The universe of municipal securities is vast, from general-obligation (GO) bonds backed by the full taxing power of a state, county or city, to revenue bonds funded via toll-road project payments, to everything in between. Municipal issuers are not limited to the states but also include U.S. territories such as Puerto Rico, Guam and the U.S. Virgin Islands. Puerto Rico’s high-profile fiscal struggle has been in the financial media lately. Much less well-known and reported upon are the municipal securities of the U.S. Virgin Islands and Guam. Here, we move beyond Puerto Rico and focus on all three.

Those who are familiar with Thornburg’s 30-year history as a municipal bond manager know we pride ourselves on in-depth credit research. Our view is that shareholders deserve the deepest and broadest possible credit research effort to mitigate any potential threats to net asset values. The company was founded on that principle in 1982 and we hold fast to it today.

An outline of our credit analysis of the U.S. territories of Puerto Rico, Guam and the U.S. Virgin Islands follows. We conclude with a review of the role these bonds play -- or do not play -- in the Thornburg municipal portfolios.

What Makes Territory Debt Different?

Investing in Puerto Rico, Guam or U.S. Virgin Islands debt entails both opportunity and risk. From our perspective as portfolio managers, the distinguishing factor of territory debt versus mainland debt is the extent and nature of the tax exemption extended to the purchaser. Interest on these bonds is “triple-tax-exempt,” which means it is excluded from federal, state, and local taxation, regardless of the investor’s state of residency. This provides a significant benefit to municipal bond portfolio managers and to investors. State-specific municipal funds, such as the Thornburg California Limited Term Municipal Fund, can benefit from the additional yield and diversifying credit exposure while maintaining a tax-neutral position. National municipal funds can benefit too. “Territory bonds,” as we call them, can produce this diversifying and yield-enhancing effect, but can also introduce an element of volatility, making the task of structuring a robust, diversified overall portfolio more critical to investment success.

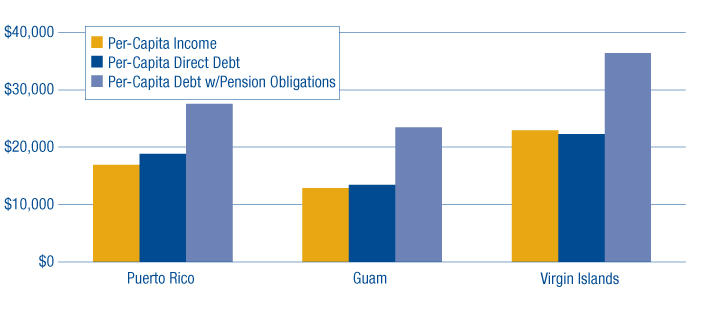

When considering U.S. territory debt for inclusion in a portfolio, it is important that we clearly understand the risks these securities pose. The benefits are somewhat obvious, in that territory bonds offer higher yields relative to comparable mainland credits. But it is important to think of yield as compensation for risk (or even as a measure of risk) and in this case, that yield is payment for structural budget deficits, chronic deficit financing, elevated government payrolls, high energy costs and non-diversified economies. These things contribute to -- and are reflective of -- lower per capita incomes, higher debt per capita and more limited economic growth opportunities than in the mainland United States. Per capita income, direct debt and debt including pension obligations are shown in Chart 1.

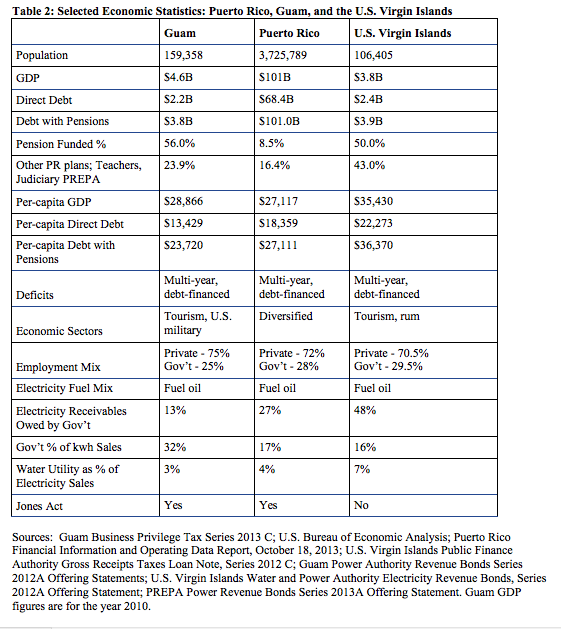

Selected summary economic statistics for each of the three territories are shown in Table 2.

