With weaker than expected jobs growth in May, the Federal Reserve’s (Fed) recent disappointing economic forecast, negative interest rates around the globe, and the Brexit, the list of worries for investors continues to pile up. The U.S. economic recovery will turn seven at the end of this month, but very few realize that or feel like it has helped them. In the face of all the bad news, the S&P 500 is still only 2.8% away from a new all-time high. So maybe things aren’t so bad?

This week we examine some of the biggest worries we have when it comes to the stock market and the economy, but we also list some reasons to be positive. The worries tend to dominate the headlines, and with the recent volatility, it is easy to get wrapped up into what could go wrong. The good news is that we see some reasons to think things could actually go right during the second half of this year.

Reasons to worry

#1 Brexit

Nearly every day for the past month, the countdown to the June 23, 2016, vote on whether the United Kingdom will remain in the European Union has been in focus. The vote is expected to be very close, with the polls showing odds of a “leave” vote increasing over the past few weeks. Although markets appear to be pricing in the U.K. staying in the EU, the weakness in the British pound and British equities could be saying this vote has the potential to surprise.

We discussed the implications of Brexit last week in the Weekly Market Commentary and are covering it again this week in our Weekly Economic Commentary, so we won’t dive much more into this subject here. Please see those commentaries for our immediate thoughts on Brexit (along with today’s blog); but the bottom line is, the implications of this vote will be felt globally, and potentially for many years.

#2 European Banks Continue to Sink

With the Brexit and negative rates taking hold, European banks are near multi-year lows, with many down 80% and some as much as 90% from their all-time highs [Figure 1]. In fact, one well-known German bank made new all-time lows last week. With German 10-year bund yields in negative territory, Japanese government bond yields negative through 15 years, and Swiss government bond yields negative through 30 years, European banks are bearing the brunt of lower rates.

The primary driver for this underperformance was their slow reaction to the 2008–09 financial crisis. Although some European banks were quick to recapitalize and shed unprofitable businesses, these banks were not. They are now suffering from a challenging market environment in which profit centers are under attack. Margins on commercial lending are being pinched by the negative interest rate policy. Proprietary trading is restricted. Capital requirements are limiting leverage and restraining profitability. Meanwhile, investment banking market share is shifting to the U.S. because EU regulators say these are high-risk areas and need further regulatory oversight. A race for a bigger share of the wealth management business is underway among European banks, but that shift likely makes margins dependent on market performance. Add in non-transparent financial statements, large derivative exposures, still significant leverage, and ongoing fines, and these banks have headwinds coming in from nearly every direction.

#3 Surging Yen

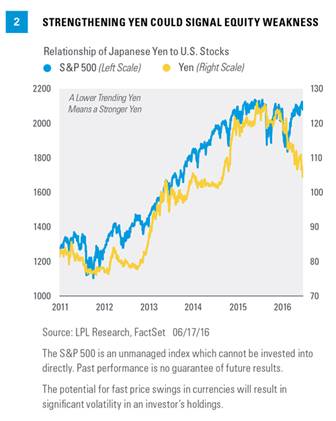

A stronger yen suggests a potentially weaker global economy, and after five years of deliberate depreciation of the Japanese yen by the central bank, the yen has begun to appreciate—and quickly. In fact, this is the highest the yen has been in nearly two years (since late August 2014). The Japanese yen is a major player in the “carry trade”—when global banks and private investors borrow money at Japan’s very low interest rates and invest in higher-yielding assets around the globe. When they determine that these investments are relatively unattractive, they tend to sell those assets and move money back to Japan, boosting the value of the yen.

As Figure 2 shows, the yen has strengthened significantly recently. Take note that on this chart, a lower trending yen actually represents appreciation of the yen relative to the U.S. dollar. When the yen has been weak, this has been generally positive for U.S. stocks—while strengthening has been mildly negative. The recent yen strength has done little to slow down U.S. equities, but history would say this is a major concern to equities should the yen continue to strengthen from here. Again, we look to yen strength as one indicator of global weakness.

Reasons Not To Worry So Much

Now the question becomes, is it really that bad? The list of worries is very well known, suggesting that if the general public is aware of the worries, the market has priced them in already. How much is priced in has no clear answer, but the reality is there are some positives out there as well. Here are a few of the key positive developments that may have the potential to produce better economic growth and stronger stock market performance the second half of the year.

