First quarter earnings results will not be very exciting, but the earnings trajectory may be at a trough. We would love to say that this earnings season, which begins on April 11, 2016 (unofficially), will bring better results than recent quarters, but that appears very unlikely. In fact, consensus estimates are calling for a 7% year-over-year decline in S&P 500 earnings for the quarter, the worst decline since the Great Recession and the third straight quarterly decline based on Thomson data (based on FactSet data, it’s the fourth). By most definitions, corporate America is in the midst of an earnings recession. Hardly something for investors to get excited about.

But on a brighter note, this quarter may mark an inflection point regarding the trajectory of earnings because the pressure on earnings from oil weakness and U.S. dollar strength is starting to abate. But that also means management teams’ popular excuses for explaining shortfalls won’t work anymore.

No More Excuses

In 2015, the combination of oil weakness and U.S. dollar strength wiped away high-single-digit S&P 500 earnings growth. Oil fell from over $100 per barrel in 2014 to as low as $26 in February 2016; while the U.S. dollar’s gains, which erode profits earned overseas, reached 20% during the second quarter of 2015. These two factors provided excuses for management teams whose results came up short.

But these drags have already begun to abate and are poised to potentially stage powerful reversals. The reversal has begun quicker for the dollar [Figure 1]. After annual increases between 12% and 20% during each of the four quarters of 2015, which delivered estimated 3–6% hits to S&P 500 earnings, the U.S. Dollar Index gained just 2% during the first quarter of 2016. If the dollar stays flat between now and year-end, 2–3% year-over-year declines will be an earnings tailwind during the remaining three quarters of the year.

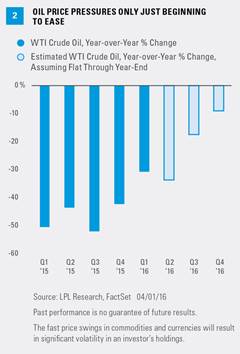

The oil reversal should take longer to play out, but the annualized declines have started to moderate and could reverse during the second half of the year if oil prices move reasonably higher from current levels. Figure 2 shows that if oil prices remain at current levels the rest of the year, year-over-year declines in average oil prices would continue through 2016. However, should oil prices return to the mid- to high $40s as we expect, oil may potentially begin to experience annual gains during the third quarter of this year. Consensus estimates are already reflecting energy’s return to year-over-year earnings gains in the fourth quarter of 2016, and oil prices are currently up about 40% off of their February 2016 lows, so the wait for better earnings news from the sector may not be too far off.

Corporate America has already lost its ability to use currency as an excuse, while the oil excuse is beginning to lose credibility. Hopefully, less reliance on these excuses will enable markets to get more useful, and better, information about business conditions.

What We’re Watching

Whether earnings declines potentially trough this quarter, should these two drags continue to fade, is the key question for us this earnings season. Given how far 2016 estimates have fallen (down 5.6% year to date), they may at least hold steady as companies report results (a rise is seen as unlikely). Remember, many of these management teams delivered their 2016 expectations to investors in late January and early February 2016 when recession fears peaked, stocks and oil bottomed, and the U.S. dollar was near recent highs. Conditions are better now, suggesting the tone of guidance may be more positive.

Some other things we will be watching this earnings season:

· Profit margins. Wage pressures have increased gradually and have started to impact profit margins. We will be watching for signs of further pressures that could lead to margin compression. To date, corporate America has done a terrific job maintaining high profit margins.

· Capital allocation decisions. We would like to see companies deploy more capital to invest in future growth, which investors may view as a positive signal for the future. We are fine with companies returning capital to shareholders, but we would like to hear that companies are making capital spending a bigger priority.

· Emerging markets demand. China, which has been seeing some improvement in economic conditions, is always worth watching. But U.S. companies may continue to be impacted by weakness in the commodity-producing regions and geopolitical hotspots overseas such as Brazil, Russia, and South Africa.

We believe energy, financials, and healthcare are the key sectors to watch. For energy, we would like to see evidence of further U.S. production cuts beyond the 8% drop already experienced. The quarter may prove difficult again for financials given lower interest rates and financial market volatility. Healthcare results should be strong again, but scrutiny over high drug prices may persist.

Quick Thoughts On Divergent Profit Measures

The large gap between operating earnings and GAAP earnings has been receiving a lot of attention from the financial media, and becoming a concern among some investors that it may signal even more earnings troubles ahead. The biggest reason for that gap has been the energy downturn, which has led to significant downward adjustments of oil and gas reserves valuations. The impacts of the energy downturn are well known and the associated risks were seemingly more than priced in when oil prices bottomed earlier this year. The gap between earnings measures was the effect, not the cause, and does not suggest increased earnings quality concerns are warranted, in our opinion.

Other similar periods that saw significant divergences in these earnings measures included the bursting of the internet bubble and the financial crisis, when acquisitions, intellectual property, and financial assets were significantly devalued. During these periods, the gap between the operating measure and GAAP earnings has ranged as high as 30% depending on the data source used for the operating earnings calculation.

Conclusion

Earnings results will not be exciting, but the quarter may mark a trough in the earnings trajectory as the drags from oil and the dollar begin to abate. We continue to believe mid-single-digit earnings growth in the second half of 2016 is achievable, consistent with consensus estimates, and we hope to get more support for that view over the next four to six weeks—and fewer excuses.

Burt White is chief investment officer for LPL Financial.