Chronic Deficit Spending: The Common Thread

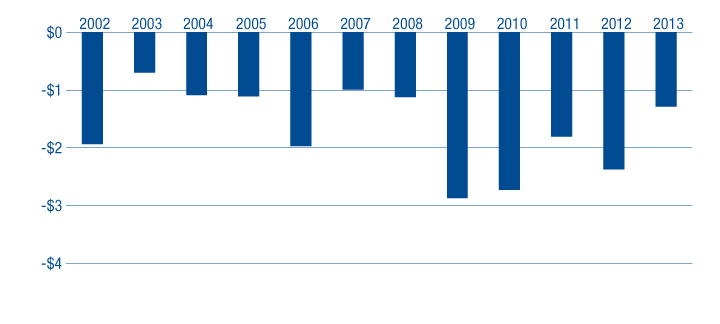

All three territories have a history of structural budget deficits and of financing the deficits via debt issuance. The deficits have led to higher and higher debt levels and diminishing revenue streams for securitization. In Puerto Rico’s case, as general-obligation debt has become harder and harder to issue during the fiscal decline, it has given way to sales-tax debt as the preferred mechanism of monetizing future dollars for today’s operating expenses. Sales-tax-backed Corporación del Fondo de Interés Apremiante (COFINA) debt outstanding has climbed from zero in 2006 to over $15 billion in 2013. Puerto Rico has run budget deficits in each of the last 12 years (depicted in Chart 2) as public-sector debt rose from $30 billion in 2002 to $70 billion in 2013.

The U.S. Virgin Islands have followed a similar pattern to that of Puerto Rico, with deficits in each of the last six years financed by gross-receipts and excise-tax bonds. Guam has chosen to finance its multiyear deficits by leveraging its sales-tax base. In that island’s case, debt issuance was necessitated by the accumulation of unpaid tax refunds. The central government simply withheld tax refunds over multiple fiscal years to meet its general-fund imbalances. This led to a large accumulated net-asset deficit, which was erased in 2012 with a $343 million bond issuance. The issuance financed $200 million in unpaid tax refunds and applied $100 million to tax-year 2011 refunds. Going forward, as a result of a suit brought against the central government of Guam, all refunds for taxes appropriately filed must be paid within six months. This eliminates a reliable source of funding, and the onus is again on the government to prudently manage revenues and expenses.

Heavy U.S. Federal Government Involvement

What drives this recurring shortfall between revenues and expenses, and how has it perpetuated itself over a multiyear period? Each of the territories has different economic drivers, but the principal player in each is indisputably the U.S. federal government. From transfer payments and direct investment, to tax policy and capital markets access, the federal government affects the economics of each island disproportionately.

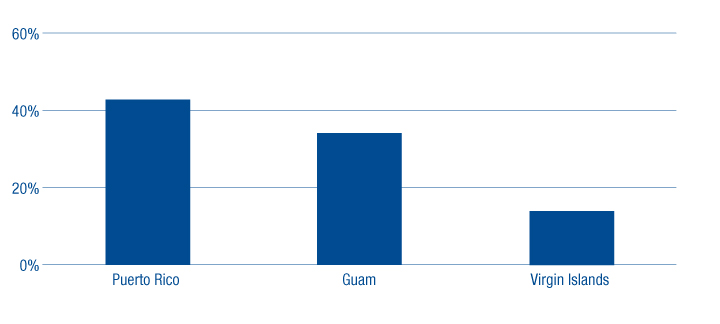

Direct U.S. federal transfers (direct dollar transfers of one form or another from the federal government) account for 43% of Puerto Rico’s governmental revenues, 34% of Guam’s and 14% of the U.S. Virgin Islands’, as depicted in Chart 3.

