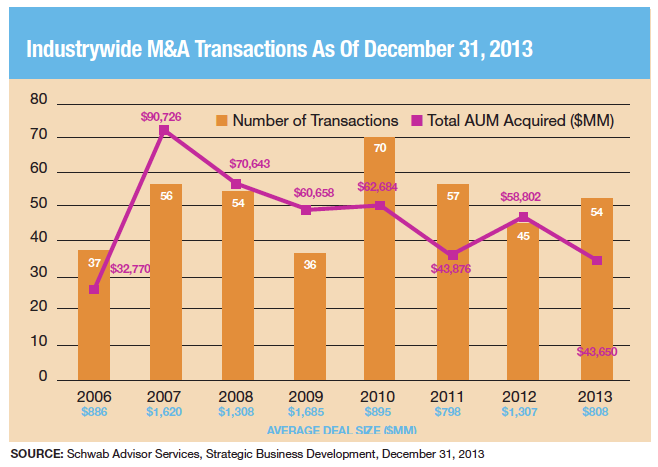

The number of merger and acquisition deals among registered investment advisors jumped 20% in 2013 versus the prior year, according to figures from Schwab Advisory Services. At the same time, the total assets purchased in those deals dropped by 26% and the average deal size sank by 38%.

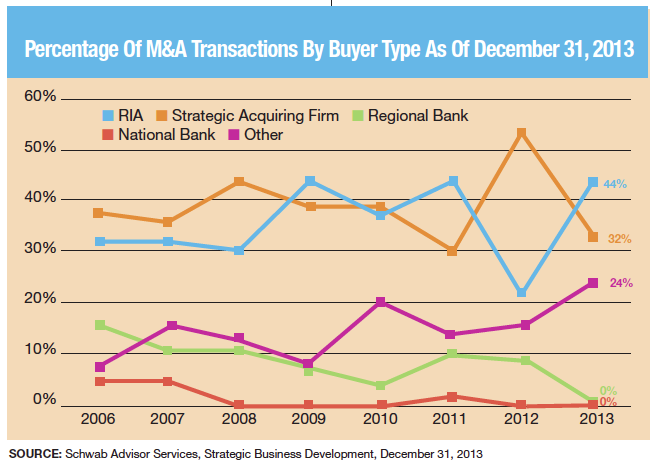

That’s because the largest share of the 54 transactions done last year were RIAs buying other RIAs (44%), as opposed to 2012 when so-called strategic acquiring firms were the leading buyers and accounted for 53% of the 45 deals.

RIA-on-RIA deals tend to be smaller and often take the form of tuck-in acquisitions that help firms expand their capabilities and footprint. “We call 2013 the year of the tuck-in because $1 billion-plus RIA firms were buying small to midsized advisor firms and tucking them into their organization,” says Jon Beatty, head of sales and relationship management at Schwab Advisor Services.

In 2013, total assets acquired were $43.6 billion, and the average deal size was $808 million. In 2012, those numbers were $58.8 billion and $1.3 billion, respectively.

Last year got off to a slow start on the M&A front, with just 18 deals done in the first half. But the pace picked up in the second half with 18 deals completed in both the third and fourth quarters as smaller RIAs used M&A as a growth strategy.

The 54 completed deals last year were slightly more than the annual average of 51 deals done during the eight years Schwab has tracked this space. “The market is healthy and it’s creating deals as necessary at a consistent level,” Beatty says.

“We expect as more advisors get scale they’ll be interested in acquisitions,” he notes, adding that the pending succession trend fueled by older advisors leaving the business has yet to generate a much-anticipated spike in M&A activity. “We know lots of firms are pursuing internal transitions,” Beatty says. “Internal transitions are just as popular as external ones.”

RIAs Lead The Way In Advisor M&A Activity

April 1, 2014

« Previous Article

| Next Article »

Login in order to post a comment