Corporate sentiment improved little based on our analysis of earnings conference call transcripts for second quarter earnings season. The message from our earnings recap commentary three weeks ago, “We Were Hoping for More,” is also appropriate for our latest Corporate Beige Book. We did see some signs of improvement in managements’ tone based on the use of more strong words. Talk of recession was virtually non-existent in the U.S., and the Brexit vote in the U.K. was generally not as disruptive as some may have feared. However, the ratio of strong words to weak ones suggests only tentative improvement, while foreign currency remained a drag and low oil prices are still in focus.

Mixed Corporate Barometer

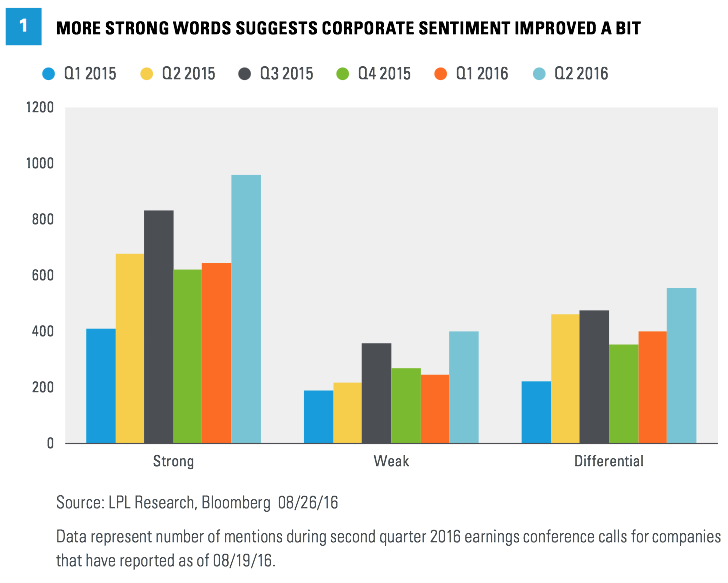

When we count positive and negative words from earnings call transcripts, we see that sentiment improved some but not much. More strong words (e.g., strong, robust, solid, improving) were counted in the call transcripts sampled [Figure 1].

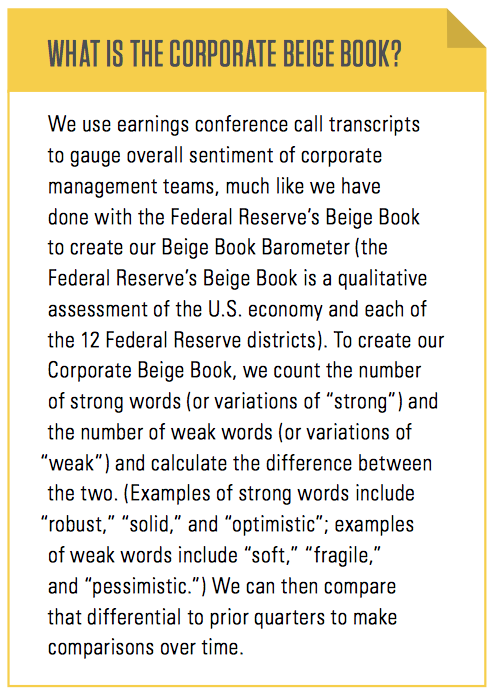

The word “strong” in particular saw a big jump from the first quarter (341 mentions) to the second (496). But the weak words (e.g., weak, soft, difficult, and challenging) also increased, leaving the ratio of strong words to weak ones worse than in the first quarter of 2016, only in line with the two quarters prior to that, and well short of the year-ago quarter [Figure 2].

This exercise does lack some precision given the varying reasons executives might use these words. Still, the result is a bit surprising given that the macroeconomic environment has generally improved during the summer, and some of the pressures on earnings over the past year, namely tumbling oil prices and the surging dollar, have let up.

We also observed a jump in the overall use of strong and weak words. This seems to suggest increased emotion, which could reflect more optimism but may also be related to investor uncertainty or the increasingly macroeconomic driven environment we are in.

Talk Of U.S. Recession Non-Existent

Corporate executives generally try to stay away from the “R” word (recession) when talking to investors and this Corporate Beige Book exercise confirms that. In fact, the average number of times the word recession was uttered during the conference calls aggregated over the past six quarters was a whopping 9. Mentions ticked up to 15 during the second quarter calls, but several of them were related to overseas economies including a potential recession in the U.K. (a staffing company), and recessions in Brazil (media, credit card processor, and industrial equipment companies) and Russia (consumer products company). Other comments were hypothetical, such as an automotive business suggesting that a potential 10–15% drop in auto sales would require a significant recession.

In the U.S., we continue to see low odds of recession over the next 12–18 months (potentially about 20%) when factoring in the economic data and risk of a potential policy mistake from a central bank or a government.

