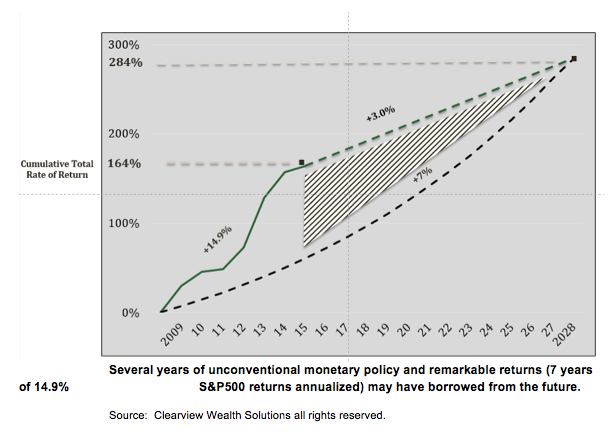

After seven years of extraordinary stock market returns (S&P averaged 14.9 percent annualized from 2009 - 2015) valuations are now full and the profit cycle appears tired. Assuming a 7 percent annualized total return over the entire bull market that began with the start of the cycle in 2009 (see explanation “A”) the next decade could see 3 percent annualized returns on average.

Put another way, over the next decade stock markets are likely to be more volatile and far less generous. Economies worldwide will struggle under high debt burdens and runaway deficits. Economic growth will remain sluggish and tax rates are likely to rise. Workforce demographics will become an economic headwind as worldwide populations age. Historically low interest rates will punish both pre-retirement savers and retirees dependent upon fixed incomes.

The end of the commodities super-cycle suggests commodity prices could remain under pressure for years, threatening additional deflation. Lower commodity prices are helping to burst emerging market credit bubbles across the globe including Brazil, Venezuela, South Africa and Nigeria. Domestic high yield credit defaults are on the rise and the U.S. credit cycle appears to be exhausting itself as well. Worldwide economic problems and the political unrest they often generate (i.e. the Arab spring) are likely to continue.

Understanding risks, especially deflationary risks, could become more challenging for advisory professionals. Arriving at a suitable asset allocation dedicated to each client’s specific objectives and retaining that mix over time may well determine the success or failure of the advisory process. With interest rates the lowest on record and government bonds no longer capable of supporting retiree lifestyles, risk assets (those with higher volatility like stocks or high-yield bonds) take on greater importance as dependence on them becomes more critical. Finally, rising volatility and difficult markets often lead to emotional decision-making and behavioral blunders.

Is Convention The Problem?

A major catalyst for the seven-year rally, the Fed’s controversial quantitative easing program, appears to be reaching its conclusion. With that, well-established return assumptions that rewarded over-sized equity allocations and allowed 4 percent plus retiree withdrawals may now prove overly optimistic. Lower baseline stock and bond returns (of 7 percent and 3 percent respectively) coupled with rising market volatility could challenge the sustainability of well-established and commonly followed investment advisory practices while further jeopardizing already vulnerable retirees’ lifestyles.

Many experts believe annual stock returns will be lower over the next several years. Rob Arnott (of Research Affiliates) anticipates less than 2 percent annually, while McKinsey (the consulting firm) expects 4 to 6 percent real stock returns and Vanguard’s Chief Economist, Joseph Davis, looks for less than 6 percent over the next 50 years. Disappointingly low returns could upset advisory assumptions for the majority now dependent upon defined contribution programs and lead to widespread difficulty among the retired.

There are two distinct potential issues for consideration; inferior portfolio returns and adverse return sequencing.

Inferior Portfolio Returns

This chart displays S&P 500 returns over the past seven years (2009 thru 2015) and the projected future returns that would ultimately provide at a 7 percent average annualized return over a 20-year period. As returns over the past 7 years have been more than twice our assumed trend, it could be argued we have borrowed from the future. Mediocre projected future market returns of around 3 percent could now be expected. Slower growth of investment portfolios will require larger contributions to meet funding objectives. And smaller retirement portfolios will result in reduced withdrawal potential and a more frugal lifestyle for retirees.

