There’s a time in everyone’s life to save. There’s also a time when you’re supposed to spend. That time is commonly known as retirement.

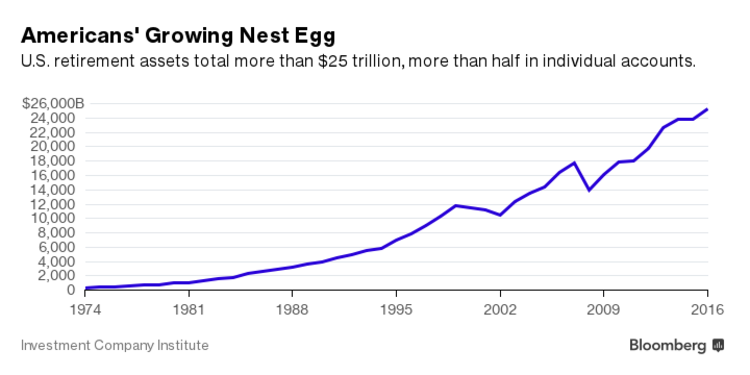

Millions of Americans aren’t doing that, however, which has put the U.S. in a perverse situation. Younger generations aren’t saving enough as their income slips further behind previous generations. Older Americans meanwhile sit atop unprecedented piles of assets built through stock market and real estate booms.

Yet these retirees, or at least the affluent ones, aren’t spending it. It turns out they’re afraid of the unknown.

A new study finds many U.S. retirees keep saving even after they’ve retired. The average American over the age of 60 cuts spending 2.5 percent per year, or about 20 percent over a 10-year period, according to an analysis of University of Michigan survey data by financial planning software company United Income. As a result, millions of Americans are living too frugally, said Matt Fellowes, United Income’s CEO . On average and adjusting for inflation, retirees are entering their 80s richer than they were in their 60s and 70s.

Unsurprisingly, given the data, Americans are dying with more money than they used to, adding to the increasing inequality that flows from inherited wealth. United Income analyzed the estates of people who died between 2000 to 2002, and compared them with those who died between 2010 to 2012. Although the later group had just lived through a financial crisis and worldwide recession, their estate values were 130 percent higher.

“We have to get people comfortable with enjoying their retirement and spending their money,” Fellowes said.

All of a sudden, they’re not getting a regular paycheck, and that makes them scared to spend.

Other studies have found affluent older Americans hoarding money. Last year, a study in the Journal of Financial Planning found that the wealthiest fifth of U.S. retirees were spending 53 percent less than they could have. Meanwhile, the poorest 40 percent generally spend more than they safely should; the median retiree spent about 8 percent less than the safe amount.

Researchers looked at all the logical reasons why affluent retirees might be so tight-fisted, including the desire to leave an inheritance or worries about future medical needs. The big motivator turned out to be some version of fear they would run out of cash too early.

“We found that even in a worst-case scenario, they could have spent more,” said Texas Tech University Professor Christopher Browning, one of the study’s authors. “There have to be other explanations,” he said–reasons that aren’t rational.One of those irrational reasons may be simple habit. Something strange happens when people retire, Browning says. All of a sudden, they’re not getting a regular paycheck, and that makes them scared to spend. Goals set before retirement are abandoned, along with pre-determined spending plans, because retirees are terrified see the balances on their retirement accounts drop even a tiny bit.