Key Points

1. S&P 500 as-reported EPS fell 14% from 2014 Q3 to 2015 Q3, one of only four drops of similar magnitude over the last 25 years, and each roughly coincided with a double-digit price decline in the U.S. equity market.

2. In the 12 months ended 2015 Q3, valuation multiples expanded by an amount roughly equivalent to earnings’ contraction, but in early 2016 prices are rapidly adjusting.

3. The current commodity-induced profits recession may be short lived, but the real secular trend growth rate in EPS should be much slower than the past quarter-century.

Earnings per share for the S&P 500 Index peaked in the third quarter of 2014. The dramatic plunge in the prices of oil and industrial commodities as a result of slowing demand from China together with increased supply from the United States, decimated energy and materials companies’ profits. In the years ahead, oil production will decline to remove excess capacity, prices will again rise above costs, energy company margins will recover, and market-level earnings will return to a normal rate of growth.

The future secular real rate of growth in corporate profits is far more important than the current commodity cycle to investors’ long-term real wealth accumulation. During the past quarter-century, politically facilitated globalization allowed profits to grow much faster than per capita GDP, wages, and productivity, propelling capital’s share of income to an unsustainable extreme.

The distribution of the economic pie is ultimately a political choice. With populist frustration increasingly pressuring policy change around the world, investors should expect labor, tax, and interest expense to rise faster than sales, thereby depressing profit margins and slowing real growth in earnings per share over the decades ahead.

Trouble in China

The past year, 2015, was turbulent for investors in most of the world’s financial markets. The messy and opaque transition in China, from subsidized over-investment by state-owned enterprises toward a more balanced economy led by domestic consumption, generated financial turmoil. This slowdown in growth was accompanied by a decline in China’s exports, capital outflows, downward pressure on the Chinese yuan, and dizzying (and market-halting) drops in Chinese equity prices.

The financial losses were not contained within China. Commodity prices continued their downward spiral, resulting from the surprise contraction in Chinese demand, following years of heavy investment and innovation to increase the supply of energy and industrial commodities. Resource- dependent emerging market currencies and equities plummeted in response.

Also in 2015, divergence in monetary policies unsettled developed currency markets: the European Central Bank and the Bank of Japan continued quantitative easing programs while the Federal Reserve rhetorically led markets on a long, slow walk to the first increase in the fed funds rate since the global financial crisis.

Shrugging off these global troubles, investors priced the U.S. equity market at year-end not far from where they had priced it at the beginning of the year. Beneath this seemingly calm aggregate market movement was growing distress in the energy and resource sectors. Perhaps even more notable, aggregate earnings peaked and began to decline. Although final full-year earnings for 2015 will not be reported for a few more months, market-level profits are obviously past their peak. Now, in January 2016, investors seem to be recognizing that U.S. corporate profits have rolled over. In this article we take a careful look at U.S. market earnings per share (EPS).

