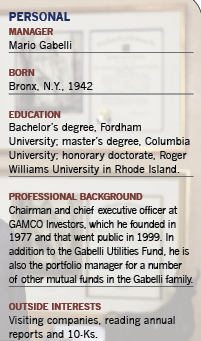

In the midst of the dot-com boom in 1999, there weren't many investment management firms coming out with utility stock funds. Then again, not too many investment managers think like noted value stock enthusiast Mario Gabelli.

The longtime money manager and founder of GAMCO Investors in Rye, N.Y., got the idea to start such a fund from one of his analysts, who saw a time in the not-too-distant future when investors would want a lower-risk value fund that would thrive in a low-inflation, slow-growth economic environment.

Since the launch of the Gabelli Utilities Fund 12 years ago, such economic conditions have come and gone more than once, and the stocks of electric, gas, water and other utilities have rotated in and out of favor. Right now, they are definitely going through the former phase.

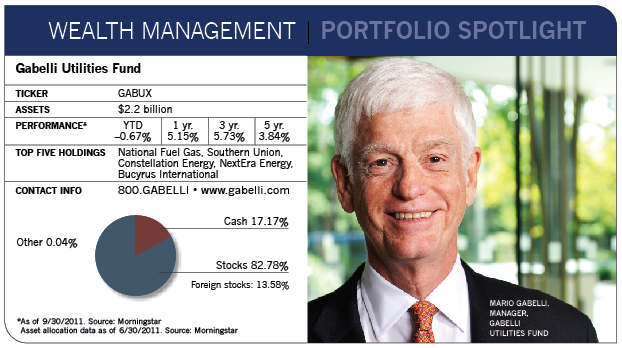

After trailing the stock market in 2009 and 2010, utilities have emerged as the leading sector so far this year, and Gabelli believes they're on track to produce competitive returns in 2012 and beyond. "Utility stocks have the potential to produce solid, low-risk total returns over the next few years," says Gabelli, the 69-year-old lead manager of this fund, as well as several others that bear his name. "From the financial advisor's point of view, they're a lower-risk way to achieve incremental returns and be a 'Steady Eddie' part of a portfolio."

Recently, utilities have displayed their classic ability to hold their ground and even prosper during tough times. During the first eight months of the year, the Standard & Poor's 500 index fell 3%, while its utilities component rose 7.3%. In August, the sector inched up 1.7% as the index fell nearly 6%.

One obvious draw here is the sector's dividend yields, which are north of 4% and look attractive next to rates below 2.5% for ten-year Treasury securities. With a weak economic environment and wobbly stock market, utility stocks' low volatility, stable earnings and other defensive characteristics stand out. The extension of the favorable 15% tax rate on stock dividends through 2012, as well as favorable legislation allowing for a 100% tax deduction for certain capital investments, also adds to their appeal.

The federal government recently projected GDP growth of 1.7% this year, down from 2.7% back in February, an indication that the economy is likely to continue limping along for a while-an environment where "flight to safety" investments, such as utilities, tend to shine.

But the appeal of both utility stocks and the fund could fade fairly quickly if the economy picks up steam and the stock market gets bullish again, at which point utilities' plodding stability would look less attractive to investors than the rapid growth elsewhere. That happened in 2009 and 2010. Utility stocks rose only 21% in those two years, while the S&P 500 leapt 51%.

Rising interest rates, which would prompt income-seeking investors to abandon stocks for higher-yielding bonds, could also end the party fairly quickly.

And in a decisive market rout, even utilities don't always provide shelter. During the market crash in late 2008, they fell nearly as much as the overall market.

The industry itself also faces challenges, including the need to raise capital for infrastructure projects to expand environmental control equipment, transmission lines and renewable generation. Industry estimates project spending of approximately $80 billion a year over the next few years on such projects, about double the amount spent in 2004.