Sloppy spending can squeeze out or dramatically reduce profits at advisory firms, according to a study of advisors by TD Ameritrade Institutional.

At a time of declining profits, revenues and assets under management, many advisory firms surveyed said that they are paying more attention to overhead, the study noted.

“More than two-thirds said they will emphasize operational efficiency to drive future growth, improving consistency and productivity levels to impact the bottom line,” stated the annual advisory firm study, “The FA Insight Study of Advisory Firms: Growth by Design.”

Indeed, for many firms, operating efficiency could be the difference between a run-of-the-mill and top-flight advisor practice, the report said.

“Operational efficiency may be the single-most-important business area that distinguishes the standout firm,” the report stated. “At every development stage, the typical standout firm devoted a much lower percentage of its revenues to overhead expenses. This trend is consistent across the past eight years. The firms’ comparatively lower expenses played an important role in greater profitability per client and ultimately higher income for firm owners.”

A TD Ameritrade Institutional official, noting the recent boom years in the stock market, warned that advisors need to avoid the operational problems that sometimes happen in fat times.

“Operational insight might have not seemed so important in the past, but today advisors are saying it is becoming more and more important,” said Eliza De Pardo, principal director of consulting for TD Ameritrade’s FA Insight.

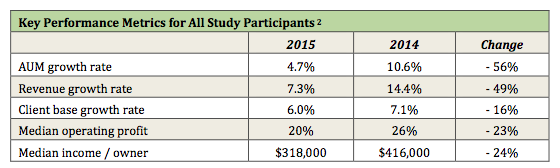

Source: TD Ameritrade

“After 2014’s record profitability and explosive growth, advisors must now be more disciplined—and that’s not a bad thing,” said Vanessa Oligino, director of Business Performance Solutions at TD Ameritrade Institutional.

The report cautioned that successful advisory firms should avoid becoming dependent on a rising market tide.

Here are some steps the study recommended for advisor practices to operate efficiently:

• Optimize scarce resources. Winners have “disciplined management practices.” This means standout firms obtain strong investment returns.

• Have more than a plan. An effective strategic plan includes objectives tied to leading as well as lagging indicators, in addition to implementation detail and assignment of accountability. This increases the chances of success. But this, the report added, means that “all team members need to understand the plan and the role they can play in the firm’s success.” This requires detailed direction, noted De Pardo. It can also require “line by line direction,” she added. This is important, she said, in creating unique client experiences that help some firms excel.

• Focus on generating sustainable growth. The firm’s capacity and infrastructure must be the best so the firm’s resources are maximized. “Without laying a strong foundation for growth, you may be at risk for experiencing some of the negative aspects of growth, which can include overworked staff, outgrowing your technology and an increase in overhead expenses impacting firm profitability,” the report states.

• Mature firms outperform through focus on operational efficiency and client experience. As firms and their clients grow in size and complexity, standout firms have become more focused on enhancing the quality of the client experience while concurrently improving efficiency, according to the report. This includes narrowing the firm’s focus on the type of client served as well as paying more attention to workflow structure and integration of technology.

• Areas of focus change as firms mature. At different developmental stages, the effectiveness of certain growth drivers can vary performance and help a firm to the next stage. A firm’s competitive environment and development stage require the continual refinement of firm objectives and flexibility, according to the report.

The report concludes that firms shouldn’t bet on bull markets:

“Advisory firms are ill-advised to rely on security markets to continually propel double-digit increases in assets under management. It is important that firms continue to adapt to the world at large, including security cycles, evolving investor needs and technology innovations, in order to remain competitive and fuel sustainable growth. Through growth by design, advisory firms can create opportunity and sustaining success through all but the most adverse of market conditions.”

The study surveyed some 325 advisory firms ranging in size from $100,000 to $10 million and over in annual revenue.

Overhead Can Kill A Practice, TD Warns

August 29, 2016

« Previous Article

| Next Article »

Login in order to post a comment