The Profits Recession

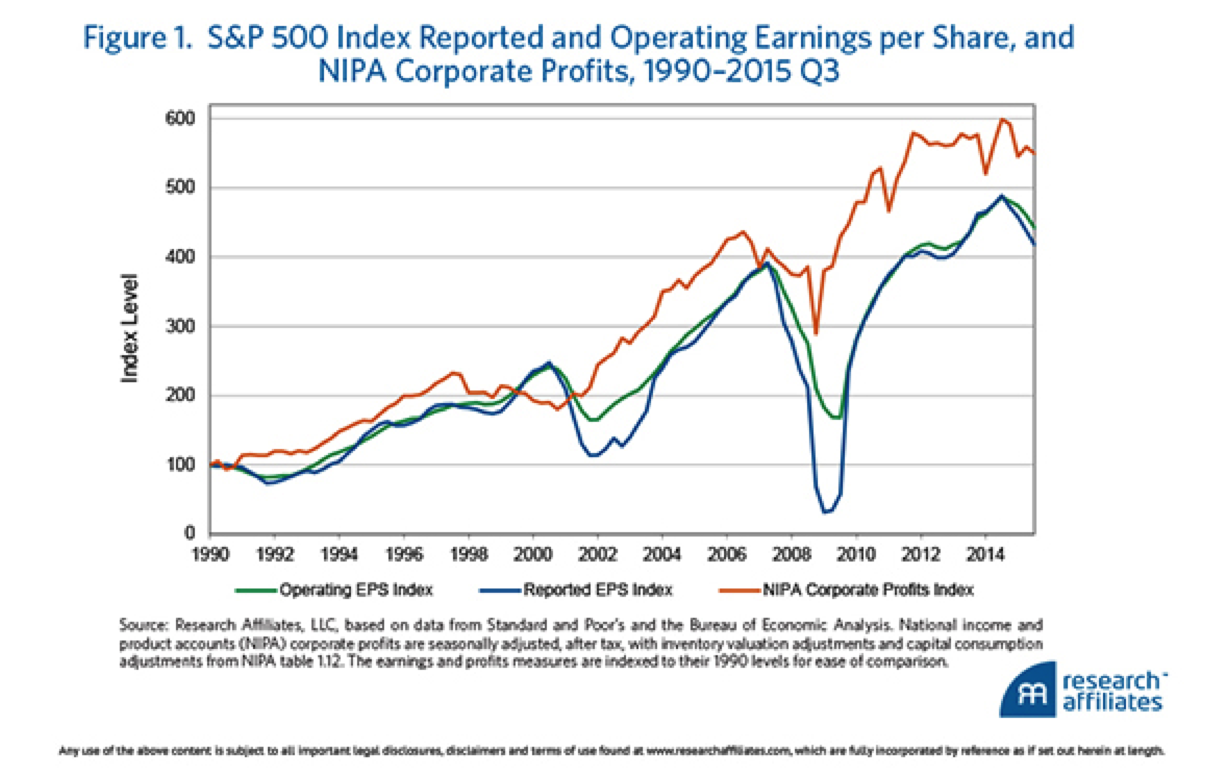

Both reported and operating EPS for the S&P 500 reached an all-time high in third-quarter 2014, then steadily declined by 14% and 9%, respectively, in the 12 months ending third-quarter 2015. Over the same period, the U.S. Department of Commerce Bureau of Economic Analysis (BEA) national income and product accounts (NIPA) measure of corporate profits fell by 8%. These declines are substantial, and little reason exists to believe the numbers will improve in the quarters ahead.1 Figure 1 helps put the 14% reported earnings decline in historical perspective. Over the past 25 years, drops of this magnitude only occurred in 1991, 2001–2002, and 2008–2009; each drop roughly coincided with double-digit price declines in the U.S. equity market.

What has caused the current profits recession? The immediate proximate cause is plummeting oil prices, responding to slowing demand from China and rising supply in the United States. A related cause of the decline in EPS is the strength of the U.S. dollar. A higher dollar both reduces demand for U.S. exports and hurts U.S. multinationals when they convert foreign-earned revenues into dollars.

Drilling Down into EPS

In our analysis we focus on the earnings per share of the S&P 500 Index, a measure of the earnings of the largest publicly traded companies. The other commonly used definition of earnings—corporate profits from the BEA’s NIPA—measures economy-wide corporate earnings. The NIPA corporate profits measure, which includes private firms and all corporations regardless of size and profitability, covers a much broader universe of firms than the S&P 500 Index measure.

We focus on as-reported EPS rather than operating EPS, because as-reported (or simply, reported) EPS provides the best measure of aggregate market earnings. Whereas both the reported2 and operating measures exclude discontinued operations and extraordinary income, operating earnings also excludes, at the discretion of management, “unusual” items. Examples of unusual items are fixed-asset write-downs, inventory impairment, goodwill impairment, gains and losses on the sale of assets, M&A costs, layoffs, and special litigations. We believe reported EPS is the appropriate measure to represent the market in aggregate because many firms—although usually not the same firms—report unusual items each quarter. Unusual items are “usual” for the market.

