The year 1999 was a very unique period. There was an overwhelming consensus that the “new economy” was a permanent investment theme that couldn’t be stopped. The valuation of technology, media, and telecom companies were bid to extreme valuations. Investors and pundits openly ridiculed observers, like me, who disagreed with the new era’s sustainability. Active managers were criticized for not being able to keep up with benchmarks even though it might have been irresponsible for a fiduciary to concentrate a portfolio in a single sector. Dividends were thought of as a lead weight on portfolio performance. Of course, the Tech bubble deflated, and investors suffered from being so myopic.

Valuations remain normal…yes, normal

Richard Bernstein is chief executive and chief investment officer at Richard Bernstein Advisors.

Investors appear similarly short-sighted today. However, they are not rabid for capital appreciation as they were in 1999. Rather, they are rabidly risk averse and always scared that a replay of 2008’s bear market is lurking. That has led to valuation distortions of historical proportions among “safe” investments that outperformed in the wake of 2008.

Many have claimed that the rush for income investments is demographic. While the aging of the baby boomers may partially explain some risk aversion, it certainly doesn’t fully explain these extreme distortions. Data increasingly suggest that fear is motivating investors’ search for safe income. We continue to believe that “octogenarians will be screaming for capital appreciation” when the stock market peak truly forms.

Safe investments are safe until everyone wants them. Once they become popular, safe investments can become quite risky. That shift from conservative to aggressive is already starting to happen. 2015’s MLP debacle and the current problems in UK property funds may be the proverbial canaries in the mine shaft with respect to the riskiness of single-mindedly investing for income, but so far income investors generally appear oddly complacent. Much as the fear of missing out on riches clouded investors’ rationality in 1999, the fear of losing money is causing an overwhelmingly risk averse environment.

Most investors disagree with this assessment. They argue that investors are too bullish because the stock market is vastly overvalued and the economy is on the precipice of recession. In this report, we show data that seems to strongly refute those contentions. Investors, by our reckoning, are extremely risk averse when it appears that the worst of the profits recession is already behind us.

Wall Street scared

For nearly 30 years, we have surveyed Wall Street strategists for their recommended equity allocation. Through time this survey has shown to be a very reliable long-term sentiment indicator. In other words, it has historically been bullish when Wall Street suggested underweighting equities and bearish when they suggested overweighted positions.

Chart 1 shows this historical survey relative to the standard long-term 60-65% neutral benchmark weight. There are several critical points that emerge from this chart:

1. Wall Street recommended underweighting equities throughout most of the bull market of the 1980s and 1990s. This represents the proverbial “wall of worry” that existed throughout that secular bull market.

2. Wall Street recommended overweighting equities in 1999/2000 just prior to the “lost decade in equities”.

3. Wall Street again favored equities prior to the 2007/8 bear market.

4. Most important, strategists have been again recommending an underweight of equities throughout the current bull market.

The notion that investors are overly bullish seems directly counter to these data. If investors are so incredibly bullish, then they obviously must be bullish counter to the recommendations of their advisors. How many investors, whether individual or institutional, have actually said, “I don’t care what my advisor or consultant says about being cautious. We need to be fully invested in US stocks.”? We strongly think the answer is none.

Negative yields

Could there be anything that suggests extreme risk aversion more than the increasing proportion of global sovereign bonds that have negative yields? Investors in bonds with negative yields must believe that there are no other assets in the world that could provide any sort of positive return. If investors were overly bullish toward equities, we doubt that bonds would carry negative yields. Rather, yields would be excessively high as investors increasingly shifted allocations toward overweighting equities.

The increase in risk aversion appears to be a reaction to the widely unanticipated profits recession. The profits cycle appears to be troughing, but investors’ portfolios are now positioned for maximum risk aversion when it could be least advantageous to be so conservatively positioned. Chart 2 highlights the sharp decline in global bond yields over the past year.

Is anyone buying an equity fund?

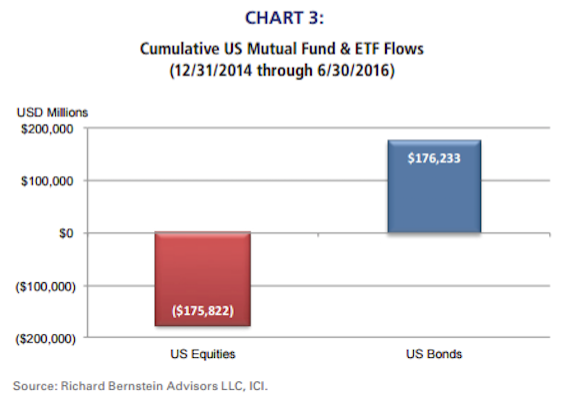

We find it perplexing that observers believe that equity investors are too optimistic when there are near-historic outflows from equities. The flows out of equity mutual funds and ETFs have been so huge that Evercore ISI has pointed out that 2015/2016’s outflows from equities (mutual funds and ETFs) is bigger than that seen during 2008/9! Meanwhile, flows into bond investments have been equally as startling.

It seems quite a stretch to suggest that investors are overly bullish when there has been an extended period of outflows from equities and similarly strong and consistent inflows to bond investments. Rather, this seems to reflect the singleminded income focus about which we are so concerned.

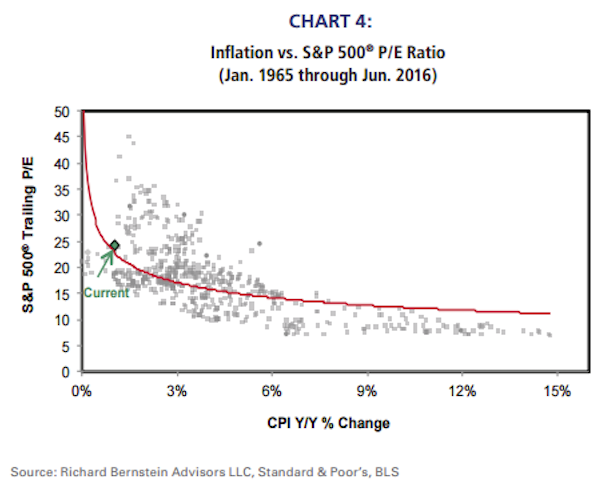

Many income-centric investors believe that the equity market is significantly overvalued simply because the market PE seems high relative to history. However, PE ratios in isolation have not historically been good forecasters of future returns because PEs must be related to interest rates and inflation.

There is an old investment rule-of-thumb called the Rule of 20 that uses combinations of headline inflation and the S&P 500® PE to determine fair value. Our valuation models are, of course, more elaborate than the simple Rule of 20, but based on a more rigorous analysis of inflation and PE ratios, the current equity market appears, at worse, to be fairly valued. Investors forget that inflation was increasing leading up to the 2008 bear market. In fact, the CPI, which is a lagging indicator, peaked at 5.6% in July 2008. Today’s headline inflation is 1.0%.

The chart below shows combinations of inflation and valuations over the past 50 years or so. The current observation does not suggest investors need to be as defensive and income-centric as they are currently.

Rabidly risk averse

In 1999 investors were rabid for capital appreciation. Today, the data suggest to us that a broad range of investors are rabidly risk averse and overly income-centric. We swam against the tide in 1999 and we appear to be doing it again today. We continue to believe that investors with multi-quarter time horizons will be rewarded for taking equity risk and overly income-centric investors will be undercompensated for the risks they don’t presently recognize.

Rabidly Risk Averse

July 13, 2016

« Previous Article

| Next Article »

Login in order to post a comment