' progress toward energy self-sufficiency, in addition to the longer term diminished effects of global trade liberalization and the slowdown in offshoring. Weak demand from the U.S. for emerging market commodities has so far not been counteracted by growing demand in the euro zone, Japan and China, where growth has slowed. So the backdrop for global emerging markets has become more challenging.

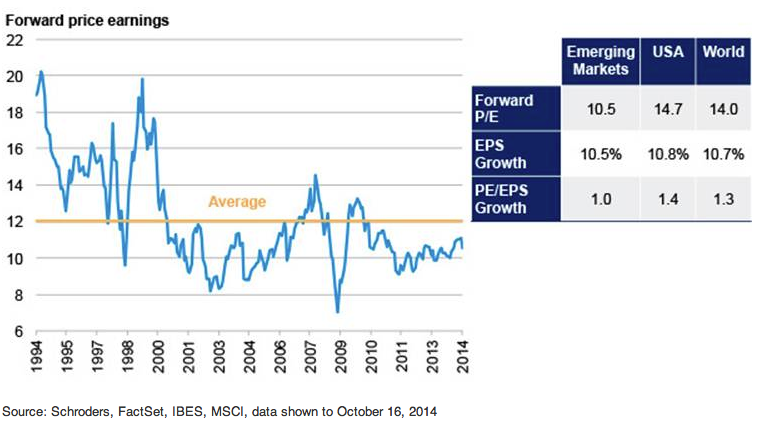

Subdued export growth has weighed on earnings. The Institutional Brokers' Estimate System (IBES) consensus earnings growth expectations of around 10% over the next 12 months look susceptible to potential disappointments. We believe instead that economic and earnings growth in these countries in 2015 will come primarily from their own domestic demand, and will be helped by reform.

Opportunities: Strong Domestic Demand

Opportunities: The New Reformers

Shifting Market Sentiment

But there is a strong case to be made that investors' concerns have already been more than priced into the market. Global emerging market valuations are attractive; the MSCI Emerging Markets index is trading at a price-to-earnings ratio of around 10.5 times, at an approximate 10% discount to history and a discount of more than 50% to the S&P 500, referencing the Shiller P/E ratio. This is the largest discount in over 10 years.

It also looks too early to start worrying about interest rate hikes at this stage of the cycle, not least of all since equities tend to perform well during the initial rounds of rate increases as the aid of strong economic growth outweighs the tighter financing environment. Furthermore, although the U.S. is one of the best-performing developed economies, interest rates, when they are finally increased, could peak at much lower levels than they would during a more "normal" cycle. With an expansionary policy in the euro zone and Japan, global liquidity is likely to remain supportive for some time to come.

Clearly, some emerging economies are more vulnerable than others to higher U.S. interest rates. However, an adjustment process has been under way in many of the perceived weaker economies, which in some cases now have smaller current account balances, more competitive currencies and slowing loan growth. Thus, when monetary policy eventually tightens in the United States, we would expect the impact to be more muted in the emerging markets than it was during the summer of 2013, especially since the prospect of interest rate hikes is now well known and, at least to some extent, looks to be already priced into the market.

Tail Risks

Cautious Optimism For 2015

We are mindful that the ramifications of a stronger U.S. dollar, a potential tighter financing environment and weak commodity prices could have a negative impact on emerging markets equities. Nevertheless, over 2015 we believe emerging market countries should deliver reasonable absolute and relative returns when they are compared with developed markets. These will be helped by attractive valuations, strong domestic demand and improving exports.

Allan Conway is the Head of Emerging Market Equities at Schroders, based in London. He was appointed to this position upon joining Schroders in October 2004. As Head of the Emerging Market Equities team, Allan has an oversight role for all eight strategies managed by the Emerging Market Equities team. These strategies include three global emerging market strategies (core, unconstrained and commodity equities), four regional emerging market strategies (Latin American, BRIC, Emerging Europe and Middle East) and a frontier markets strategy.

Outlook 2015: Emerging Market Equities

January 23, 2015

« Previous Article

| Next Article »

Login in order to post a comment