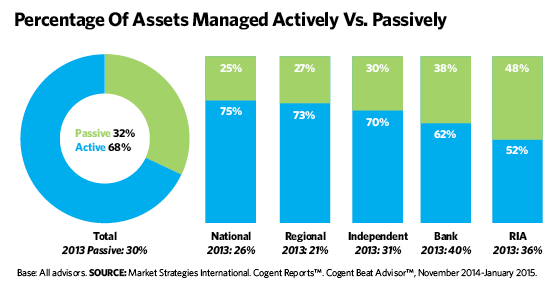

Registered investment advisors have become increasingly passive, and we’re not talking about their personalities. According to the research firm Cogent Reports, the percentage of overall advisor assets across various channels that were funneled into passively managed investments rose by just two percentage points from 2013 through 2014, from 30% to 32%. But among RIAs, the portion of their books placed in passively managed investments jumped from 36% to 48% during that period. That’s the highest level both in terms of total allocations and year-over-year increases among five different channels tracked by Cogent.

Going hand-in-hand with that is the RIA channel’s growing use of exchange-traded funds, the vast majority of which employ passive index-tracking strategies. Allocations to ETFs among RIAs more than doubled from 12% to 25% between August 2014 and January 2015. During that period, allocations to ETFs among advisors overall rose from 10% to 15%.

“Regarding the active versus passive debate, there’s often an ebb and flow depending on market conditions,” says Meredith Lloyd Rice, senior director in the syndicated division at Cogent Reports. “We’ve had a bull market for a number of years, and over the next year or so as we see more market volatility it potentially could be an opportunity for active managers to show they’re better prepared to manage through some of that volatility and take advantage of changes in the market. That said, I think passively managed investments are a trend that’s here to stay.”

RIAs Are A More Passive Lot

May 1, 2015

« Previous Article

| Next Article »

Login in order to post a comment