Adverse Return Sequencing

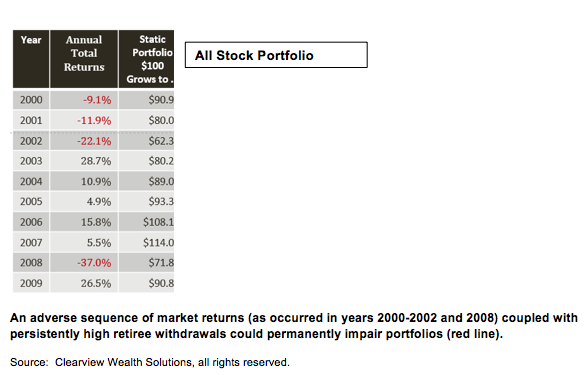

With markets fully priced (S&P cyclically adjusted P/E ratio at 26), returns over the next several years may be less predictable with a higher probability of negative front-loaded returns much like those that occurred in 2000-2002 and 2008 timeframes. A sequence of returns similar to those periods could cause extensive losses to retiree stock portfolios and play havoc on accumulated portfolio principal. Ultimately this could impair retirees’ ability to sustain their originally planned withdrawals and thus lifestyles. Bear in mind that a 25 percent loss to portfolio requires a 33 percent gain to fully recover.

Table 2 and the associated chart describe the actual damage done to an all stock portfolio as a result of annual withdrawals of $4.00 (or 4 percent of the original principal amount) during the 2000-2009 decade. The red column (left table) and red line (right graph) powerfully illustrate the potential damage attributable to adverse return sequencing. Note that the large negative returns coupled with persistently high withdrawals in the face of those declines causes the post-retirement portfolio to shrink by over half in only 10 years!

Possible Solutions

Advisors using established withdrawal rate assumptions now run the very real risk of allowing a potentially irreversible drawdown to occur that could permanently impair client portfolios. We believe impairment begins once a portfolio declines 20 percent greater than plan. A significant, multi-year bear market (similar to the 2000 time frame) could lead to widespread portfolio impairment causing serious consequences for those reliant on fixed incomes. After a decline of this magnitude portfolio recovery might be possible without extreme retiree withdrawal /lifestyle changes. The overall economy would suffer as lifestyles would be moderated and spending curtailed.

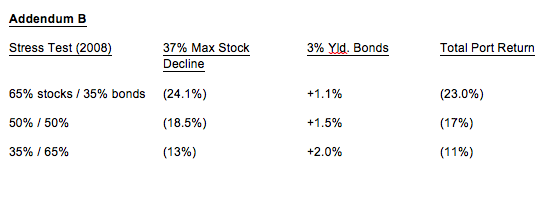

Fortunately, impairment may be managed, if not controlled through advisory support and intervention. Perhaps most important, more conservative advisory assumptions should be embraced. Well established asset allocation recommendations (60 percent stocks and 40 percent bonds) may no longer be appropriate for retirees. The newly retired are especially vulnerable and should hold fewer stocks early-on to avoid the potential of portfolio impairment. Stock holdings of 35-40 percent in the first few years of retirement or until more desirable (lower) stock valuations avail themselves could reduce the risk of significant loss (see stress test data “B”). A larger allocation to non-traditional investments such as alternative assets may make sense.

Sustainable retiree withdrawal rates should also be analyzed as a way of avoiding portfolio impairment. The near universally accepted advisory industry rule of a 4 percent withdrawal rate in retirement, let alone the 4.5 percent “Safe Max” popularized by William Bengen, could prove too high over the next decade as heightened volatility and lower overall returns eat into retirees’ nest-eggs more rapidly. Note that a more conservative withdrawal of 4 percent of prior year-end principal would help minimize the drawdown of the portfolio by about 10 percent (to $59.53 vs. $48.31) over the decade in our all stock portfolio. Clearly, basing withdrawals on the prior year-end principal amount can help to limit losses through difficult markets.

