Economists are famous for pronouncing gloomily that “there’s no such thing as a free lunch.” Yet finance theory does offer a free lunch: the reduction in risk that is obtainable through diversification. An investor who spreads her wealth among many investments can reduce the volatility of her portfolio, provided only that the underlying investments are imperfectly correlated. There need be no reduction in average return and thus no bill for the lunch.

— John Y. Campbell, Diversification: A Bigger Free Lunch

If diversification has the potential to improve the risk and return of a portfolio (a supposed “free lunch” to investors) then perhaps the recent track record of rebalancing for improving returns and reducing risk may seem like a “free snack.”

Diversification is a valuable tool for managing risk in a portfolio. A portfolio that holds assets that do not perform similarly should experience less overall volatility over time. But maintaining the proper allocation of a client’s portfolio through rebalancing is also an important step to manage risk.

If you and your client determine that a basic portfolio made up of 50 percent stocks and 50 percent bonds is right for them, then you’ll want to keep it that way, and that’s where rebalancing comes in.

Each of the asset classes in a portfolio reacts differently to market and economic environments and generates dissimilar returns. While dissimilar returns provide the benefit of diversification, they can also cause the asset allocation of the portfolio to “drift” away from its target. And since riskier asset classes are generally expected to earn greater returns over time, they will gradually assume a greater weight in the portfolio, thus increasing the risk of the overall portfolio.

Without rebalancing, the original 50/50 investment portfolio over time can turn into a 70% stocks and 30% bonds mix.

We’ve all heard the investing adage that we should “buy low, sell high.” This is exactly what rebalancing attempts to accomplish, by taking money from assets that have performed well and reinvesting in assets that haven’t. Rebalancing systematically trims the highest-returning asset classes, restoring the portfolio to its target allocation.

And better yet, it is historically shown that investors are also likely to see better returns over time by rebalancing a portfolio.

According to research by Fernholz & Shay (1982), investors are likely to see better performance over time by rebalancing a portfolio because managing portfolio volatility should have a positive impact on long-term portfolio growth1. Of course, past performance is no guarantee of future results.

Rebalancing does not increase portfolio returns over every time period because the returns are highly dependent on the prevailing market environment and cycles during the investment time period measured.

But the good news is that rebalancing did provide many investors with a “free snack” during the turbulent market environment surrounding the financial crisis and the debt crisis that followed — a time when investors could really use a little extra return from their portfolios.

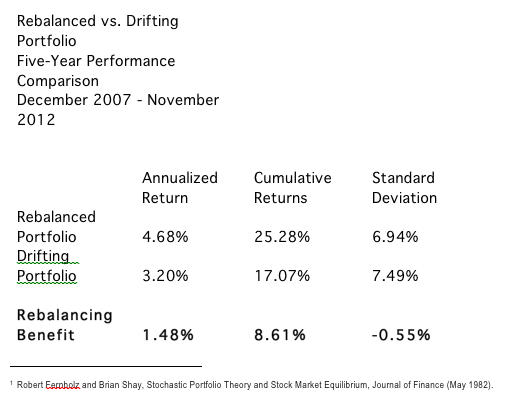

For the five-year period from December 2007 through November 2012, a portfolio with 50 percent in stocks and 50 percent in bonds that was rebalanced annually to its target allocation would have earned an almost 1.5 percent greater annualized return than the same portfolio that was not rebalanced at all during the five-year period.

This equates to 8.6 percent more cumulative growth over the five-year period. And the best part is that the rebalanced portfolio delivered greater returns with lower overall volatility, as measured by standard deviation.

(Source: Dimensional Returns 2.0 (December 2012) Portfolio consists of 50% stocks as represented by the S&P 500 Index and 50% bonds as represented by Five-Year Treasury Notes. The Rebalanced Portfolio is rebalanced back to target weights on an annual basis on January 1, whereas the Drifting Portfolio is not rebalanced for the entire investment period. The inception date of the portfolio is January 2003, and the standard deviation is measured from this date. Past performance is no guarantee of future results. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index. Performance shown includes reinvestment of dividends and other earnings but does not reflect the deduction of advisory fees, transaction costs or the taxes associated with trading the portfolios. The buying and selling of securities for the purpose of rebalancing may have adverse tax consequences.)

Again, rebalancing does not guarantee greater returns over every period, and often the return enhancement will be lower over longer periods measured. For example, if we examine the 20-year period beginning January 1993 through November of 2012, the return enhancement for a rebalanced portfolio was only 0.4% on an annualized basis; however, the rebalanced portfolio enjoyed much lower volatility with a standard deviation of 7.51 as compared to 9.09 for a portfolio which was not rebalanced.

The five-year period was selected in this analysis to represent the financial and debt crisis period which we believe is notable because it was a particularly trying and emotional time for investors. Many investors would have been reluctant to sell bonds and buy stocks during this period.

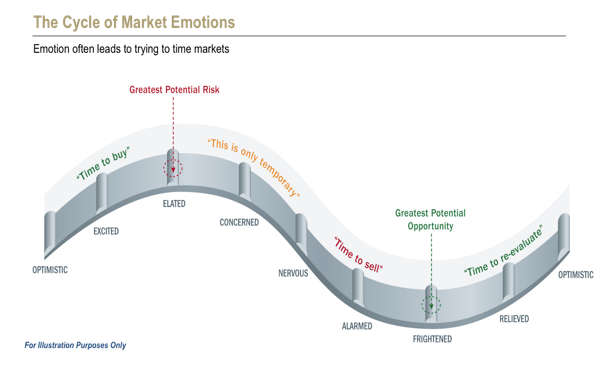

Unfortunately, rebalancing may seem counterproductive to some investors. Why sell a portion of a high-performing asset to acquire a larger share of a low-performing asset? Intuition might suggest that selling previous winners may hinder returns in the future. As the chart below illustrates, when the stock market is going up, emotionally we tend to believe it will continue to go up and we’re driven by the desire to buy. When it goes down, we’re afraid it will continue to decline, and our fear may make us want to sell.

In the end, it’s not peaks and valleys that really matter, but the growth of wealth over an investor’s time horizon. And historical data demonstrates that investors are likely to see better performance over time by rebalancing a portfolio than they would by leaving the portfolio unattended.

So remember, once you have established an investment portfolio that suits your client’s unique financial situation and risk tolerance, rebalancing helps to ensure that their portfolio stays on track with their risk profile and stays true to their long-term plan for achieving their financial goals.

Joni Clark is chief investment officer at Loring Ward, a Silicon Valley-based firm that provides investment and business management and practice development to independent financial advisors and their clients.