The rise of populist movements may be one more factor to keep economic uncertainty high and investors on edge. Investors may exact a premium for such uncertainty. In addition to greater volatility (which has become more frequent over the past year), stock valuations (measured by price-to-earnings ratios) may remain in check and not rise as high. Investors may push up stock prices only so high given the uncertainty. In the bond market, lower bond yields reflect a premium on safety. Ultimately, the pace of the economy and financial shape of corporate America will have a greater impact on financial market returns but policy uncertainty could limit investment returns. The climate of shifting voter sentiments is unlikely to fade completely and may keep investors guessing as to the impact of policy change. Brexit is a good example of how a policy change has led to renewed volatility in financial markets.

A SWING BACK TO THE CENTER

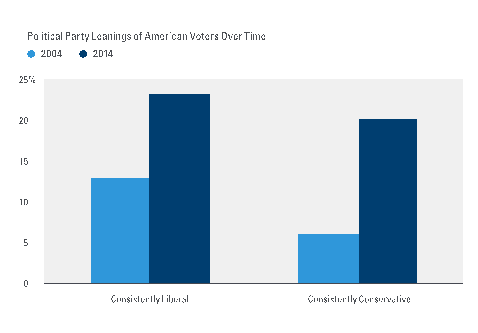

Increasing populist sentiment could drive political views and policy back toward the center after more than a decade of rising polarization [Figure 4]. At the extreme, a change to America’s political composition could develop over the long term. No group has emerged as a significant threat to either Democrats or Republicans, but Trump has shaken up the Republican Party and shown affiliation to both parties over the years. Trump’s proposed tax plans include a reduction in taxes but also the repeal of corporate tax breaks — ideas that span both parties’ ideologies. Conditions may be ripe for a third party, perhaps more centrist, to emerge and fill the gap left by both Democrats and Republicans.

CONCLUSION

Voter angst and frustration are driving populist sentiment globally, but history is full of such movements failing to win national elections or have a lasting impact. Recent events in Europe support this theme even after the Brexit vote results and Spanish elections. Domestically, the undercurrents of these populist movements, no matter who wins the White House in November, are likely to remain and have broader implications, including an increased probability of new fiscal policy, greater investing risk premiums, and a move to more centrist politics and policy.

Anthony Valeri is fixed-income and investment strategist for LPL Financial.