Public-Sector Employment and Pension-Funding Levels

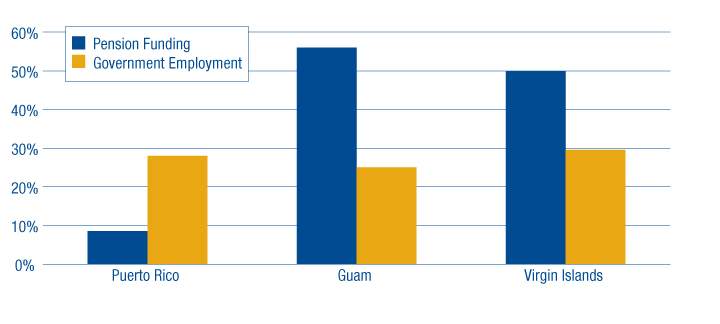

Public-sector employment accounts for 28% of Puerto Rico’s labor base, 25% of Guam’s, and 30% of the U.S. Virgin Islands’, versus just 15% on the U.S. mainland. This is illustrated in Chart 4, which also includes pension-funding levels. High public-sector employment levels increase not only current operating expenses but, more importantly, they create outsized pension- and health-benefit liabilities.

Puerto Rico’s Employment Retirement System (ERS), for example, is funded at 8.5%, an extremely poor level (the U.S. median pension funded status is 68.6%) that implies near-term insolvency. Actions taken to rectify this situation culminated in the passage of Act 3, a major pension reform bill passed on July 1, 2013. Prior to passage, it was anticipated that gross assets would be depleted by 2019. With Act 3 (pension-reform legislation that among other things increased the retirement age, reduced benefits, froze the current ERS plan and moved participants to a hybrid-defined contribution plan) and Act 32 (additional annual contributions from the participating employers), the annual funding shortfall decreased from $905 million to $524 million in 2014 and will fall to $325 million by 2018. While this is a step in the right direction, the funding shortfall continues, albeit at a slower rate. By contrast, Guam and the U.S. Virgin Islands are veritable guardians of fiduciary responsibility, with funded levels of 56% and 50%, respectively. Chart 4 portrays pension funding levels and levels of government employment for each of the three territories.

Economic Effects of Federal Tax Policy

Federal tax policy is pivotal to the economies of both the U.S. Virgin Islands and Puerto Rico. The U.S. Virgin Islands issue excise-tax bonds -- backed by federal excise taxes paid per gallon of rum shipped to the U.S. The tax allows the U.S. Virgin Islands to attract rum producers such as Cruzan and Diageo to the islands. The benefits extend beyond the ability to “bond out” the revenue stream, but also to direct employment on the island and contributions to the gross-receipts tax base.

Puerto Rico was by far the largest beneficiary of tax policy, with the passage of Section 936 of the IRS tax code, passed in 1976. It gave incentive to U.S. corporations to increase their manufacturing presence on the island, in return for a 100% federal tax credit on repatriated profits generated by those investments. This was taken to heart, especially by the pharmaceutical industry. With the sunset of Section 936 in 2006, direct manufacturing jobs in Puerto Rico declined from 160,000 to 78,000. The pharmaceutical sector alone shed 6,075 (or 24%) of its jobs between 2009 and 2013.

This employment loss is a function not only of the sunsetting of Section 936 but also of improved productivity (which has the effect of lowering employment levels) through capital investment and the concurrent creation of controlled foreign corporations (CFCs). The CFC construct allowed corporations to avoid paying federal income taxes until profit repatriation occurred. In an effort to compensate for the change in federal taxation, the central government of Puerto Rico passed Act 154, which unilaterally imposed an excise tax on foreign corporations operating on the island. Given that manufacturing accounts for 46% of Puerto Rico’s gross domestic product (GDP), it is arguable that this was not the best course of action.

However, closer examination of the mechanics behind Act 154 indicate it may be better seen as an indirect transfer from the U.S. Treasury to Puerto Rico. Martin A. Sullivan states in “Economic Analysis: The Treasury Bailout of Puerto Rico” that “as a policy matter, because it is likely that the U.S. government is merely providing a subsidy to a foreign government rather than relieving U.S. taxpayers, the U.S. government should deny the foreign tax credits for taxes like the Act 154 excise tax.”

