Key Points

• Optimism for political reform can help drive stock markets higher.

• Those gains might not last as the enthusiasm for reform meets the political challenges that can come with structural changes.

• We have a neutral outlook for both emerging markets and international stocks. Factors that supported a rebound in emerging market stocks in the first half of 2016 may reverse in the second half.

Markets aren’t immune to the optimism that can bubble up with expectations of political reform. The hope is that a new leader might make changes that boost a country’s economic growth potential or improve its financial outlook. The political atmosphere in Brazil offers a current example of this dynamic, though the recent experiences of Indonesia, India and Mexico also come to mind. So is this something investors can use to plan their own overseas investments?

We would urge caution. Most of the bang for the reformer buck happens early, before any political changes actually occur, and successfully timing the market is nearly impossible over time. Also, the effect of an initial burst of political enthusiasm may not be durable. Stock markets tend to be disappointed as the honeymoon vibe wears off and the challenges that can accompany reform pop up. This isn’t to say reform is impossible. Changes can happen, producing positive results for the economy and markets, but investors should realize that the stock market often moves faster than politics.

Markets price in hope

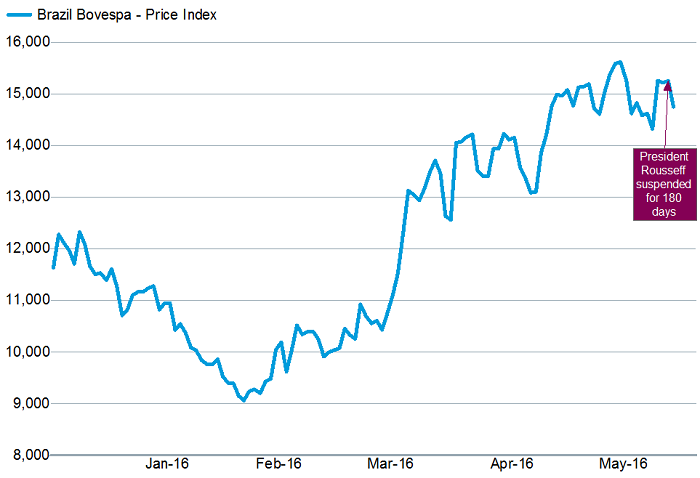

Even as other emerging market stocks, currencies and bond markets have rallied this year along with the fall in the U.S. dollar and rise in commodity prices, Brazil has been an outlier. In U.S. dollar terms, Brazil’s Bovespa Index has delivered a 69% return so far this year, beating the 14% return for the MSCI Emerging Markets Index.1

Brazil owes much of that outperformance to the market’s expectations for political change in the months leading up to the recent vote to suspend President Dilma Rousseff pending an impeachment investigation. Brazil’s economy has been stuck in a recession—it contracted 3.8% in 2015, and the International Monetary Fund projects another 3.8% decline in 20162—even as it struggles with inflation, weak commodity prices (a key export), and a growing budget deficit. Expectations that the president could be replaced by a more reform-minded leader may have inspired investors to drive stocks higher. Following President Rousseff’s suspension, the interim president, Michel Temer, announced a series of reforms to address some of the economy’s troubles.

Brazil’s market has rallied, but will it last?

Source: FactSet, Bovespa, data from 12/02/2015, when impeachment proceedings began, through 5/12/2016.

Temer could reduce the fiscal deficit and economic data suggests the worst of the recession may be over. That could help push Brazil’s stock market even higher in the coming months. However, the experience of other countries suggests markets can struggle if reforms come slowly or fail to match investors’ optimism.

