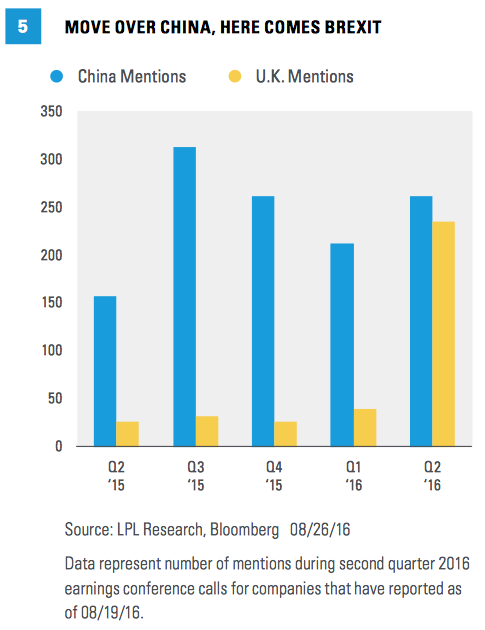

Move Over China, Here Comes Brexit

China continues to get attention from corporate executives but Brexit has taken over as the focus. The U.K. got as many mentions in company conference calls in the latest quarter as China did [Figure 5], despite the fact that the U.K. has still only voted to leave the European Union — they haven’t started the process of leaving. On China, stability in the number of mentions is encouraging (as is recent economic performance) considering just three quarters ago the country nearly ended the U.S. bull market and led many pundits to predict recession.

With regard to Brexit, the message from most management teams is minimal short-term impact besides currencies, with some companies being more affected:

-

“Currently, we don’t anticipate any significant impact from Brexit this year. However, foreign exchange headwinds will continue to be with us in 2016 although they continue to moderate from the recent past given current FX rates.” (Credit card processor)

-

“We haven’t seen a significant change in consumer demand in the U.K. since the vote.” (Restaurant)

-

“As you also know, the British pound for the quarter on average has deteriorated, but obviously particularly post-Brexit, the decline has been significant and has a significant impact on our margins.” (Appliance maker)

-

“We are expecting to have headwinds of about $200 million this year associated with Brexit.” (Automaker)

-

“Over the course of the past quarter, we’re a little more negative on the world economy and the Brexit, Turkey, the elections, oil price,

-

you name it, all of that contributes. And we’re less bullish on second half sales because of that.” (Machinery)

-

“While Brexit has caused some uncertainty in the region, we don’t expect a near-term impact in our businesses.” (Industrial conglomerate)

-

“Now, with the foreign currency pressure from the steep drop in the pound, the economic uncertainty from Brexit, and continuing yield pressures in the North Atlantic, we’ve decided to take an additional six points of capacity out of the U.K. for the winter season.” (Airline)

-

“Second, on Brexit, uncertainty running up to the referendum led to a risk-off environment. And following the decision, the markets were quite volatile as expected, and volumes were materially higher in the immediate aftermarket. The market functioned quite well, absorbing the volatility.” (Money center bank)