Currency Impact Fading

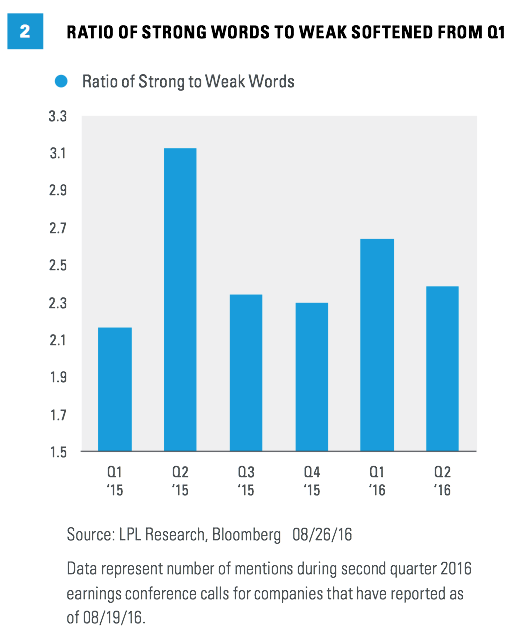

Arresting the surge in the U.S. dollar is a big part of ending the earnings recession. But while the improving year-over-year comparisons for the dollar set up a better earnings environment in the second half of the year, the mentions of foreign exchange on conference calls have not died down lately [Figure 3]. In fact, the number of mentions on second quarter earnings calls was greater than four of the previous five quarters; though currency did get 17% fewer mentions last quarter than in the third quarter of 2015 when the dollar’s year-over- year increase peaked.

Should the U.S. Dollar Index stay where it closed on August 26, 2016, for the rest of the year, the dollar would represent a tailwind in both the third and fourth quarters of 2016 thanks to respective year-over-year declines in the Dollar Index of 0.7% and 2.3%.

Partly due to the post-Brexit weakness in the British pound sterling versus the U.S. dollar, companies ended up experiencing more of a currency hit during the quarter than we had hoped. Here are some examples:

-

“All-in sales for the company were down 3%, including a 3-point headwind from foreign exchange and a 2-point drag from the combination of Venezuela deconsolidation and minor brand divestitures.” (Consumer products)

-

“After adjusting for the benefit of the extra week in the prior year, net sales declined 5%, reflecting a 4% decline in volume, flat price mix, and a negative 1% impact from foreign exchange.” (Food producer)

-

“We are anticipating a marked improvement in our September monthly numbers, as we implement our capacity changes, and see benefits from our domestic revenue management initiatives, and easing of foreign exchange headwinds ...” (Airline)

-

“Second quarter revenues were approximately $13.1 billion and reflect year-over-year operational growth of $1.6 billion or 13%, which was partially offset by the unfavorable impact of foreign exchange of $302 million or 3%.” (Drug maker)

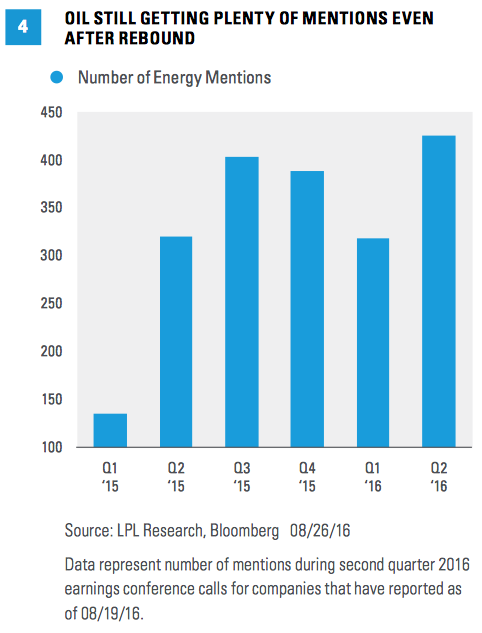

Oil Still In The Picture

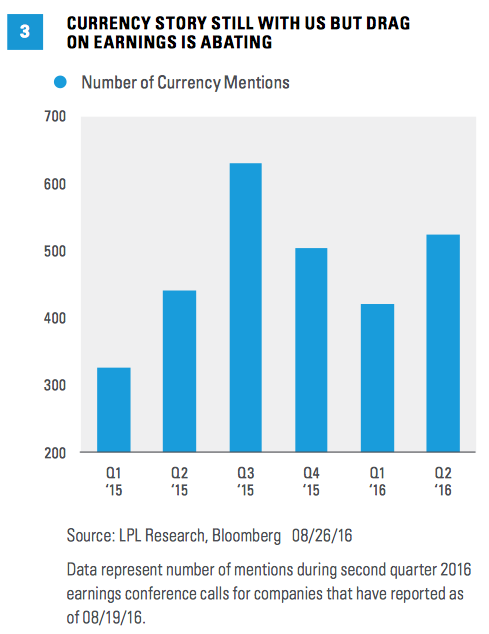

Oil’s rise from the February 2016 lows in the mid $20s per barrel to a current price in the high $40s (as of August 26, 2016) has eased concerns about the negative impact of low prices on energy companies and energy-sensitive companies. However, as shown in Figure 4, the topic has not stopped getting airtime on conference calls. Some of the discussion has been about the rebound and the positive impact, but much of it reflects the challenges and wide-ranging impacts of the low commodity price environment.