Disappointment sets in

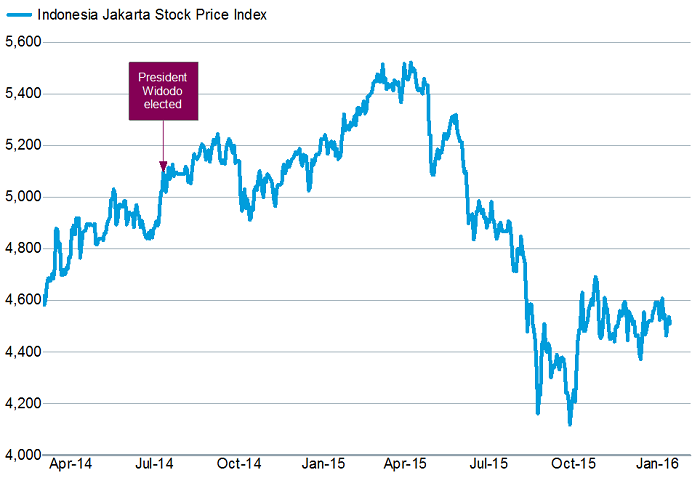

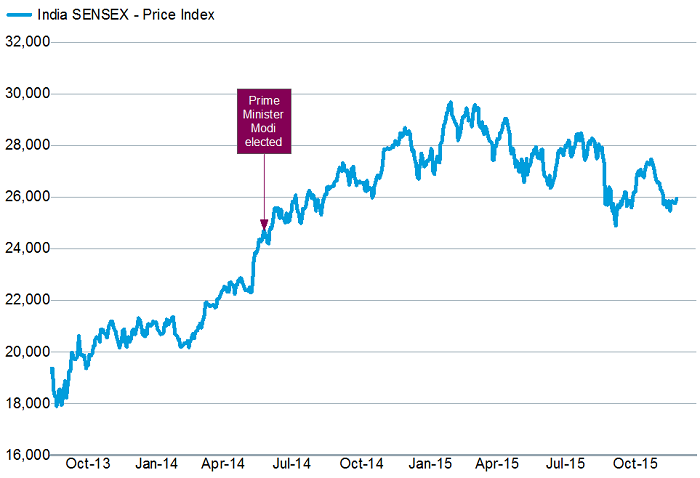

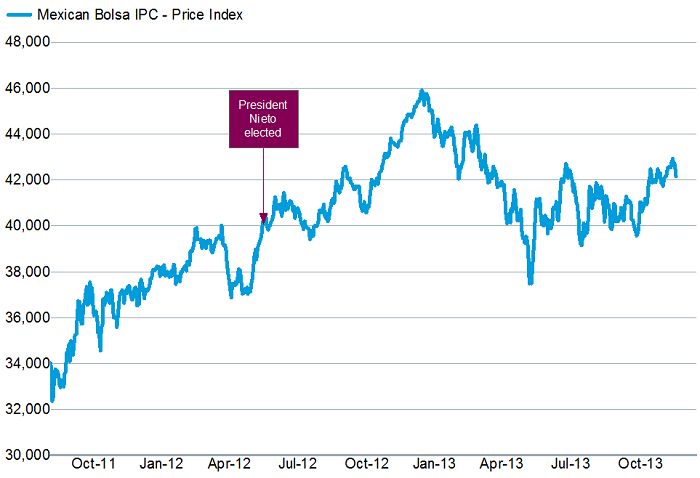

Similarly high expectations abounded ahead of the elections of President Joko Widodo in Indonesia, Prime Minister Narendra Modi in India and President Enrique Peña Nieto in Mexico. So how did those situations work out? The following charts, which track local markets for the 18 months after the different politicians announced their candidacies, help tell the tale.

Indonesia rose and fell

Source: FactSet, Indonesia Stock Exchange, data from Widodo’s candidacy announcement on 3/14/2014 through 1/14/2016.

India rose and leveled off

Source: FactSet, Bombay Stock Exchange, data from Modi’s candidacy announcement on 8/13/2013 through 11/26/2015.

Mexico rose and leveled off

Source: FactSet, Bolsa Mexicana de Valores, data from Nieto’s candidacy announcement on 9/21/2011 through 1/2/2014.

What accounts for the fizzling in enthusiasm? Often, it’s the result of what happens when the promises of structural reforms encounter entrenched political interests, which may oppose different measures to boost growth, deal with labor relations, regulate business, or restructure pension obligations.

After all, even the most inspiring leaders still have to work with legislative bodies that might be dominated by opposition parties, or deal with the fact that while they are personally popular, the reforms they are pushing might not be.

There are exceptions though. Japan’s experience after electing Prime Minister Shinzo Abe suggests stocks can go further if legislators and central bankers work together to push forward reform and stimulus simultaneously. However, even Japan is facing difficulty creating enough structural change.

Key takeaway

Again, this isn’t to suggest that inform is impossible, or that a reforming leader can’t introduce changes that are good for a country’s economy—and its markets—over the long run. It’s just that it’s difficult to know when expectations are running ahead of reality or whether a potentially transformative political moment will actually lead to reform. Plus, markets tend to move faster than politics, so timing is difficult.

Overall, we have a neutral outlook for emerging markets stocks. Factors that supported a rebound in such stocks so far in the first half of 2016—the stabilization of China’s economy, rising commodity prices and a decline in the U.S. dollar—may not continue through the second half. The driver of China’s recent economic reacceleration—debt-fueled infrastructure spending—isn’t sustainable, in our opinion. A renewed slowdown in China could weigh on commodity prices and emerging market assets in general. Additionally, the U.S. dollar could recover some of its strength if the U.S. Federal Reserve moves back to a more hawkish stance. Recent commentary from Fed officials and the minutes from the Fed’s April meeting raised the possibility of a rate hike in June, which would be sooner than markets were expecting.

All things considered, we believe investors should be careful chasing returns from potential political transitions around the globe. Instead, we suggest taking a globally diversified asset allocation approach to investing.

1Bloomberg, year-to-date through 5/12/2016.

2“World Economic Outlook,” International Monetary Fund, 4/2016.

Michelle Gibley is director of international research at the Schwab Center for Financial Research.