KEY TAKEAWAYS

· Corporate earnings, the most important factor in market performance, were poor in developed foreign markets last quarter.

· Forecasts for future earnings have been improving in emerging markets and Europe, but have declined dramatically for Japan.

· Strength out of the German DAX could be one clue that better times are ahead for Europe.

Macroeconomics and geopolitics are interesting to discuss, but earnings are what drive markets. We tend to forget that truism when dealing with international markets. The recent Brexit vote and discussions on how, and even if, the United Kingdom will eventually leave the European Union have dominated the news, and especially social media. However, the biggest problems facing developed foreign markets are not politics or economics, but the inability of non-U.S.-based companies to grow earnings and revenue. In Europe, earnings are falling faster than revenue, though expectations have been improving for growth in both metrics. The earnings picture in Japan remains very troubled. Overall, we are looking for a turnaround in earnings and earnings expectations before becoming optimistic on developed foreign equities.

AMATEURS VS. PROFESSIONALS

There is an old expression in the military that “amateurs discuss strategy, professionals discuss logistics.” For investors, we can translate that to “the macro matters, but ultimately markets move on earnings.” Earnings season is, for the most part, over in the U.S., but we are still in the tail end of earnings for developed international stocks, with 76% of firms reporting as of August 11, 2016. Emerging markets (EM) earnings season is just beginning, with less than half the companies releasing earnings as of this date. We will provide an update on EM earnings in September after more companies have announced results.

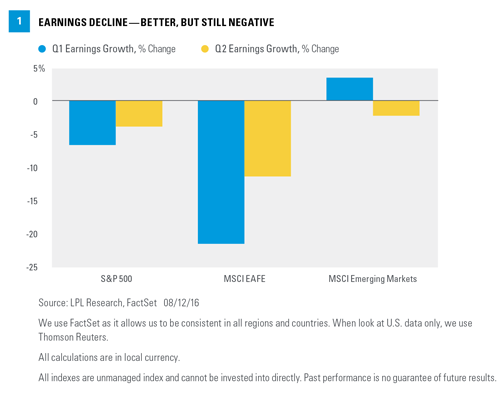

Unfortunately, revenue and earnings in developed foreign markets are in reverse [Figure 1]. If the U.S. is experiencing an “earnings recession,” then overseas stocks are in an “earnings depression.” The decline in both revenue and earnings is surprising. Though both Europe and Japan have economies that are sluggish at best, they have managed to avoid recession. There are many possible culprits for such poor corporate performance, most recently, the uncertainty created by late June’s Brexit vote. The true reasons likely run deeper. The two biggest problems in developed markets are demographics and rigid labor markets, which make hiring and firing workers difficult.

LOOKING THROUGH THE NUMBERS

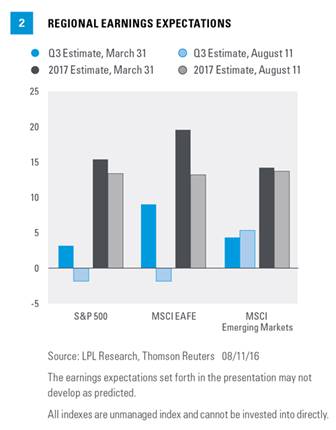

What matters most to financial markets are not historical earnings, but forecasts for future earnings and how these forecasts evolve over time. Wall Street analysts tend to be overly optimistic about future earnings, reducing forecasts as earnings season approaches. There are two data points related to earnings: the release of current earnings and revisions to future earnings. The current earnings reporting season is following the typical pattern, with forecasts coming down since the beginning of the year [Figure 2]. Two things are striking about this chart. Earnings estimates for emerging market equities in the third quarter of 2016 have increased in the past few months, and the outlook for next year’s earnings are essentially unchanged. However, for developed international markets, estimates for both next quarter and next year have fallen—dramatically.

