“The day is not far off when the economic problem will take the back seat where it belongs, and the arena of the heart and the head will be occupied or reoccupied, by our real problems — the problems of life and of human relations, of creation and behavior and religion.”

– John Maynard Keynes, First Annual Report of the Arts Council (1945-1946)

When Keynes expressed his thoughts in 1946, the world was beginning to recover from World War II and the Great Depression of the 1930s. As we cross the midpoint of 2016, the market is again staring into the dark, looking for a few sparks of global economic growth to light its path. In many ways, this is more than just a redux of the double-dip recession fears we waded through during 2010 and 2011.

We now have several things to add to the list of all that is scary, disruptive or dislodging, or the worst of all prognostications: boring and slow. China’s economy has noticeably slowed, and commodities have responded. Global interest rates have softened meaningfully, and the interest rate on the debt of some countries has converged towards zero or even negative levels. Great Britain is dealing with how to handle its porous borders by threatening to leave the European Union altogether. Domestically, rhetoric has increased about the new economy leaving the old economy in the dust – again (remember 1999?). The hope of higher interest rates becoming a tailwind to earnings for banks looks temporarily shattered, while lending activity remains tepid. Add the political season to the mix, and we’ve got quite a game right now.

Much of this has little or no direct relevancy to the fundamentals of the individual companies we own. Similar to other times of macroeconomic myopia, we view today’s version largely as an exhibition of noise, albeit at increased levels. In a market greatly affected by psychology, especially the fragile type, perception is indeed reality. And fragile psychology is exactly where we’re at today, if the votes tallied from individual investors who participate in investing clubs are any indication. Recent readings have given us the least bullish sentiment than any time over the prior 10 years, including the 2008/2009 economic Armageddon we lived through.

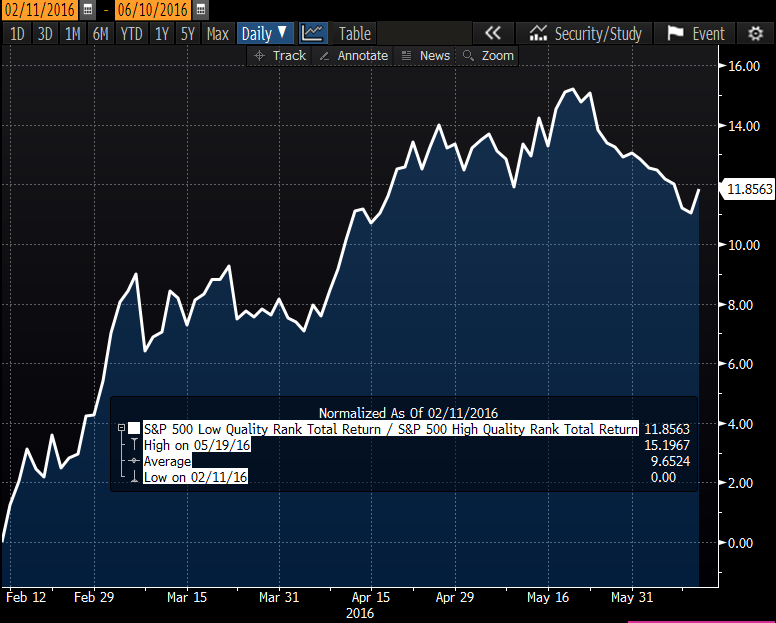

So where do you go if you want to make money in the stock market, yet approach it with a frangible psyche? You look for a trade and don’t invest at all. Instead, you look to buy something that may be beaten up in price, perhaps appears to have reached a capitulatory point, and take a position. What got beaten up the most as the market reached its yearly low on February 11th? It’s been cyclical, debt-laden companies that are generally low quality price-takers. These bottom of the barrel common stocks are exactly what has accounted for the market rebound through the second quarter. The chart below shows that low-quality has beaten high-quality by nearly 12% from the intra-year market low. Cyclical companies have beaten defensive stocks by more than 9% over that same period:1

We’re always on the hunt for companies that have a propensity to be multi-year compounders of wealth. To do that, we need to own them over long periods of time. This includes times like today, when the market has a fondness for betting on statistical probabilities rather than investing in high quality companies that generate attractive and consistent levels of profitability and cash flow.

We love the quote from John Maynard Keynes, reminding us that these periods of fixation on macroeconomic problems will pass. At a minimum, they will be replaced with new issues for obsession. But throughout these rotations, Keynes reminds us that the problem of life and human relations will persist! We have some more modern economic commentary that seems to nail this phenomenon on the head, credit to Ms. Spade and Ms. Derek:

“Playing dress-up begins at age five and never truly ends.” ―Kate Spade

“Whoever said that money can’t buy happiness, simply didn’t know where to go shopping.” ―Bo Derek

What Keynes was saying is that there are fundamental problems that are rudimentary to the human condition and give us a baseline. It’s like gravity. These “real problems” give a hint to where the mean reverts. We think it offers good insight into how to think of the consumer as well.

