RIAs remain willing players in the mergers and acquisitions game within the profession, but outsiders appear to be less enthused. The result is that RIAs are playing a bigger role in RIA M&A activity, even as the number of deals and assets involved declined in this year’s first half.

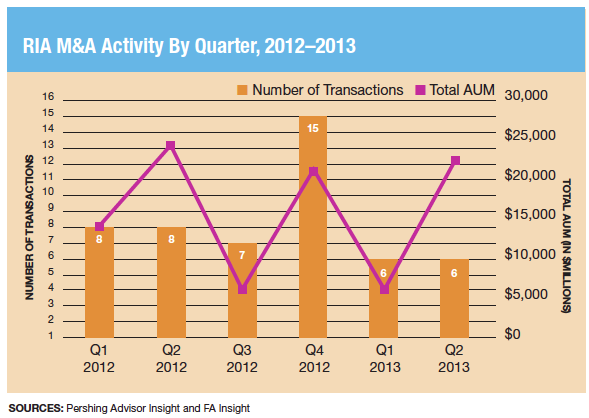

According to data from Pershing Advisor Solutions and FA Insight, there were 12 deals involving RIA firms during the first half of 2013, or 25% less than last year’s first half. Those 12 deals comprised assets of $29 billion, compared with $38.3 billion during last year’s first half.

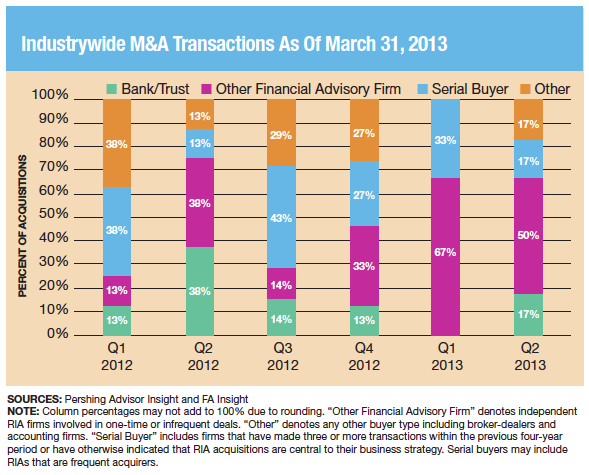

While deal-making volume is down, RIAs are taking a more active role on a percentage basis as they accounted for 58% of all RIA deal activity during this year’s first half, versus 37% through all of 2012.

RIAs have competitive advantages when it comes to acquiring or merging with other RIAs, says the Pershing/FA Insight report. For example, RIA-on-RIA deals potentially accomplish one or more strategic goals, such as realizing economies of scale, accessing new geographic or niche markets, attaining new skills and experience, or enabling succession planning.

Acquisitions of RIA firms by bank and trust firms have ground to a halt, and acquisitions by entities outside financial services have slowed significantly. For these groups, it seems the RIA space isn’t as attractive as it was before the recession. “After going through the recession and observing the experiences of many of the acquirers who’ve come and gone in the past five to seven years, I think many people are observing the [RIA] space with a lot more caution than they had in the pre-recession period,” Dan Inveen, principal and research director at FA Insight, says in an interview.

The Pershing/FA Insight data jibes with recent data from Schwab Advisor Services that showed M&A activity among RIA firms during this year’s first half dropped to its lowest level since the first half of 2008. According to Schwab, there were 18 completed M&A deals totaling $15.4 billion in assets under management during this year’s first half.

While the pace of M&A action has slowed, Schwab says, the largest percentage of deals made in the first half (50%) were RIAs buying other RIAs.

RIAs More Active In M&A Deals, But Deal Volume Falls

October 3, 2013

« Previous Article

| Next Article »

Login in order to post a comment