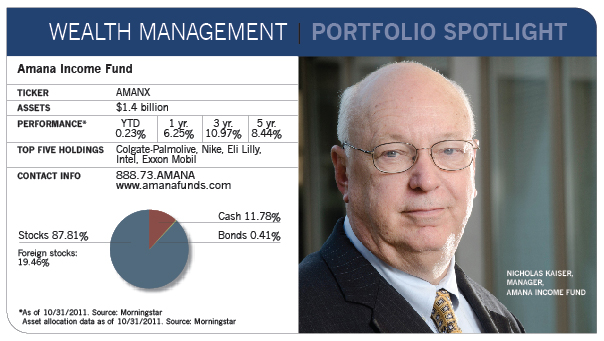

chart 1

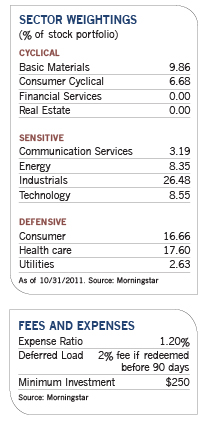

On the surface, Nicholas Kaiser seems an unlikely candidate to manage a mutual fund based on Islamic principles.

When a group of Muslim business leaders approached him in 1984 about becoming the investment advisor to what would become the Amana Funds, he knew little about the centuries-old tenets that would figure into his stock-selection process for decades to come. At a time when faith-based mutual funds were almost unheard of, he thought the proposition presented both an interesting challenge and a good way to expand his client base.

Today, Kaiser manages three Islamic funds from the Amana group out of the offices of his Bellingham, Wash.-based firm, Saturna Capital. Amana Trust Income, the oldest, focuses on dividend-paying large-cap stocks and recently celebrated its 25th birthday.

The 65-year-old Episcopalian readily admits that running funds to meet strict religious guidelines hasn't always been easy. "Sometimes it seems like I'm investing with one hand tied behind my back," he says. "But people investing for religious reasons just want to make sure I'm following the rules, and that's what I darn well try to do."

Religious restrictions weed out some obvious candidates. Because portfolio companies cannot engage in lending, bank stocks are off the table. Companies that derive more than 5% of their revenues from alcohol, gambling, pork and pornography are prohibited, as are those whose debt exceeds one-third of their total stock market capitalization.

The restriction that companies derive no more than 5% of revenue from prohibited sources eliminates some unexpected companies. As the largest wine retailer in the U.S., big-box retailer Costco is off limits. Target also recently got the thumbs down from one of the firm's analysts after he discovered that its California stores were selling wine.

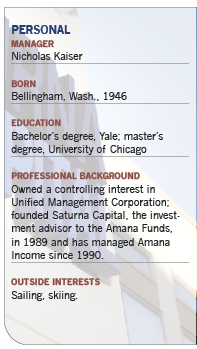

chart 2

The fund's low leverage requirements also eliminate many utilities, which tend to have heavy debt loads. But meanwhile, the fund gives the nod to cyclical names such as Freeport McMoRan Copper & Gold. "Cyclical mining [companies] have such variable earnings that banks don't like lending to them," says Kaiser. "So they tend to have very low debt levels."

Freeport yields an attractive 5.5% (which includes a special dividend it declared in June). "Even though the company can't borrow money, there are certain periods when it makes a lot of it and shareholders get rewarded," he says.

Despite these investment parameters-and perhaps to some extent, because of them-Kaiser has been able to guide Amana Income through several market cycles to the list of top long-term performers in Morningstar's large blend group. The fund has also held on to a five-star Morningstar rating since October 2006, and at $1.4 billion in assets, it's the second-largest public equity mutual fund governed by Islamic principles. Its sibling, the $1.9 billion Amana Growth fund, is the largest.

Taken together, the two funds represent 22% of the total $15 billion in assets under management held by the 43 faith-based mutual funds in Morningstar's database. That's impressive, considering that other funds in this group, which includes names such as Timothy Plan, Guidant, Ave Maria and Thrivent Financial, invest for more mainstream Christian denominations and would seem likely to have broader audiences.

Kaiser's advantage, however, is his performance, which makes his fund attractive to Muslim and non-Muslim investors alike. While the firm doesn't keep track of shareholders by their religious affiliation, "the vast majority of names in the shareholder database-I'd say at least 75%-do not sound like Muslim names," he observes. And one of those names belongs to Kaiser, who has a large portion of his personal assets invested in the funds he manages.

