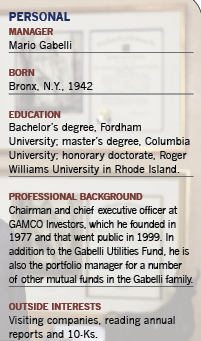

In the midst of the dot-com boom in 1999, there weren't many investment management firms coming out with utility stock funds. Then again, not too many investment managers think like noted value stock enthusiast Mario Gabelli.

The longtime money manager and founder of GAMCO Investors in Rye, N.Y., got the idea to start such a fund from one of his analysts, who saw a time in the not-too-distant future when investors would want a lower-risk value fund that would thrive in a low-inflation, slow-growth economic environment.

Since the launch of the Gabelli Utilities Fund 12 years ago, such economic conditions have come and gone more than once, and the stocks of electric, gas, water and other utilities have rotated in and out of favor. Right now, they are definitely going through the former phase.

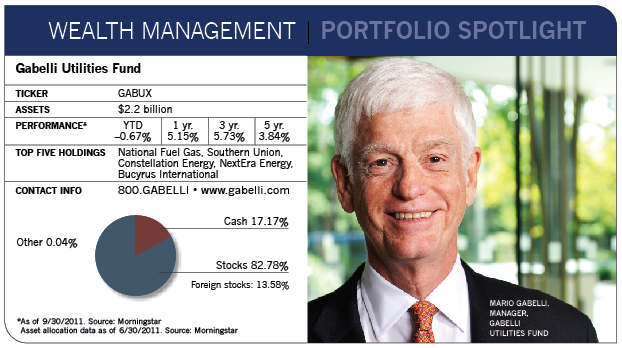

After trailing the stock market in 2009 and 2010, utilities have emerged as the leading sector so far this year, and Gabelli believes they're on track to produce competitive returns in 2012 and beyond. "Utility stocks have the potential to produce solid, low-risk total returns over the next few years," says Gabelli, the 69-year-old lead manager of this fund, as well as several others that bear his name. "From the financial advisor's point of view, they're a lower-risk way to achieve incremental returns and be a 'Steady Eddie' part of a portfolio."

Recently, utilities have displayed their classic ability to hold their ground and even prosper during tough times. During the first eight months of the year, the Standard & Poor's 500 index fell 3%, while its utilities component rose 7.3%. In August, the sector inched up 1.7% as the index fell nearly 6%.

One obvious draw here is the sector's dividend yields, which are north of 4% and look attractive next to rates below 2.5% for ten-year Treasury securities. With a weak economic environment and wobbly stock market, utility stocks' low volatility, stable earnings and other defensive characteristics stand out. The extension of the favorable 15% tax rate on stock dividends through 2012, as well as favorable legislation allowing for a 100% tax deduction for certain capital investments, also adds to their appeal.

The federal government recently projected GDP growth of 1.7% this year, down from 2.7% back in February, an indication that the economy is likely to continue limping along for a while-an environment where "flight to safety" investments, such as utilities, tend to shine.

But the appeal of both utility stocks and the fund could fade fairly quickly if the economy picks up steam and the stock market gets bullish again, at which point utilities' plodding stability would look less attractive to investors than the rapid growth elsewhere. That happened in 2009 and 2010. Utility stocks rose only 21% in those two years, while the S&P 500 leapt 51%.

Rising interest rates, which would prompt income-seeking investors to abandon stocks for higher-yielding bonds, could also end the party fairly quickly.

And in a decisive market rout, even utilities don't always provide shelter. During the market crash in late 2008, they fell nearly as much as the overall market.

The industry itself also faces challenges, including the need to raise capital for infrastructure projects to expand environmental control equipment, transmission lines and renewable generation. Industry estimates project spending of approximately $80 billion a year over the next few years on such projects, about double the amount spent in 2004.

Despite these issues, Gabelli and his firm's longtime utility analyst Tim Winter cite a number of other reasons why the group's solid run since the beginning of the year should continue.

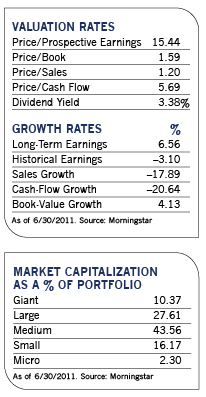

Reasonable stock prices. Based on estimated 2012 earnings and their attractiveness to investors in a slow-growth, low-interest-rate environment, Winter believes the stocks are "reasonably priced, if not undervalued." Currently, the group is trading at around 14.5 times 2012 earnings estimates, slightly higher than the midpoint of its historic range of 10 times to 17 times forward earnings over the last 20 years. He admits that while higher interest rates pose a threat, the market has already factored that possibility into stock prices.