A more conservative 3 percent or 3.5 percent withdrawal rate could also benefit retirees, especially the newly retired who are most vulnerable to impairment. In the 2000 all stock example, decreasing the withdrawal to 3 percent would have lessened the portfolio principal drawdown by nearly 11 percent (to $46.904). This lower withdrawal rate would have major consequences however as it would mean 25 percent less capital available for consumption and therefore a far more frugal lifestyle.

Feeling Lucky?

We believe that markets are less likely to be cooperative over the next several years. Recent returns have been well above expected trends—more than twice what many experts anticipate over the current cycle. Lower, more volatile returns coupled with greater reliance on risk assets will pressure pre-retirees and retirees alike in ways that will impact their lives and the economy in general.

Feeling lucky? If not, there are several practices that advisory professionals can employ to combat this more challenging market environment. In addition to tax-aware best practices including location management, gain budgeting and tax-loss harvesting, advisors should also employ portfolio management best practices including a core-satellite approach, separately managed accounts (in core portfolios) and a long-term balanced portfolio approach. Holding “blue chip” large cap stocks in a balanced, client customized core portfolio should improve risk-adjusted returns. Most importantly, behavioral coaching support designed to help clients stay engaged and not attempt to market time or quit the market during emotionally trying times may be the highest value element an advisor can provide.

A 2014 Vanguard study entitled “Putting a Value on Your Value: Quantifying Vanguard Advisor’s Alpha” attributed over 3 percent to a client’s annual return through employing these advisory best practices. Quantifying the benefits associated with these best practices is difficult and will vary by client, family circumstances and stage of life.

Lower market returns will slow the growth of investment portfolios, require larger contributions or longer time frames to meet objectives, and ultimately increase the likelihood that retirees will be forced to adopt more conservative lifestyles in retirement. Providing clients with the guidance to adapt and manage temporary lifestyle modifications as a way of helping them take control over their financial lives and thus retirement quality should be the strategic objective.

As chart 2 clearly illustrates, the near-term sequence of returns holds great importance to the newly retired. If markets evolve in a fashion similar to 2000-09 where retirees suffered large negative returns on two separate occasions, established withdrawal rates may prove detrimental impairing retirees’ ability to sustain originally planned withdrawals and thus lifestyles. Lower stock holdings (more in line with 35-40 percent as opposed to the more common convention of 50-60 percent) for the first few years or until more desirable (lower) stock valuations avail themselves will moderate the risk of significant loss. See stress-test “B” below.

By withdrawing less in retirement than the commonly accepted 4 percent rule (or 4.5 percent “Safe Max”), and instead using 3 percent to 3.5 percent retirees can substantially reduce losses should adverse market events occur. Also, through variable withdrawals (based upon a fixed percentage of the prior year-end valuation) principal protection can be improved. Unfortunately, all of these strategies may require a more modest lifestyle. We advise clients to adjust withdrawals to align with portfolio fluctuations, especially after impairment, and maintain this discipline until the portfolio recovers. Perhaps the best advice may be the hardest…put off full retirement until market conditions are more favorable (i.e. risk asset valuations, especially stocks, are lower) and assets are adequate given these more conservative withdrawal rates.

Addendum A

Why only 7 percent over a 20 year time period?

i. Lower growth…since 2005 U.S. GDP growth has averaged only 1.4 percent/yr.

ii. Consistent with lower GDP growth, we expect annual corporate earnings growth of mid-single digits. Since stock prices track earnings gains, future stock price appreciation is likely to be less than long-term averages. Other reasons for slower earnings growth include:

a) Profit margins have peaked and are declining

b) Wages are rising

c) World-wide GDP growth remains low

d) High debt levels mean less room for company financial engineering (stock buybacks)

e) Interest rates could rise over time increasing the overall cost of company debt

Steve Riley ([email protected]), CFA, CFP, and Rick Furmanski ([email protected]), CFA, CFP, are portfolio managers at Clearview Wealth Solutions in Lake Zurich, Ill.