-

On September 1, Real Estate will become a distinct sector in the Global Industry Classification Standard (GICS), elevating it from its former position as part of the Financials sector.

-

Real estate investment trusts (REITs) offer a diversified, cost-effective, transparent way for investors to access commercial real estate and are available today in nearly 40 countries around the world.

-

REITs can act as a portfolio diversifier and an inflation hedge; research supports the fact that they also hold up well in periods of rising interest rates.

-

We believe that holding global vs. US-only REITs can further enhance portfolio risk-adjusted returns and offers exposure to a diversified set of geographic and economic environments.

September 1st will mark an important milestone for the real estate investment trust (aka REIT) industry. Effective that date, real estate will become the 11th sector in the Global Industry Classification Standard—the first new sector since Standard & Poor’s and MSCI formulated GICS in 1999. Here’s how MSCI explains the GICS addition: “With the creation of the new Real Estate Sector, we acknowledge its growing importance in today’s global economy. This change will elevate its position from under the Financial Sector, recognizing Real Estate as a distinct asset class and a foundational building block of a modern portfolio.”

I’m aware of some industry projections that a tsunami of tens of billions of dollars of new capital will pour into real estate once it’s a separate and distinct sector (indeed, the looming change may already have stimulated inflows into REITs this year). I have no idea if those forecasts will be realized, but it is easy to imagine that REITs will attract more money from diversified mutual funds, institutional and other investors simply from its higher profile after it is split off from financials. Additionally, being categorized and traded more distinctly from banks, insurance companies, and other financial companies could also reduce correlations with the broader equity market (which would enhance REITs’ portfolio diversification benefit, a theme I will return to below), improve REIT securities’ liquidity, and lower the sector’s cost of capital.

This stock market development represents an opportunity for investors to review their exposure to diversified real estate and REITs, and I have long believed that many investors are particularly under-allocated to REITs outside the US (nearly 40 countries now have REIT legislation in place). In the balance of this entry, I’ll briefly summarize what I think makes global REITs an attractive asset class for most investment portfolios.

Making Commercial Real Estate More Accessible

The creation of REITs—publicly traded securities that own and operate properties such as office and apartment buildings, shopping centers, hotels, and self-storage facilities—effectively democratized commercial real estate investing. These securities provide investors lacking large pools of capital with exposure (and with excellent liquidity) to commercial projects and professional real estate management. We view REITs as an attractive long-term strategic portfolio holding that generates returns that are highly correlated over market cycles with those of private real estate markets, as measured, for instance, by the National Council of Real Estate Fiduciaries (NCREIF).

Over most extended time periods, say 10 years or longer, REIT returns have been equal to or better than those of equities. For instance, during the 10 years to June 30, 2016, the S&P Global REIT Index returned 6% annualized, compared to just 2.1% for the MSCI EAFE Index of developed-country equities and 7.4% for the S&P 500 Index. But the way REITs and equities generate those returns is quite different, with the lion’s share of equity returns coming from capital appreciation and the bulk of REIT returns stemming from dividends (REITs are required to distribute at least 90% of taxable income—the source of those dividends–to shareholders each year). As an asset manager with a high degree of tax awareness, by the way, this fact is key to my frequent recommendation that many investors have distinct and targeted real estate exposure, so that they may own their REITs more heavily within retirement or other tax-advantaged accounts.

Indeed, this hybrid asset class—with bond-like yields and stock-like appreciation potential—offers nice portfolio diversification due to relatively low correlations with other major asset classes. From January 1, 1990 to June 30, 2016, global real estate’s correlation with US and international equities was about 0.6; with US and international bonds (as measured by the US Aggregate Bond Index and Citigroup WGBI 1-5 Year ex US) the correlations were only 0.22 and 0.25, respectively.

I earlier indicated my preference for global—as opposed to US-only—REITs, since international REITs provide exposure to geographic and economic environments ranging from London to Singapore to Sydney. We have conducted a considerable amount of research on how adding 5% to 15% REIT allocations to various equity and equity/fixed income portfolios impacts portfolio returns and volatility. We found that, for instance, adding a helping of REITs (perhaps 5% to 15% of the total portfolio) to all-equity or 80 equity/20 fixed income portfolios produced better risk-adjusted returns. I invite you to read our research paper on this topic, “Investment Insights: Taking a Global Approach to Investing in Public Real Estate.”

REITs And Rates

Finally, I would like to address the link between REITs, inflation, and interest rates. One benefit of REITs is that they can act as a strong hedge against inflation. Historically, REIT yields have been higher than the inflation rate, as measured by the Consumer Price Index (CPI), and over most extended periods—in stark contrast with fixed-income securities—the income stream from REITs has increased at a higher rate than CPI. Keep in mind that lease agreements for commercial property typically have clauses that build in inflation adjustments for rental payments based on the CPI or some other inflation index during the lease period.

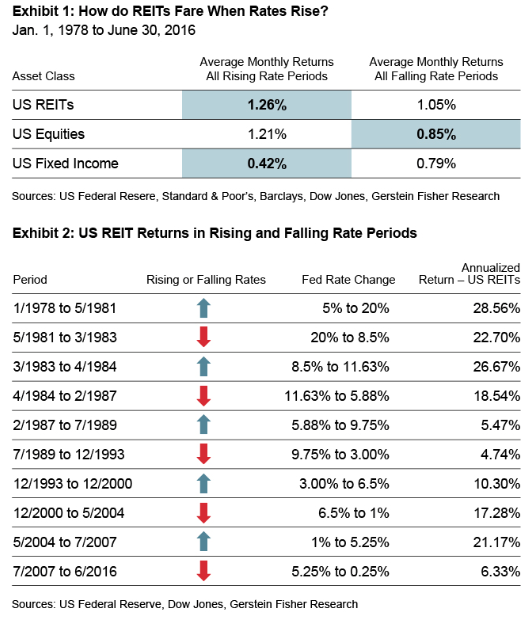

I am often asked whether rising interest rate cycles (which is bound to occur one of these days) negatively impact REIT prices. Though each scenario is somewhat different, our research shows that REITs have in fact historically performed relatively well in environments of steadily rising rates—outperforming equities and fixed income. Remember that rising rates usually coincide with periods of a strengthening economy and rising inflation, which are generally positive factors for REITs. Exhibit 1 reports the returns of the three asset classes in periods of both rising and falling interest rates from January 1, 1978 to June 30, 2016. Exhibit 2 details how US REITs performed during 10 specific cycles of rising and falling rates during the same 38 ½-year time frame.

While real estate becoming a sector unto its own may generate increased investor interest, at Gerstein Fisher we’ve always felt it has a place in most diversified portfolios, for the reasons outlined above. Real estate securities such as REITs are an effective and diversified way to access global real estate, allowing individual investors to participate in a growing and important segment of the global economy.

Gregg S. Fisher is chief investment officer of Gerstein Fisher.