The rise in the value of gold and other precious metals has been a boon to many client portfolios, but advisors would also be wise to consider the impact on their jewelry. If clients have not adjusted their insurance to account for the higher prices, they could be in for a surprise if their keepsakes are lost or stolen.

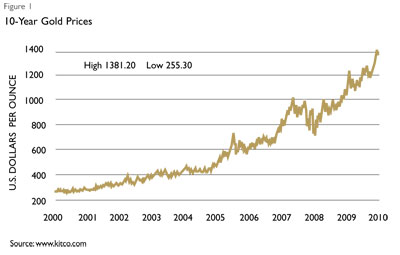

The rise in the value of precious metals and gems has been dramatic in recent years. Since September 2000, the price of gold has nearly quintupled. Kitco, a large precious metal retail and research firm, reports that gold has appreciated more than most other investments during the past ten years (See Figure 1).

Some experts warn of a price bubble-similar to the inflationary mania that impacted technology in the 1990s and residential real estate less than ten years later. But other experts say the price of gold has found a strong level of support near $1,200 per troy ounce and could continue to rise into 2014.

The upward trend has brought a corresponding increase in the prices of some other precious metals. Silver has almost matched gold's rise and the price of platinum has nearly tripled over the past decade.

While most gold investors know the price of gold on any given day, they and most other people may be unaware of how the price of gold and other precious metals affects the value of their jewelry and collectibles.

Roger Ponn, a 40-year veteran in the appraisal business, cites as an example the jewelry collection of a longtime client. In 2004, the collection was valued at $384,000. This year, its value had risen to $682,000, solely due to the price spikes in precious metals and diamonds over the past six years.

Another high-net-worth client family saw its 400-piece jewelry collection increase in value by 45% over two years, he says.

"Quite a few of the handmade pieces were of 22-karat and 24-karat gold, with 24-karat of course being pure gold," Ponn says. "Higher karat content means faster price appreciation when precious metal prices rise-it's similar to what occurs with gold bullion and gold coins, which appreciate at a more rapid pace than most gold jewelry simply because they are pure gold."

Ponn and other valuables appraisers have encouraged their clients to increase their insurance correspondingly, but industry statistics show that many clients have not followed this advice.

Of those owning a valuable collection, such as wine, fine art, jewelry or antiques, nearly half (47%) said they did not have special insurance coverage for their collections, according to a survey by Trusted Choice, a trade association for independent insurance agents.

This trend is borne out by other studies and independent appraisers.

"We have seen clients underinsured across all categories of valuable articles, including jewelry," says Gerald Escobar, principal of Asset Archives, a global appraisal firm based in Atlanta. "Historically, clients who do not proactively manage their valuable articles can be underinsured by up to 40 to 60%."

Reappraising Valuables

An updated inventory of valuables is critical if a loss occurs. Clients should keep photographs or videotapes of their collectibles in a bank safe deposit box and at home. An accurate inventory helps in determining exactly what was lost and in obtaining a quick and accurate claim settlement.

To ensure your clients know the precise worth of their precious metals valuables, an estimate by an independent appraiser is often worthwhile. A good appraiser will ensure that the valuables receive the documentation needed to satisfy insurance requirements to determine replacement value.

Appraisals need to be detailed, Ponn says. A description of a wedding ring that reads "2.15-carat diamond in a yellow gold setting" is not adequate for assessing retail or market value nor in determining how much it would cost to replace the ring.

Updating Insurance Coverage

Once clients have updated and documented their inventory, they should review their insurance policies to ensure their valuables have adequate coverage. For exceptional items that were scheduled on a valuables policy, the value stated in the policy should be updated to reflect the current replacement cost. Top insurance companies offer valuables policies with buffers against market value appreciation. A policy that provides extended replacement cost coverage pays the amount stated on

the policy plus, typically, an additional 20% to 25%. An exceptional policy pays 50% more.

The additional percentage is a cushion in case market appreciation causes the coverage to be too low at the time of loss. But for the buffer to be adequate, it is important to update the policy periodically. Some policies include an annual inflation adjustment, but when gold prices are quintupling every ten years, a 2% or 3% increase in coverage will likely not be enough.

Clients should also revisit items that were not valuable enough to schedule on a valuables policy when they were purchased. These items would be covered under a homeowners policy by default, but these policies typically limit the amount they will pay at the time of loss for certain valuables, including jewelry, silverware and money. The most common limit on jewelry is $1,500. Gold bars and coins are often classified as money, for which there is often a $200 limit. Superior homeowners insurance policies include higher sub-limits, such as $10,000 for jewelry, but these may still be inadequate if your client purchased a gold bracelet for $4,000 ten years ago and it has appreciated to $16,000.

Some insurance companies also allow groups of similar items, such as wine or art collections, to be covered on a "blanket" basis. With this approach, the client sets a coverage amount for the entire collection and doesn't need to estimate the value of each item, which makes the overall policy easier to manage. Valuables coverage also has the advantage of having no deductible.

While your clients might need to increase coverage for their jewelry and other valuables, they can manage the cost of insurance by changing storage locations. It can be five to six times cheaper to insure jewelry stored in a bank safety deposit box rather than at home. Clients should consider keeping jewelry they wear infrequently at a bank. They can still use the items as needed by notifying their carrier or agent, but usually only on a limited basis.

Finally, once your clients have updated their valuables coverage, they should consider having their jewelry and other items appraised every three to five years. Some insurance companies require recent appraisals of the items prior to insuring the valuables.

John Paolini is senior vice president and chief operating officer of ACE Private Risk Services, the high-net-worth personal lines business of ACE Group of Companies insurance group.