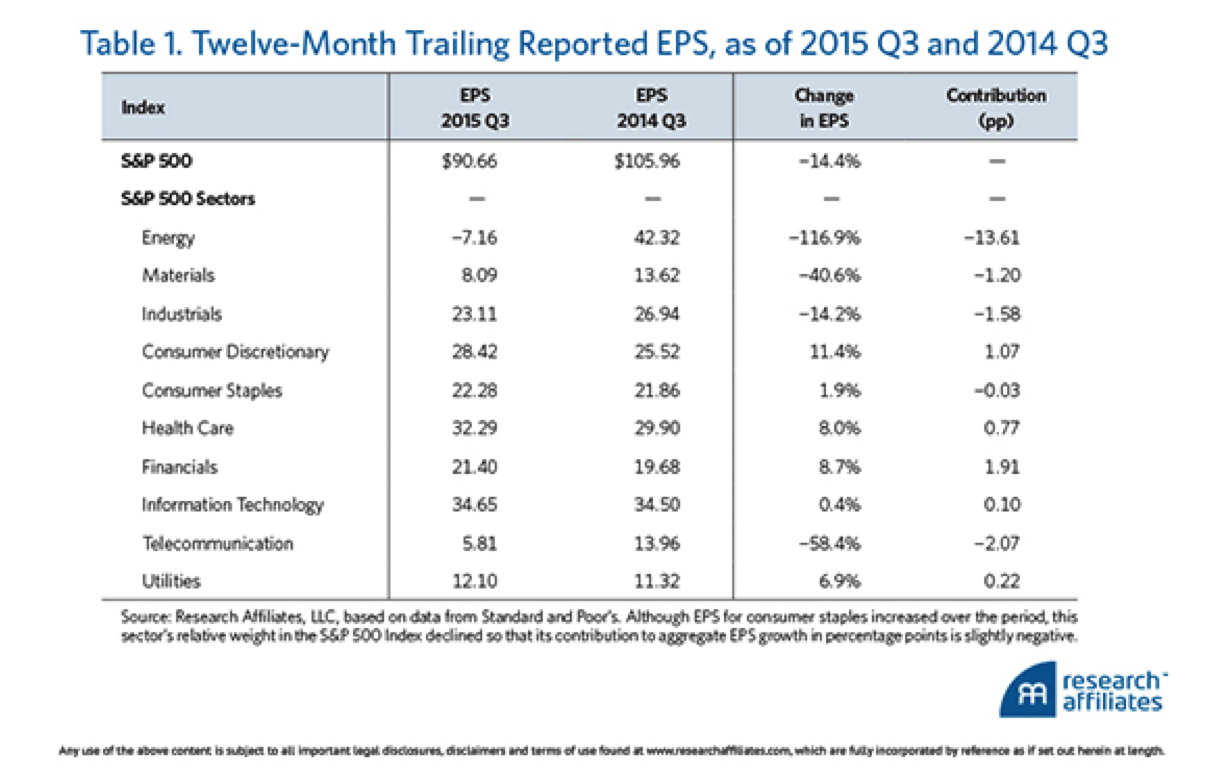

Table 1 reports 12-month trailing EPS for the S&P 500 and its 10 sectors at the end of the third-quarter in both 2014 and 2015. One data point stands out in a big way—the decline in energy sector EPS over the 12 months from $42.32 to −$7.16. Table 1 shows that the vast majority of the 14.4% year-over-year (y-o-y) decline in aggregate EPS can be attributed to the energy sector. The materials and industrials sectors also significantly contributed to the decline in S&P 500 earnings per share, dropping respectively from $13.62 to $8.09 and from $26.94 to $23.11 year over year. For many industrial and resource companies, slowing global demand more than offset the benefit of cheap energy.

On the positive side, Table 1 reveals that the consumer and financials sectors helped buffer the overall drop in aggregate EPS. Low energy prices benefited consumers by allowing them to spend a larger portion of disposable income on non-energy consumption. Consumer sector earnings improved in response, rising from $25.52 to $28.42 (discretionary) and from $21.86 to $22.28 (staples) year over year.

The financials sector improved on already healthy margins. Trading revenues propelled y-o-y increases in earnings for the top five largest investment banks. These banks also experienced a strong run in M&A activity, completing deals worth $867 billion, making third-quarter 2015 the strongest quarter for M&A volume and advisory fee revenues since the financial crisis.