Critical Capital Markets Access

The preferential tax treatment accorded the territories’ debt through the triple-tax exemption created and maintained investor demand for their securities. This outsized appetite has been partially responsible for fueling and financing the recurring budget deficits incurred by each of the islands. Financial engineering has helped create new revenue streams to “bond out.” Credit rating agencies have proved reticent to issue downgrades, despite clear and obvious signs of fiscal deterioration. All this has been complicit in the increase in each island’s outstanding debt, but more importantly has delayed difficult decisions that need to be made. Unfortunately for the issuers, when the investment thesis no longer works due to fiscal deterioration, the pricing of issued debt can quickly fall to distressed levels. Puerto Rico is currently experiencing very negative investor sentiment across all debt classes.

Elevated Energy Costs

Higher energy costs relative to those on the mainland are common to each territory. Given their inherent isolation, fuel oil has been the predominant source of electricity for each. Fuel-oil-fired generation leads to higher electric bills versus those on the mainland, higher power-authority receivable balances and pricing volatility that must be passed on to the customer. And in the current energy environment, fuel oil is more expensive than alternatives such as natural gas. Liquefied natural gas (LNG), in fact, presents an opportunity to lower territory fuel costs, but requires significant up-front expenses associated with infrastructure build-out. The Jones Act (a.k.a. the Merchant Marine Act of 1920, which regulates maritime commerce in U.S. waters and between U.S. ports), introduces additional costs associated with the sourcing and transporting of LNG.

The most affected territory is the U.S. Virgin Islands. The recent closure of the Hovensa refinery, once one of the 10 largest in the world, has not only negatively affected GDP (a $580 million decline from a $4.23 billion base) and employment (a loss of 2,500 jobs) but also fuel oil costs. Prior to closure, the island and the refiner shared a concession agreement whereby the power authority was provided discounted fuel oil. Post-closure, that concession agreement no longer stands, nor does its $40 million to $50 million in annual savings. This could affect Cruzan and Diageo’s continued use of the islands’ power system. Higher rates may force them to generate their own power or relocate, depending upon the revised cost.

Puerto Rico’s economic base is especially sensitive to elevated energy prices, given the contribution that island’s manufacturing sector makes to its GDP. The passage of Act 154 must certainly affect negatively any company’s decision to locate or expand on the island, given the increased tax burden.

Bond Market Perceptions

At a certain level, it is difficult to make a case to invest in any of the islands, given the structural mismatch in revenues and expenses, over-reliance on federal transfer payments and a dearth of economic growth opportunities. The capital markets have played a key role in easing each island’s present situation through access to credit at reasonable terms and continued innovation in sourcing revenue streams to “bond out.” But within the universe of investable bonds, there are certain characteristics that, for some, alleviate a few of the above concerns.

Guam paper now has the tightest credit spreads relative to its territory peers, compared by pledged revenue source (credit spread measures the difference between the offered yield and the "AAA"-rated yield for that maturity). The lower the spread, the greater is the perceived safety of the bond.

From a credit-risk perspective, sales-tax bonds (Puerto Rico’s COFINA, Guam’s Business Privilege and the U.S. Virgin Islands’ Gross Receipts) represent the least risky debt issued by the islands. Essential services, such as water and power bonds, are subject to various factors that reduce the strength of their monopoly positions and thus their credit appeal. For example, higher rates driven by fuel-oil generation tend to lead to lower collection rates and to elevated water/power entity accounts-receivables balances. Excise-tax-backed bonds remain sensitive to the volume of rum shipments, to the question of the rum producers remaining on the islands and to the sensitivity surrounding prudent use of bonding capacity (self-restraint in leveraging the revenue stream). Credit spreads (as of February 4, 2014) for the various issuing entities of Puerto Rico, Guam and the U.S. Virgin Islands are shown in Table 1.