Should oil stay at current levels (as of August 26, 2016), crude prices would average a 1% year-over- year decline in the third quarter and a 13% increase in the fourth.

Comments from oil and gas producers reflect the still challenging environment:

-

“Our financial performance was challenged, like the rest of the industry, but did improve sequentially in line with prices.”

-

“The business is performing well operationally and we grew production 3%, but the low commodity price environment continues to impact financial results.”

-

“We are focused on maximizing value, not volume, and have reduced our drilling program to levels that allow us to manage near-term cash flow, while maintaining our operating capabilities in the current low price environment. When oil prices approach $60 per barrel, we will begin to ramp up activity, starting with the Bakken.”

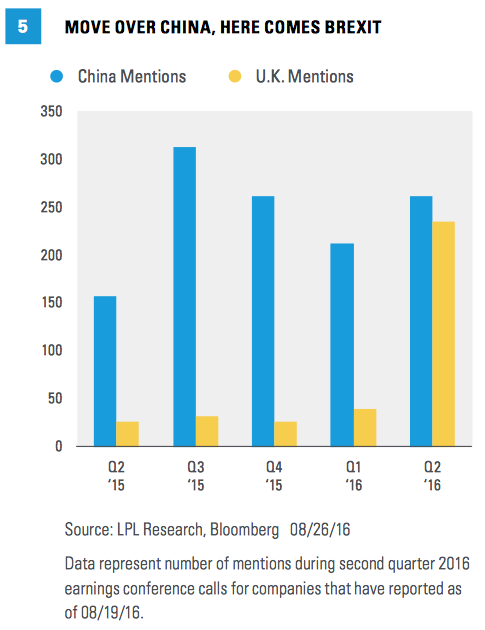

Move Over China, Here Comes Brexit

China continues to get attention from corporate executives but Brexit has taken over as the focus. The U.K. got as many mentions in company conference calls in the latest quarter as China did [Figure 5], despite the fact that the U.K. has still only voted to leave the European Union — they haven’t started the process of leaving. On China, stability in the number of mentions is encouraging (as is recent economic performance) considering just three quarters ago the country nearly ended the U.S. bull market and led many pundits to predict recession.

With regard to Brexit, the message from most management teams is minimal short-term impact besides currencies, with some companies being more affected:

-

“Currently, we don’t anticipate any significant impact from Brexit this year. However, foreign exchange headwinds will continue to be with us in 2016 although they continue to moderate from the recent past given current FX rates.” (Credit card processor)

-

“We haven’t seen a significant change in consumer demand in the U.K. since the vote.” (Restaurant)

-

“As you also know, the British pound for the quarter on average has deteriorated, but obviously particularly post-Brexit, the decline has been significant and has a significant impact on our margins.” (Appliance maker)

-

“We are expecting to have headwinds of about $200 million this year associated with Brexit.” (Automaker)

-

“Over the course of the past quarter, we’re a little more negative on the world economy and the Brexit, Turkey, the elections, oil price,

-

you name it, all of that contributes. And we’re less bullish on second half sales because of that.” (Machinery)

-

“While Brexit has caused some uncertainty in the region, we don’t expect a near-term impact in our businesses.” (Industrial conglomerate)

-

“Now, with the foreign currency pressure from the steep drop in the pound, the economic uncertainty from Brexit, and continuing yield pressures in the North Atlantic, we’ve decided to take an additional six points of capacity out of the U.K. for the winter season.” (Airline)

-

“Second, on Brexit, uncertainty running up to the referendum led to a risk-off environment. And following the decision, the markets were quite volatile as expected, and volumes were materially higher in the immediate aftermarket. The market functioned quite well, absorbing the volatility.” (Money center bank)

Bottom Line

Our Corporate Beige Book may not inspire much confidence, but it may provide some assurance for those who fear earnings may get worse, not better. We continue to expect earnings to rebound in the second half of the year, despite another decline in the just-completed second quarter and little evidence that corporate executives are more confident. We expect better U.S. economic growth to help more as the year progresses, while currency and energy drags should continue to abate through year-end and the resilience of estimates is a positive sign. Look for more from us on earnings in about a month as we gear up for the start of third quarter earnings season in October.

Burt White is chief investment officer for LPL Financial.

Jeffrey Buchbinder, CFA, is a market strategist for LPL Financial.