#1 Strong Market Breadth

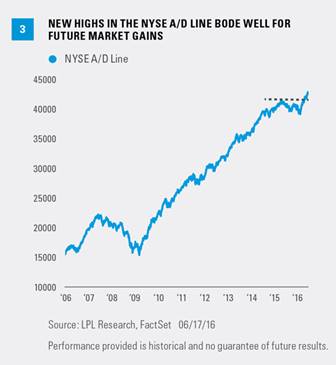

Think back to exactly a year ago at this time, the S&P 500 was up 2% year to date and struggling to gain any traction (sound familiar?). The one major negative, however, was that very few stocks were leading, which is also known as weak breadth. About the only stocks participating in the market’s gains were the so-called “FANG” stocks (Facebook, Amazon, Netflix, and Google). This weak underpinning led to massive volatility and an eventual big crack lower in August 2015, aided by China’s sudden decision to weaken its currency. Fast-forward to today and it is once again a market that is up close to 2% for the year and can’t seem to break out of a range. But this time, there is wide participation—a very good sign.

One of our favorite ways to measure market breadth is via advance/decline lines (A/D lines). A/D lines are computed daily by adding the number of securities on an index that are higher and subtracting the number that are lower. An upward trending A/D line is a sign of broad participation and underlying strength, a good sign. Turning to the New York Stock Exchange (NYSE) A/D line, it recently broke out to new highs [Figure 3]. Although the S&P 500 has yet to break out, this is one clue that there is greater participation to the current rally and the underpinnings of the market are much stronger than this time a year ago. In nearly all major market peaks, the NYSE A/D line has started to lag well before the actual S&P 500 broke down. With new highs recently hit in the NYSE A/D line, this shows very little reason to believe a new bear market will start in equities anytime soon.

#2 No One Trusts This Bull Market

Even though the S&P 500 is only 2.8% away from a new all-time high, you’d never know it by the overwhelming amount of negative investor sentiment we continue to see. For instance, the American Association of Individual Investors (AAII) Sentiment Survey has seen the number of bulls beneath the long-term average (38%) for 32 consecutive weeks dating back to the fall of 2015. This is the second-longest such streak in the history of the poll dating back to the late 1980s. Not to be outdone, the number of bears in the recent survey came in at 37.5%, the most since mid-February 2016.

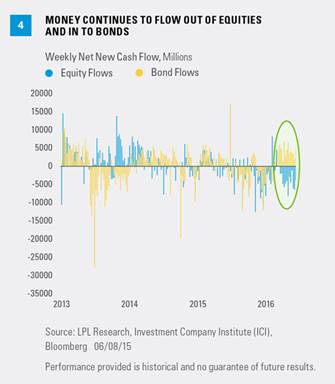

We like to use investor sentiment as a potential contrarian indicator. If everyone has sold, then only buyers are left. The flip side is, if everyone is bullish, then no one is left to do any buying. Sentiment polls are one part of it, but what people say in a poll and do with their actual money is much more powerful. For instance, the CBOE Volatility Index (VIX) surged 50% in five days for only the 38th time since 1990. This shows that the demand to be hedged in case of any future rise in volatility is very high.

The inflows and outflows of stocks and bonds are just as fascinating. There have been 13 consecutive weeks of outflows from equity strategies, while bonds have seen inflows for 15 consecutive weeks [Figure 4]. That tells you what most investors are doing; with yields near record lows, they would still rather own bonds than invest in “risky” equities. All of this negative sentiment could provide future buying pressure on any good news in the second half of the year.

#3 Stabilized Crude Oil & U.S. Dollar As Tailwinds

Lower oil prices have been a major hindrance to corporate earnings growth; but now with the commodity back up near $50 per barrel, should it stay near current levels, it will show year-over-year growth by the third quarter of 2016 for the first time since the oil bear market took hold in mid-2014. With supply and demand coming more into balance, we do think there is a good chance that crude can hold current levels. Although a huge rally might not be in the cards, a big drop back to the February 2016 lows is not likely either, in our view. Should crude stay near current levels, the energy sector may reach double-digit earnings growth by year-end,[1] after posting a loss and registering a more than 100% decline during the first quarter 2016 earnings reporting season.

The strength in the U.S. dollar continues to ease and could potentially provide a significant boost to earnings in the second half of the year. With nearly half of the S&P 500’s sales coming from overseas, the strength in the U.S. dollar has been as much as a 20% drag on foreign earnings (since the second quarter of 2015). Should the dollar remain at current levels, it would act as a potential tailwind to earnings over the remaining quarters of the year, after providing a major headwind over the past year.

Conclusion

The worries out there are very real and could continue to hinder economic growth and stock market gains. The good news is there are some major positives that might not get the same amount of publicity as the bad news does, but that could very well help produce a strong second half of the year. We continue to anticipate mid- to high-single-digit total returns for the S&P 500 overall in 2016.[2] With the year-to-date return near 2.5% currently, we expect more gains before the year is done.

Burt White is chief investment officer for LPL Financial.

Thanks to Jason Hoody for his contributions to this commentary.