Losers from Cheap Energy

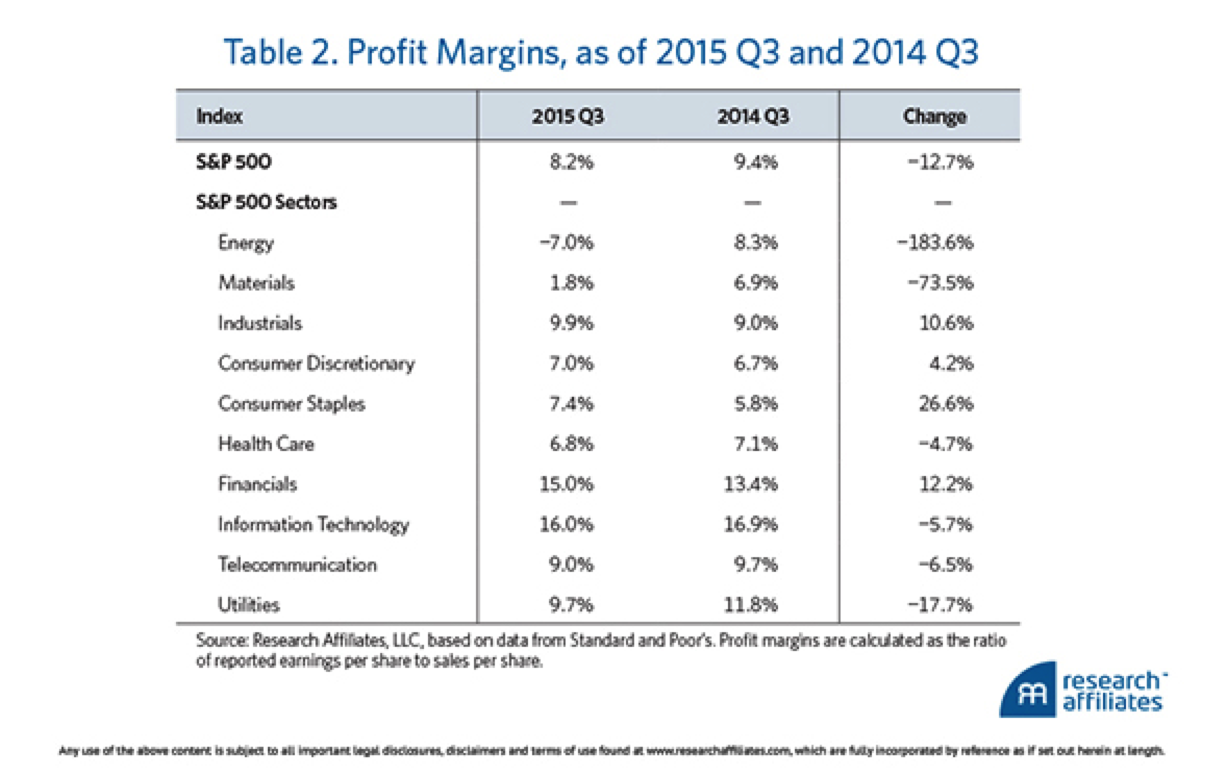

The falling price of oil has been particularly painful for energy companies. Servicing debt burdens in the presence of dramatically lower oil prices has thrown the profit margins of many energy companies into the red. The sector lost $0.07 for every dollar of revenue generated in the 12 months ended September 2015, compared with a gain of $0.08 in the 12-month period ending September 2014.

The materials sector has not benefited from the cost savings of cheap oil as the sector’s profit margins fell from 6.9% to 1.8% year over year (Table 2). Chemical companies, including DuPont and Dow, led the decline. U.S. chemical producers’ margins suffered as European manufacturers gained a cost advantage. European petrochemical producers use naphtha derived from crude oil as feedstocks, whereas U.S. producers use natural gas. In recent years, U.S. producers enjoyed a competitive advantage from cheap shale gas, however, in 2015 as the price of oil plummeted, this cost advantage reversed. As a result, petrochemical production and its profits have shifted to Europe.

Other companies in the materials sector are feeling the squeeze too. Freeport-McMoRan, a copper mining company that borrowed heavily to acquire a large oil and natural gas division in 2013, is facing both low oil prices and historically low copper prices due to weakening global demand for raw materials. Nucor, the largest steel producer in the United States, has suffered reduced demand for steel used to build oil rigs, pipelines, and other energy infrastructure as oil companies scale back capital expenditures in the face of sustained low oil prices.

