The earnings recession will likely continue with second quarter results, which will begin with a small handful of companies reporting this week (July 5–8, 2016). The Thomson-tracked consensus estimate for S&P 500 earnings per share (EPS) is calling for a 4% year-over-year drop, which would mark the fourth consecutive quarterly decline (by FactSet’s count the streak would reach five). Perhaps the best thing to say about this streak, the longest since 2008, is that the drop will likely confirm that the 5% year-over-year decline in the first quarter of 2016 marked a trough.

But signs are pointing to better times ahead. U.S. economic growth has picked up in the second quarter of 2016 based on available economic data. Despite the U.S. dollar rally following the Brexit news on June 23, 2016, we expect the dollar to turn from a headwind to tailwind in the second quarter of 2016. Higher oil prices should lead to a smaller (but still large) decline in energy sector profits. And we do not expect the Brexit news to have a meaningful impact on results.

This week we preview the upcoming earnings season and update our thinking on the prospects for an earnings rebound in the second half of 2016.

BETTER U.S. ECONOMIC PICTURE

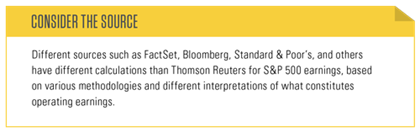

U.S. corporate profits are closely tied to manufacturing activity and capital spending. Accordingly, earnings have historically been well correlated with the Institute for Supply Management’s (ISM) Manufacturing Index, a survey of purchasing managers’ future spending plans. As a result, the strong and better than expected ISM Index of 53.2 for June (reported July 1), the fourth straight reading above 50 and second straight month of improvement, is a positive signal [Figure 1].

We expect another bounce back in second quarter gross domestic product (GDP), to perhaps 3.0% or more, despite the weak May 2016 jobs report and weakness in Europe, and see capital spending beginning to pick up following the nearly two-year oil-driven slump, despite heightened political uncertainty.

FADING DRAG #1: U.S. DOLLAR

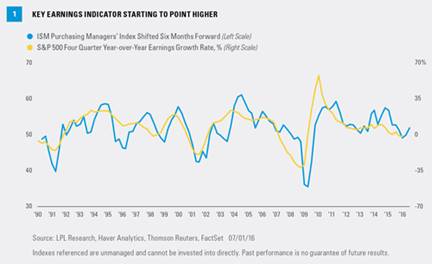

We expect the earnings drag on foreign profits from a stronger U.S. dollar to dissipate during the second quarter of 2016 despite the latest Brexit-driven rally. Even with the 3% jump since the Brexit news on June 23, 2016, the dollar has weakened considerably since December 2015, as expectations for Federal Reserve (Fed) rate hikes in 2016 have been pared back—to the point where no hikes are being fully priced into federal funds futures markets in 2016 or 2017. The average dollar index level in the second quarter of 2016 was 1.7% below that of the same quarter a year ago, providing a tailwind for earnings. And should the dollar remain where it is for the rest of 2016, currency would be a tailwind for the second half of the year as well, after representing a drag of as much as 20% on foreign profits during the second quarter of 2015

[Figure 2].

FADING DRAG #2: OIL

The drag on earnings from the energy downturn has been even bigger than the dollar drag over recent quarters. The sector posted a small loss in the first quarter of 2016, registering a 105.7% year-over-year earnings decline, which trimmed about 5 percentage points off of overall S&P 500 profits. Low oil prices will still likely lead to energy sector profit declines in the second and third quarters of 2016 based on consensus estimates. Oil prices averaged 21% less in the second quarter of 2016 than in the second quarter of 2015. However, should oil prices stay at current levels, the commodity would show a year-over-year price gain in the third quarter of 2016 [Figure 3] and position the sector to potentially produce double-digit earnings gains in the fourth quarter.

BREXIT IMPLICATIONS

Broadly, we expect Brexit to have limited impact on earnings. S&P 500 companies overall have minimal exposure to the U.K. (estimated less than 5%, according to FactSet). Although some companies will surely use Brexit as an excuse for falling short of estimates, overall, we do not expect political and economic uncertainty in the U.K. to have much impact on U.S. company profits.

Brexit has had some negative impact on corporate profits through the stronger dollar and tighter financial conditions. The financials sector is perhaps most impacted given its sensitivity to interest rates, which remain near post-Great Recession lows; the 10-year Treasury yield closed at 1.46% on July 1 and dipped below 1.40% intra-day on July 5. One way Brexit has not yet negatively impacted earnings is commodity prices; the Bloomberg Commodity Index is actually up since the Brexit news despite dollar strength.

ALL ABOUT GUIDANCE

It’s always about guidance as stocks trade more on expectations for future quarters than on results for a quarter that ended. Since the Great Recession, earnings estimates for the next 12-months have typically fallen 2–3% during earnings season. During first quarter 2016 earnings season, the estimate reduction was at the low end of that range—an encouraging sign. We believe we will see a similar result this quarter for several reasons:

• Better growth. We continue to see 2–2.5% GDP growth for the second half of the year despite stalled overseas growth, the Brexit-related tightening of financial conditions (via the stronger U.S. dollar), which we expect to be short-lived, and U.S. election uncertainty that will be with us for the next several months. This growth pace is supportive of a return to high-single-digit earnings gains by year-end.

• Easing drags of the dollar and oil. The significant drop in earnings estimates early this year was largely due to weak oil prices and the strong dollar. Even with the post-Brexit dollar rally, these drags are easing considerably and increase the chances that companies are able to at least maintain their outlooks through year-end and into 2017.

• Favorable pre-announcements. The ratio of companies pre-announcing negative results relative to those pre-announcing positive results (2.3) has been more favorable during the second quarter 2016 than in the prior quarter (3.8) and the year-ago quarter (4.3). The ratio is also better than the 20-year average of 2.7.

• Estimates held up well late in the quarter even post-Brexit. Estimates for the second quarter of 2016 and the next year held up very well in June 2016, even following the June 23, 2016 Brexit vote, after which many economists reduced their European and U.K. economic growth forecasts and currencies experienced extreme volatility. Consensus estimates, which have fallen less than 0.2% since the vote, are calling for a 10% increase in S&P 500 EPS over the next four quarters, so we would view a number near this or slightly lower after earnings season is over as a positive surprise.

These factors suggest that high-single-digit earnings gains in the fourth quarter of 2016 are potentially achievable (consistent with consensus estimates), in our opinion, and can help support modest stock market gains in the second half of 2016.

CONCLUSION

The earnings recession will likely continue with second quarter results. Although the decline is likely to be smaller than the first quarter’s and suggest a trough is in, there will not be much good to say about the results. But better times may lie ahead. U.S. economic growth has started to pick up, the drags from the U.S. dollar and oil are starting to abate, Brexit appears unlikely to hurt U.S. companies all that much, and we generally expect guidance to be pretty good. We continue to expect a second half earnings rebound to drive further stock market gains in the second half of 2016.

Burt White is chief investment officer for LPL Financial.