The potential for modest earnings growth. Unusually hot weather, recovering industrial sales, and cost-control efforts helped utilities post unusually strong earnings growth of 8.7% in 2010.

Winter sees more modest but stable annual growth at around 4% to 6% over the next several years. "As the economy continues to recover slowly, earnings growth should be modestly higher than both GDP growth and the retail electric demand growth rate," he says.

The capacity to maintain or increase dividends. In 2010, electric, water and gas utilities raised their annual dividend rates by 4%, 3.8% and 2.8%, respectively.

"Current dividend payouts are approximately 60% of forecast earnings for 2011, which provides a comfortable margin for dividend maintenance and growth," says Gabelli. "Over the next several years, investors can expect dividend growth above recent inflation rates."

The ability to raise rates and access capital. Despite the recession, utilities have been able to raise their rates to keep pace with inflation, and federal and state authorities are likely to allow them to continue doing so to help offset the cost of investment in generation and transmission facilities. With their healthy balance sheets, solid credit ratings and rapid depreciation schedules, they shouldn't have much trouble tapping the capital markets to raise money, says Winter.

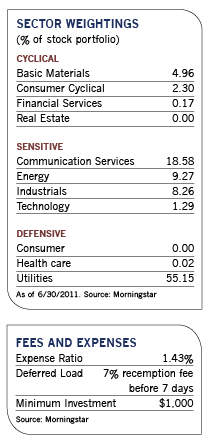

The increased use of cheap natural gas. Coal-fired generation produces roughly 45% of U.S. electricity, while natural gas generates 25%; nuclear 20%; and hydro, wind and solar approximately 10%. But the public's concern about the pollution of coal-burning plants and its wariness of nuclear power mean that facilities utilizing natural gas, a cheap fuel source over the last several years, will likely represent the majority of new building projects.

Merger and acquisition activity. Consolidation has emerged as an investment theme over the last couple of years as smaller utilities experience increased pressure to deliver cleaner energy at cheaper prices. Gabelli believes that trend will continue as utilities seek to increase scale or enter new markets. "The small companies, as well as some larger ones, are selling out at premium prices as the cost of staying in the game rises," he says. "And as policy makers understand the new economic dynamics of the industry, the lengthy merger review and approval process appears to be easing."

Even with 90 completed utility mergers and acquisitions since 1993, there are still about 60 electric utilities and 30 gas utilities. "From the standpoint of economic efficiency, that's about 50 more than we need," notes Gabelli.

A major fund focus for several years has been financially stable, reasonably priced small-cap and midcap utilities that are likely acquisition targets for larger utilities. Some of its best performers so far this year have been acquisition targets such as Constellation Energy and Central Vermont Power Service.

Gabelli and Winter look for utilities with locations in favorable regulatory environments and generation facilities that produce lower carbon footprints. They also like utilities with pending transmission line developments, which will help improve efficiency and increase capacity, as well as natural gas pipeline and storage operators that can take advantage of the growing demand for natural gas.

The strategy has helped Gabelli Utilities deliver better performance with less volatility over the long term than most other utility sector mutual funds and indexed ETFs. The most popular of these, the Utilities Sector SPDR (XLU), saw annualized returns of 0.53% over the last three years, 2.9% over the last five years and 4.9% over the last ten years ended August 31 while the Gabelli Utilities fund saw growth of 4.4%, 4.3% and 6.6% in those periods. While the mutual fund sank 21% during 2008's stock market rout, it still held up better than the ETF, which saw a 29% decline.

Fund holdings with favorable earnings prospects include El Paso Electric, which serves some 378,000 customers in and around El Paso, Texas and Las Cruces, N.M. The company is experiencing a strong growth in its customer base and should benefit from the expansion of a nearby military base by 2012.

Gabelli also likes Central Hudson Gas & Electric, which operates in the Poughkeepsie, N.Y., area. He believes the company, which raises its dividends regularly and has been actively buying back its stock, stands to benefit if drilling opens up at the Marcellus Shale, an expansive natural gas source that spreads through New York and several other northeastern states. (He notes for the sake of disclosure that the firm's institutional clients and its mutual funds own about 10% of the utility's stock.)

Another fund holding, Great Plains Energy, is a midsize utility serving eastern Kansas and western Missouri. It recently received permission to raise rates from state regulators after completing construction of a clean coal plant and making significant investments in other environmental equipment. Over the long term, its strategic location in the wind-rich Midwest will provide the opportunity to take advantage of wind generation.