In contrast, profit margins in the industrials sector have increased slightly year over year. Lower oil prices have reduced input costs, thus allowing industrial companies to generate more earnings per dollar of sales. This improvement, however, has been more than offset by a drop in sales. The companies driving the sectoral decline in earnings per share—including Caterpillar, Deere & Company, Fluor Corporation, and Emerson Electric—supply construction equipment and engineering services to global energy and mining companies.

What’s in the Price?

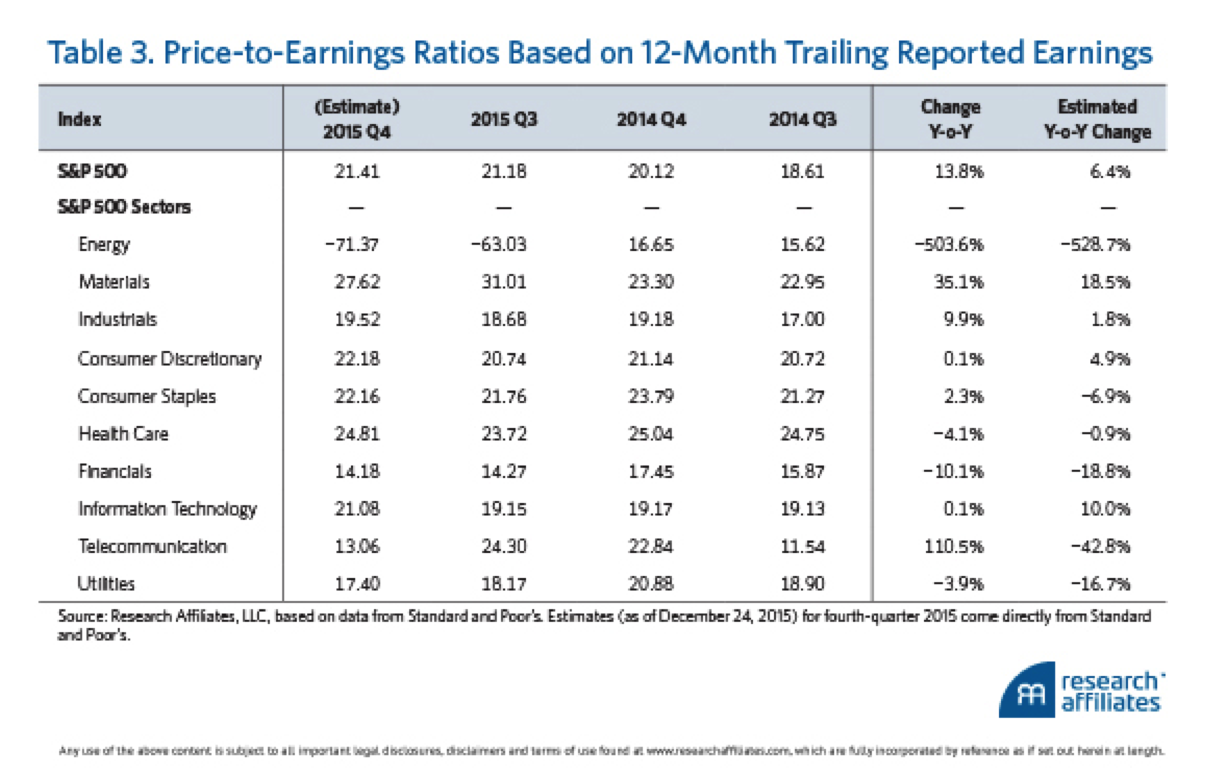

How have valuations adjusted to the profits recession? The answer appears to be...not much, at least by year-end. Trailing 12-month price-to-earnings ratios, displayed in Table 3, show valuation multiples expanding 13.8% over the same period that earnings experienced a contraction of similar magnitude, −14.4%.

End of the Profits Super-Cycle

The current profits recession may well be a short-term phenomenon. In due time, oil producers will remove supply from the market, inventories will fall, prices will rebound, and margins will return to normal. In the meantime, however, oil prices could fall even further if inventory capacity runs out, particularly as export sanctions on Iran have now been lifted.

