(Bloomberg News) They call it "money camp." Twice a week, 6- to 11-year-old scions of wealthy families take classes on being rich. They compete to corner commodities markets in Pit, the raucous Parker Brothers card game, and take part in a workshop called "business in a box," examining products that aren't obvious gold mines, such as the packaging on Apple Inc.'s iPhone rather than the phone itself.

It's all part of managing money for the wealthiest families, says Katherine Lintz, founder of Clayton, Mo.-based Financial Management Partners, which runs the camp for the children of clients. Supplying the families with good stock picks and a wily tax strategy isn't enough anymore. These days, it's about applying the human touch, she says.

Lintz, 58, is on to something. Her 22-year-old firm was No. 2 among the fastest-growing multifamily offices in the second annual Bloomberg Markets ranking of companies that manage affairs for dynastic clans. The assets that FMP supervises grew 30% to $2.6 billion as of December 31, just behind Signature, a Norfolk, Va.-based family office that expanded 36% in 2011 to $3.6 billion.

In sheer size, the family office units of banks dominate the ranking. Nine of the top 10 are associated with banks. HSBC Private Wealth Solutions, a unit of London-based HSBC Holdings Plc, is No. 1 by total assets under advisement for the second consecutive year, with $123.6 billion as of December 31, an increase of 21% over 2010.

No. 2 on the list is Northern Trust Corp., based in Chicago, with $90 billion, while No. 3 is BNY Mellon Wealth Management, a unit of Bank of New York Mellon Corp., with $64.5 billion.

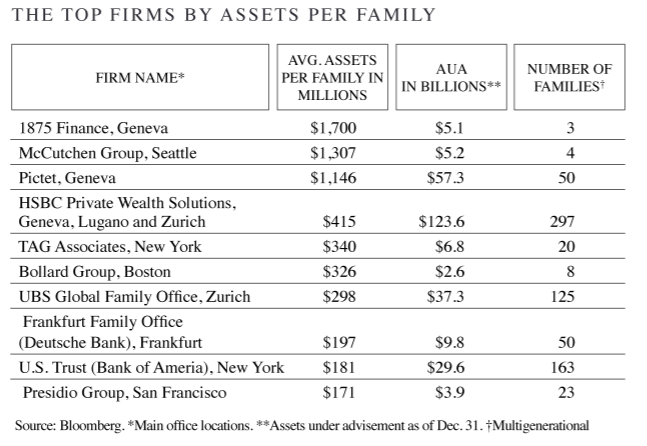

The top family office in assets per family is 1875 Finance of Geneva, which manages the wealth of three multigenerational families, whose assets average $1.7 billion.

It's easier to grow when you're small. Even so, of the top 10 fastest-growing firms in the ranking, only one-HSBC Private Wealth Solutions-was part of a big bank. The other nine were boutiques such as FMP-small companies that are often willing to accept thinner profit margins to mind money, prepare taxes, pay bills and arrange the purchase of private-jet shares for the ultrawealthy.

"We're getting so good at providing things that people didn't know they wanted," Lintz says.

She was a financial planner at Chase Manhattan Bank, now part of JPMorgan Chase & Co., before moving to a sports agency called Bry & Associates, where her clients included professional football and baseball players. Many of them stuck with her when she started her own firm in 1990.