Consumer discretionary companies―and more specifically retail―have been one of the weakest spots in the portfolio this year. The entire retailing ecosystem has been upended on the heels of a weak Christmas season coupled with an unseasonably warm spring. The resulting inventory glut was met with discounting and clearance activity, while the next “must-have” items in fashion seemed elusive at best. Former plans to build out stores have been scrapped, and weak retailers such as Sports Authority, Aeropostale and Pacific Sunwear have filed or are planning to file for bankruptcy protection. Then there is the 800-lb gorilla scaring traditional retailers, as Amazon is extending its efforts in soft-goods and apparel. Amazon has created its own in-house clothing brands, and is buying flatbed trucks and airports to fulfill its orders. The Amazon affect into the psyche of the retail investor has become nearly monomaniacal.

In a recent meeting with Nordstrom management, we touched on some of these issues. While we are not dismissive of the Amazon factor, we believe the decibel level of this threat has increased partially due to timing. Jamie Nordstrom, President of Stores at Nordstrom, indicated that we are in a fashion dead-zone right now. We are past the zenith in popularity of skinny jeans, wrap dresses, the boot revolution, fashionable branded spandex, and Rolex-style watches for women. These aren’t going away, but many of these categories are in maintenance mode and not bringing new adopters.

Fashion cycles happen about every 7-8 years, and some cliffs are steeper than others. This particular cycle was more multi-pronged, and exacerbated by demographics vis-à-vis the Millennials getting into full stride. This has caused a huge void in fashion and style leadership. During transitions like this, it’s understandable why mall traffic would be down sharply over the last six months. If the weather didn’t do the job of keeping people away, the lack of need-to-have items simply didn’t mandate the trip.

We also know that there will be a ‘next thing’ in the world of fashion. This is a near certainty, and has never failed. It’s human. It’s a baseline that solves or alleviates some of the real problems that Keynes referenced. What no one knows is the when, and this is no small factor in what bothers the world of retailing today. Time will cure this problem, but what about the Amazon affect?

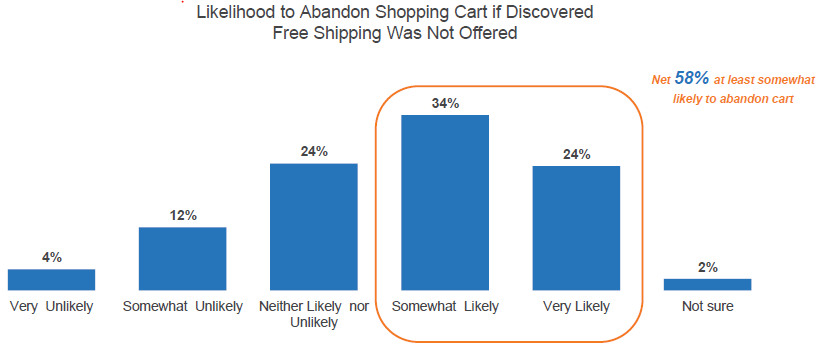

Amazon offers a wide assortment of attractive goods at competitive prices, but free shipping remains the most critical factor in deciding whether to shop online vs. going to the store. Amazon’s primary value proposition is free shipping, and convenience comes in second place by a fair margin. Its customers have taken full advantage of this, as its Prime-members represent ~60% of total merchandise sales, but only ~20% of the total customer base. We think they represent the least profitable customers since they eat up far more shipping costs with every click. More than half of retail shoppers rate free shipping as the most important consideration in deciding whether to shop online and when free shipping is not offered, there is a 58% chance that shopping carts are left abandoned.2

Retailers across the board have responded to the free shipping mandate. The percent of e-commerce sales that offered free shipping was 63% in Q1 2016 vs. just 48% in Q1 2013. FedEx and UPS have benefited from this by raising prices about 5% per year each of the last three years, and shipping costs were +44% for Amazon last quarter.

At Smead Capital Management, our criteria for stock selection require that companies meet an economic need, and maintain significant barriers to entry around its products and services. Convenience is a meaningful benefit, but when the primary offering is centered on fast and free shipping, you may have a weak moat! Amazon has moved the price of Prime membership +25% in late 2014, and imposed a whopping $299 annual fee for its grocery customers using AmazonFresh. We don’t yet know the AmazonFresh numbers, but anecdotal evidence suggests customers have responded with outrage, voting with their feet, and have happily rediscovered their local grocery stores. How quickly the perception of value erodes when it is built merely on price!

Retailing is a very difficult business, but its purpose is quite simple. When you watch someone walk into a local department store or specialty retailer, you can see their heads swivel around like a loose bar stool. As the executives at Nordstrom explained to us recently, they are seeking something they don’t know they need. They want to be led towards what to buy, and they will act when they see something they can’t live without. They want to be surprised, and they want to feel good about themselves. They want to play dress-up. They want to be reintroduced to newness and relevance. They also want to see what others are wearing, and perhaps obtain personal recommendations from experts in particular areas. This is extremely difficult to replicate in an online-only world, especially if price differentials converge. We believe traditional retailing has a permanent place in the world, and does a great job of meeting a persistent and particular human need.

Tony Scherrer is the director of research at Smead Capital Management.