We assess the consumer and regions around the world that may benefit if oil prices remain low in part 2 of our series, “Potential Winners of Low Oil.” Sectors, industries, and even countries adversely impacted from the sharp drop in oil prices since mid-2014 are easy to spot, and their struggles have made headlines for more than a year. However, identifying potential winners from a prolonged period of low oil prices is more difficult to assess. Still, consumers, specific regions, and countries may benefit from these low prices.

Prior to the drop in oil prices that began in late 2014,[1] the average household spent almost 4% of its total income, roughly $2,500, on gasoline each year. This number does not include natural gas or heating oil expenses, where lower prices may translate into additional cost savings.

Based on a more than 50% drop in the price of gasoline (from $3.70 per gallon in mid-2014 to $1.74 in February 2016), the average household is now saving approximately $1,200 per year, or an additional $100 per month in disposable income. Lower oil prices are putting money in consumers’ pockets.

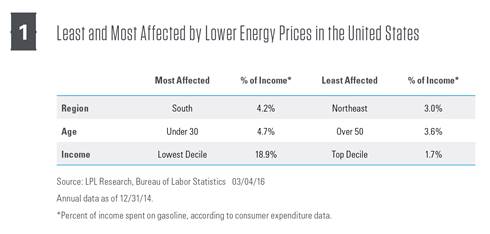

Digging deeper into consumer expenditure (CE) data reveals how consumers from different regions, age groups, and income levels may benefit from lower energy prices. Although 2015 data have yet to be released, expenditure data change slowly; therefore, the trends highlighted in Figure 1 are roughly stable.

REGIONAL, DEMOGRAPHIC, AND INCOME FACTORS: SOUTH A BIG BENEFICIARY

On a regional basis, consumers in the South may benefit most. Southern consumers tend to spend a larger share of income on gasoline. At the opposite end of the spectrum is the Northeast, where public transportation is more common and consumers spend less on gas.

The regional differences are also supported by income trends. A greater percentage of lower-income households reside in the South versus the Northeast, which tends to have higher average incomes. To some degree, average incomes reflect cost of living differences; however, both regional characteristics and income levels suggest consumers in the South are more likely to benefit from lower oil prices.

Unsurprisingly, the lower-income consumers spend a much higher percentage of their income on energy and are obvious winners of low oil on Main Street. For higher-income earners, energy savings are less impactful.

Age also plays a role, with the youngest group surveyed (those below 30 years old) spending a higher percentage of income on gasoline; the over 50 group spends the least, although these data are also impacted by older consumers’ generally higher incomes.

HOUSING, FOOD AND AUTO SPENDING RISE ALONG WITH INCOMES

CE data also reveal what consumers from varying income groups are buying. Increased cost savings from lower energy prices might lead to an increase of spending in these other areas, highlighting potential beneficiaries.

Housing is a common area of increased spending among both low- and high-income consumers. Looking exclusively at the amount of money saved from low oil prices, this factor on its own isn’t likely to push consumers into the purchase of a larger home; however, home improvement retailers and home furnishings stores are potential beneficiaries.

Both low- and high-income consumers also tend to increase spending for food as they move up the income ladder, specifically healthier options such as fresh fruits and vegetables. Higher-income consumers also spend more on dining out, a potential boon for the restaurant industry. Both also spend more on lodging, indicating travel-related industries may stand to benefit.

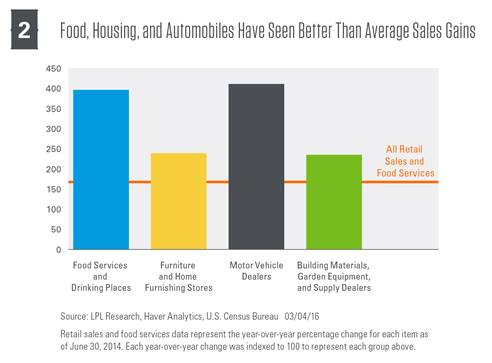

Retail sales data show building materials, home furnishings, and restaurants generated consistently higher than the average level of retail sales, confirming the trends of higher spending for housing-related items and dining out data. Another area that shows strength over the past few years is motor vehicles, implying the auto industry may also be a beneficiary [Figure 2].