The investment industry has historically considered Europe and Japan together, classified as developed foreign markets and included in the MSCI EAFE Index, which most asset allocators use as a primary asset class. Investors typically use diversified international strategies with EAFE as their benchmark to implement this allocation. However, the two regions have very different economies and market systems and should be evaluated separately. For example, expectations for next year’s earnings growth for Japan were reduced from 19.2% as of the end of March 2016, to 9.3% as of August 11, 2016. Much of this decline comes from reduced expectations for automobile and industrial equipment companies, companies that are heavily impacted by the stronger Japanese currency, the yen. Expectations for growth in European earnings for 2017 were reduced from 20.1% to 16.2% over the same period. Most significantly negatively impacted are financial stocks, which are potentially the most directly impacted by Brexit, as well as by negative interest rates. Conversely, expectations for energy companies have been improving with higher oil prices. We use local currency figures, not U.S. dollars when examining earnings. Currency movement matters, as it affects the actual earnings and may be an investment consideration for those outside the country. But the earnings in local currency are what investors in that country will be looking at when making their decisions.

CLOSER LOOK AT GLOBAL RETURNS

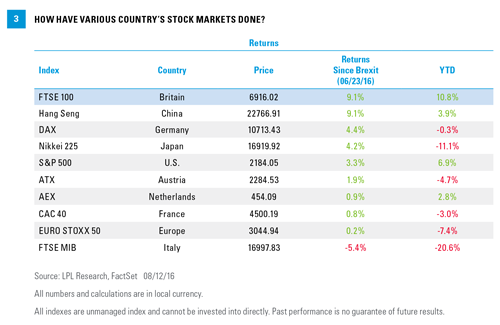

Taking a step back from earnings and looking at various country stock market returns shows a mixed backdrop in Europe, while Japan continues to lag. Japanese earnings continue to disappoint, contributing to the Nikkei 225, down 11%, being one of the worst performing stock indexes in 2016. What would come in as one of the bigger surprises of 2016 though is that since the Brexit vote, the British FTSE 100 is up 9.1% to a new 52-week high—making it one of the top performing stock markets in the world [Figure 3]. These returns would have been hard to predict the morning after the vote to leave, with global markets declining sharply. Sparking the surge in the British equities was a huge drop in the British pound, which helps the export-heavy U.K. economy.

POSITIVE TECHNICAL DEVELOPMENT?

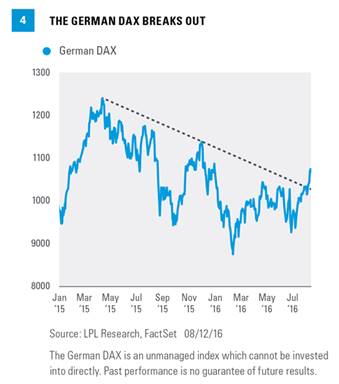

Germany continues to be one of the most (if not the most) important countries for the overall health of Europe. Some of the recent German economic data have been strong, led by last week’s (August 8–12, 2016) second quarter report on gross domestic product (GDP), which showed a better than expected 0.4% gain. As Figure 4 shows, since the Brexit vote, the German DAX has been a leader—a potential sign that the largest economy in Europe could be signaling future strength for Europe in general.

Last, there is a very positive technical development looking at the German DAX, as it recently broke above a bearish trend line going back 16 months. Many times we have seen markets lead economic data by as much as six to nine months, and this recent improving price action out of Germany could be another clue that an improving German economy, and likely European economy, could be coming later this year.

CONCLUSION

Financial markets were clearly overly optimistic regarding both European and Japanese earnings earlier this year. Earnings have been very disappointing, and near-term estimates have been reduced. But looking to next year, analysts are still positive overall on these markets. The market is already looking to the future, beyond recent earnings weakness, though some uncertainty remains, particularly around Brexit. Should the German DAX continue to lead, it may be a step in the right direction for European markets in general. While reasons for optimism on foreign equities exist, we want to see some of these potential points of improvement come to fruition before we can recommend increasing investment overseas.

Burt White is chief investment officer for LPL Financial.