While strong performance may be one of the fund's attractions, a study from Cornell University released last year suggests that loyalty is another, less obvious reason that funds like Kaiser's thrive. The study, "Morality in the Financial Market-A Look At Religiously Affiliated Mutual Funds in the USA," concludes that shareholders of faith-based mutual funds are more likely to stay invested, regardless of market conditions, than those who own non-religious funds. The study's author, Jared Peifer, cites "a faithful adherence to the investment's religious principles."

In the Amana funds, shareholders get an investment management process that starts out with a universe of roughly 5,000 large-cap stocks. About 60% of those companies will fail to meet the three funds' religious guidelines. To be considered for the Amana Income fund, companies must produce dividend yields equal to or greater than the S&P 500 index. After that screen, the universe is whittled down to about 400 companies with low leverage, solid dividends and acceptable sources of revenue.

Even though Kaiser's investment universe may be more constricted than most, he has ample latitude when it comes to moving money into cash. Unlike most stock fund managers, who usually keep no more than 10% of their assets in cash so they don't wander too far from their benchmarks, Kaiser has the flexibility to move large amounts of money out of the market when he believes a downturn is likely.

Because Islamic guidelines prohibit deposits from earning interest, most of the money that's not in the stock market just sits there. "Our bank custodian really likes us," quips Kaiser.

Although the Amana Income fund can't invest in interest-bearing securities, it has a small position in Malaysian government sukuk with a yield of 2.55%. The equity-like instruments make regular distributions of pass-through income, similar to a real estate investment trust, and are like equities in that investors own a proportional interest in the trust that holds the assets.

The restriction against earning interest usually isn't a big drawback. As the income fund's low 7% turnover suggests, a high cash position is more of an infrequent defensive maneuver than a frequently used market-timing strategy. It's also kept the fund treading more lightly in stocks when downturns hit.

That happened in 2008, when 37% of the fund's assets were in cash. That year, the fund fell 23.5%, compared with 37% for the S&P 500 index.

While its ability to move to cash and its lack of financials and highly leveraged companies has helped the fund hold up better than others in recent bear markets, those features also held the fund back during the intervening rally when those stocks were among the best performers, notes Morningstar analyst David Kathman.

"Kaiser's patient buy-and-hold approach means that there will inevitably be such spells when the fund lags in the short term, but over the long run his stock-picking instincts have been excellent, as shown by the fund's stellar five-, ten- and 15-year rankings," Kathman notes.

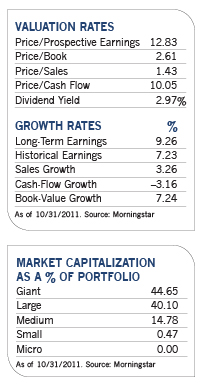

charts 3-6

Kaiser observes that the income fund is dominated by low-debt, large-cap stocks that grind out consistent earnings. This means, however, that the fund tends to underperform the market averages during strong bullish periods. "People who buy the fund are looking for a stable, safe approach, and they'd rather lose less on the downside than outrun everyone else in bull markets."

The income fund's current 16% cash position, up from 7% at the end of June, reflects its manager's cautious attitude toward the economy and his worry about how the economy will affect the stock market. Still, with signs of improvement such as stronger retail sales and upward-trending railroad loadings, Kaiser believes that the economy "might surprise on the upside rather than the downside."

"Even though cash is higher than normal, we're not extremely worried, and if we find undervalued companies we like, we will buy them at the right price," he says.

One company that stands to benefit from an economic upturn is fund holding Canadian National Railway, Canada's largest freight railroad. The company's revenues from the transport of goods such as petroleum, chemicals, grains, fertilizer and forest products reflect the country's healthy, diversified economy.

"The stock is a good way to own the Canadian economy, which is doing better than the U.S. and is well positioned to take advantage of developing market growth. The country's 15.5% corporate tax rate doesn't hurt either."

At 28% of assets, consumer non-durables is the income fund's largest sector weighting. Kaiser says that's partly by default, since the screens tend to turn up a lot of low leverage companies in the group with strong dividends and solid earnings growth. Included in its ranks are supermarket favorites Colgate-Palmolive, General Mills, J.M. Smucker and Kellogg. In addition to having stable sales in the U.S., many of these companies are deriving a growing share of their revenue from emerging markets.

At 13% of assets, health-care stocks such as Novartis, Abbott Laboratories and Eli Lilly offer both steady earnings growth and high dividend yields ranging from 3.75% for Abbott to 5.3% for Lilly.

The fund's technology holdings, which represent 12% of assets, include Microsoft. Kaiser says the stock is reasonably priced compared to its potential earnings growth, and it sports a dividend yield that's a bit above the market average.