COUNTRIES: HEAVY IMPORTERS BENEFIT

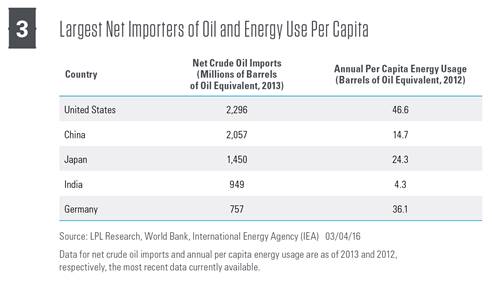

Nations that are heavy importers of oil, rather than producers, are likely to benefit from low prices over time, whereas exporters are more likely to be negatively impacted. Figure 3 shows the five largest importers of oil, along with energy use per capita, which may help us determine how energy usage will change as a country develops.

China and the United States are the two largest importers of oil and stand to benefit, but macroeconomic factors cloud the outlook. Chinese oil demand is down due to a domestic slowdown, and economic risks continue to overshadow potential benefits as broad growth concerns remain at the forefront. In the U.S., growth of the shale oil boom and broader energy industry in recent years remains on watch for spillover effects to the rest of the economy. Rather than a macro tailwind, low oil prices may have a more targeted beneficial impact, such as on consumers, in the current environment.

Japan and India are also large oil importers and stand out as potential beneficiaries. Interestingly, these two countries are also on very different trajectories. India, with approximately 1.3 billion people, is second only to China (1.35 billion) in population, though India’s population is growing faster, with a growth rate in 2014 of 1.2%, versus 0.5% for China.[2] Although India is the fourth largest user of energy and importer of oil, per capita energy use is very low, with India’s per capita use approximately one-tenth that of the U.S. and less than one-third that of China. Approximately 22% of India’s energy consumption was from oil,[3] but an equal percentage came from traditional biomass (such as burning wood, charcoal, or agricultural residue for cooking or heating), as nearly 20% of the population lacks access to electricity.[4]

India’s economic growth has been strong in recent years. In 2015, India—with an official gross domestic product (GDP) growth rate of 7.5%—actually surpassed China’s 6.9% growth, making it the world’s fastest growing economy for the year. As India’s infrastructure develops (electric and transportation), energy use per capita is likely to rise. In other words, although India is already a big beneficiary now, it could see even more positive effects in the future, and continue to reap the benefits should oil prices remain low.

Japan, though it has a much smaller population (approximately 127 million), is more developed; energy usage per capita is about six times higher than India, though still about half that of the U.S. However, Japan, given its shrinking population and slower economic growth, isn’t likely to see energy consumption increase as quickly in the future. On a relative basis, Japan has a higher dependency on petroleum, with approximately 44% of total energy usage coming from petroleum products,[5] meaning the per capita impact of lower oil prices will be much higher in Japan in the near term. Combined with fiscal and monetary stimulus, the Japanese economy may benefit from this additional support.

Japan also stands out in another area—it imports nearly all of the energy it consumes. The U.S. and China imported 16% and 13%, respectively, of their total energy needs in 2012. However, Japan imported 94%, and another Asian country, Singapore, imported 98%. While Singapore may not make the top 10 oil importers on an absolute basis, its position as the 13th largest importer of oil versus its status as the 36th largest economy in the world shows that it is likely to feel a stronger benefit from low oil prices on a relative basis.

CONCLUSION

Outside of a significant surprise, such as cut in supply from OPEC or a pickup in economic growth that leads to additional demand, low oil prices may linger in the near term. Additionally, long-term factors, such as increased conservation and alternative energy, may keep oil prices low relative to recent years, which may mean that $100 oil, not the current price, will be considered the anomaly in the future. This would be a headwind for the energy industry and oil-exporting countries; however, consumers overall are benefiting from lower prices, as are the sectors and industries of the market more exposed to increasing consumer disposable income. Large oil-importing countries, including India and Japan, may also benefit from the tailwind of lower oil prices for longer.

[1] According to the annual consumer expenditure survey from the Bureau of Labor Statistics (BLS).

[2] According to World Bank data.

[3] According to Energy Information Administration (EIA) data.

[4] According to World Bank data.

[5] According to EIA data.

Anthony Valeri is investment strategist for LPL Financial.