When the commodity cycle inevitably concludes, to what secular rate of growth will market EPS revert? The real secular rate of growth in market EPS is far more important for long-term wealth accumulation than the duration of today’s cyclical fluctuation in profits. We have strong reason to believe that this secular trend growth rate in EPS will be much slower than many investors have come to believe is normal. To our long-time readers, this view should come as no surprise. In early 2014, we wrote about this subject in “The Profits Bubble”:

For nearly a quarter-century, we have experienced profits growing at a faster clip than GDP. Extrapolating this trend into the future is speculative at best. Equilibrium real growth in earnings per share cannot exceed real growth in per capita GDP, real growth in wages, and real productivity growth, on a long-term basis, without violating our sense of social fairness: More rapid growth in profits than GDP means a rising share of income to capital. Capital’s share cannot rise in perpetuity; social and political forces, if not economic developments, will cause it—sooner or later—to revert to a more usual level…

The macroeconomic cause of today’s profits bubble can be understood as a quarter-century of politically facilitated globalization. During the 50 years following WWII, we lived in an open global developed economy containing less than one billion people in Europe, North America, Australia, Japan, Korea, Taiwan, and a handful of others. Some countries were growing faster, some slower, but the technological level and population growth rates were not very different across the predominant countries within this relatively open global economy. The shares of income to labor and capital varied cyclically but tended to revert toward long-term averages.

Beginning in the 1990s, we experienced a seismic shift in our global political economy. Approximately three billion people began to join this open global economy: about one billion each in China and India and another billion or so in Russia, Eastern Europe, South America, and Southeast Asia. Average wages, level of technology, and amount of accumulated capital in the countries of the aspiring three billion lagged far behind those enjoyed by the one billion in the developed world. Imitation and appropriation is far easier than innovation and invention, so catching up has been rapid for those nations willing to make even modest concessions to the aspirations of their citizenry. For the past quarter-century, the capital and technology accumulated by the old equilibrium advanced global economy has been suddenly shared across a labor force and populace that quadrupled.

This tectonic shift in our global political economy produced some winners and some losers. Incomes of many of the three billion newly joined rose quickly. Global poverty rates have plummeted. Meanwhile, wages in the old advanced economy countries stalled at least partly in response to competition from the lower wages welcomed by workers in developing countries….

This period of globalization and the inflation of our profits bubble has been facilitated in part by a corporate capture of government policy, inhibiting competition, depressing investment, and promoting rent seeking. Rent seeking may be more extreme within our very own financial industry than in any other. TARP and QE are just the most recent and largest examples of government intervention to benefit corporate interests. For several decades, under governments led by both parties, the close nexus between Wall Street and Washington has facilitated an economic policy that favors politically savvy corporations and too-big-to-fail megabanks. Our policymakers have too often mistaken what is in the best interest of their elite peer group (and, surely by sheer coincidence, some of their largest campaign contributors) as in the best interest of the broader society. The result has been decades of stagnation in wages, high taxes on labor income, subsidies for debt and consumption, underinvestment, and soaring corporate profits.

Now, we applaud business success and the resulting profits, particularly when profits flow from inventing new processes, products, and services and providing value to customers. We eschew government meddling in the economy especially when the results favor the politically connected and thwart fair competition. Because globalization and corporatist economic policies seem to have unfairly tilted the scales against lower-skilled workers in developed countries, we sympathize with the growing political pressure to subsidize the creation of low-skill jobs, to improve the skills and wages of the less proficient, and provide a living wage to the working poor.

We cannot predict the quarter or year when profits will peak. We can predict the catalyst. The share of corporate profits is a political choice. The present share of income going to capital seems increasingly intolerable. Populism is rising throughout the developed world and will likely lead to political change. Today we have libertarians joining progressives in rhetorically attacking big banks and advocating redistribution through raising the minimum wage and subsidizing low-wage jobs. Expect corporations’ labor, interest, and tax expenses to rise faster than sales over the next couple of decades, and profits to grow much more slowly, or even decline, in real terms.

Endnotes

1. As of January 21, 2016, Standard and Poor’s estimates that for the 2015 calendar year reported EPS will decline by 7.3% and operating EPS will decline by 5.6%.

2. Reported earnings, which conform to generally accepted accounting principles (GAAP), are also known as GAAP earnings.

Chris Brightman is chief investment officer at Research Affiliates LLC. Johathan Treussard is the firm’s senior vice president for product management and Mark Clements is senior researcher.