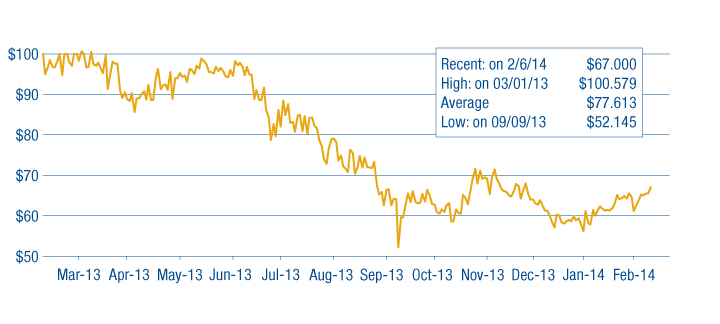

The general-obligation debt of Puerto Rico tends to be the weakest credit, as it lacks a specific revenue pledge. The unlimited general-obligation pledge is, broadly speaking, very strong, but depends upon a stable underlying foundation. The city of Detroit declared bankruptcy in 2013, and it is a prime example of the shortcomings that even an unlimited GO pledge can exhibit if underlying economic fundamentals deteriorate so much that debt obligations cannot be honored. Puerto Rico’s general-obligation debt has seen a significant drop in price over the last six months, falling from par to 63 cents on the dollar, as shown in Chart 5.

There are numerous risks that must be priced into owning debt issued by Puerto Rico, Guam and the U.S. Virgin Islands. The overriding issue is the significance the U.S. government plays in each of the islands’ finances. From tax policy and direct transfers to capital markets access, the federal government is an inordinately large player in each territory’s finances. It’s critical to understand, however, that the federal government should not be viewed as a backstop to structurally deficient budgeting techniques.

The factors that have negatively impacted the pricing of Puerto Rico debt are present, to lesser degrees, in both Guam and the U.S. Virgin Islands. Should the spotlight shine on them, it may reveal a similar silhouette, with a comparable outcome, making constant credit vigilance even more critical.

Territory Debt: Its Role in Thornburg Municipal Portfolios

Investing in U.S. territory debt can have its place in a well-diversified portfolio, especially one that is robustly structured to withstand the volatility and price performance of these bonds. Thornburg has not been a buyer of Puerto Rican debt for approximately 15 years. This includes all debt issued by the commonwealth or any of its many debt-issuing entities such as the Puerto Rico Electric Power Authority (PREPA) and COFINA. In our view, the pricing of the securities has not accurately reflected the risks associated with ownership. Such risks include pervasive budget deficits, pension underfunding, growing debt levels and an increasing reliance on market access to roll over previously issued debt.

With the brutal sell-off of Puerto Rican debt in June 2013, these risks have been more accurately reflected in market prices, but even at these levels, prices still remain outside our comfort level. Should prices continue to decline, we may revisit our investment thesis on Puerto Rican bonds.

Because of the enhanced yield they offer and because of our careful attentiveness to the risk/reward trade-off, we do have exposure to both Guam and Virgin Islands credits in our municipal funds. Percentages of total net assets range from 0.32% in the California Limited Term Municipal Fund to 3.27% in the New Mexico Intermediate Municipal Fund. Within the California fund, we have exposure to both Guam Power and VI excise-tax bonds. The New Mexico fund holds Guam Power, Guam income-tax bonds and VI excise-tax bonds. Our Strategic Municipal Income Fund does have exposure to Guam general-obligation debt, but in total that debt constitutes less than 1% of the fund’s assets under management. It is also the fund’s mandate to assume greater credit and duration risk, so this fits within the fund’s investment parameters. Again, such exposure should be viewed as a relatively small percentage of a diversified, robustly constructed portfolio. While none of the funds would be immune to price deterioration of either Guam or U.S. Virgin Islands debt, the holding percent relative to total fund assets would mitigate negative net-asset-value consequences.

Why does Thornburg own Guam and U.S. Virgin Islands credits but not Puerto Rico? After all, they share fiscal traits such as deficit financing and heavy reliance on federal transfers. But through fundamental credit analysis, certain mitigating distinctions can be made. For instance, in Guam’s case the U.S. military plays a key role in island finances. Besides the obvious strategic import, the U.S. military employs large numbers of military and civilian personnel and indirectly supports industries such as construction. While not party to any of the island’s debt, the military stabilizes the economy of Guam, a stability not enjoyed by Puerto Rico. The security pledge of the bonds we own (rum excise-tax bonds) is driven to a large extent by U.S. congressional re-authorization actions.

While all the territories share the same macro-level issues, at the individual security level certain mitigating factors provide adequate likelihood of repayment. We believe that we are compensated for the risks involved in purchasing the debt of Guam and the U.S. Virgin Islands. We hope this summary of our research into the creditworthiness of U.S. territory debt has provided insight into some of the work behind constructing the Thornburg municipal bond fund portfolios.